- United Kingdom

- /

- IT

- /

- AIM:RCN

Exploring 3 High Growth Tech Stocks In The United Kingdom

Reviewed by Simply Wall St

Amidst the recent downturn in the FTSE 100 and FTSE 250 indices, driven by weak trade data from China and its impact on global markets, investors are closely monitoring high-growth sectors for potential opportunities. In this environment, identifying tech stocks with robust growth prospects and resilience to external economic pressures can be crucial for navigating market volatility.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Facilities by ADF | 26.24% | 161.47% | ★★★★★☆ |

| Pinewood Technologies Group | 27.24% | 25.48% | ★★★★★☆ |

| Redcentric | 5.32% | 67.90% | ★★★★★☆ |

| YouGov | 7.55% | 56.01% | ★★★★★☆ |

| Windar Photonics | 36.65% | 46.33% | ★★★★★☆ |

| Audioboom Group | 32.11% | 175.02% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

| Faron Pharmaceuticals Oy | 45.35% | 15.15% | ★★★★★☆ |

| Cordel Group | 33.50% | 148.58% | ★★★★★☆ |

Click here to see the full list of 41 stocks from our UK High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

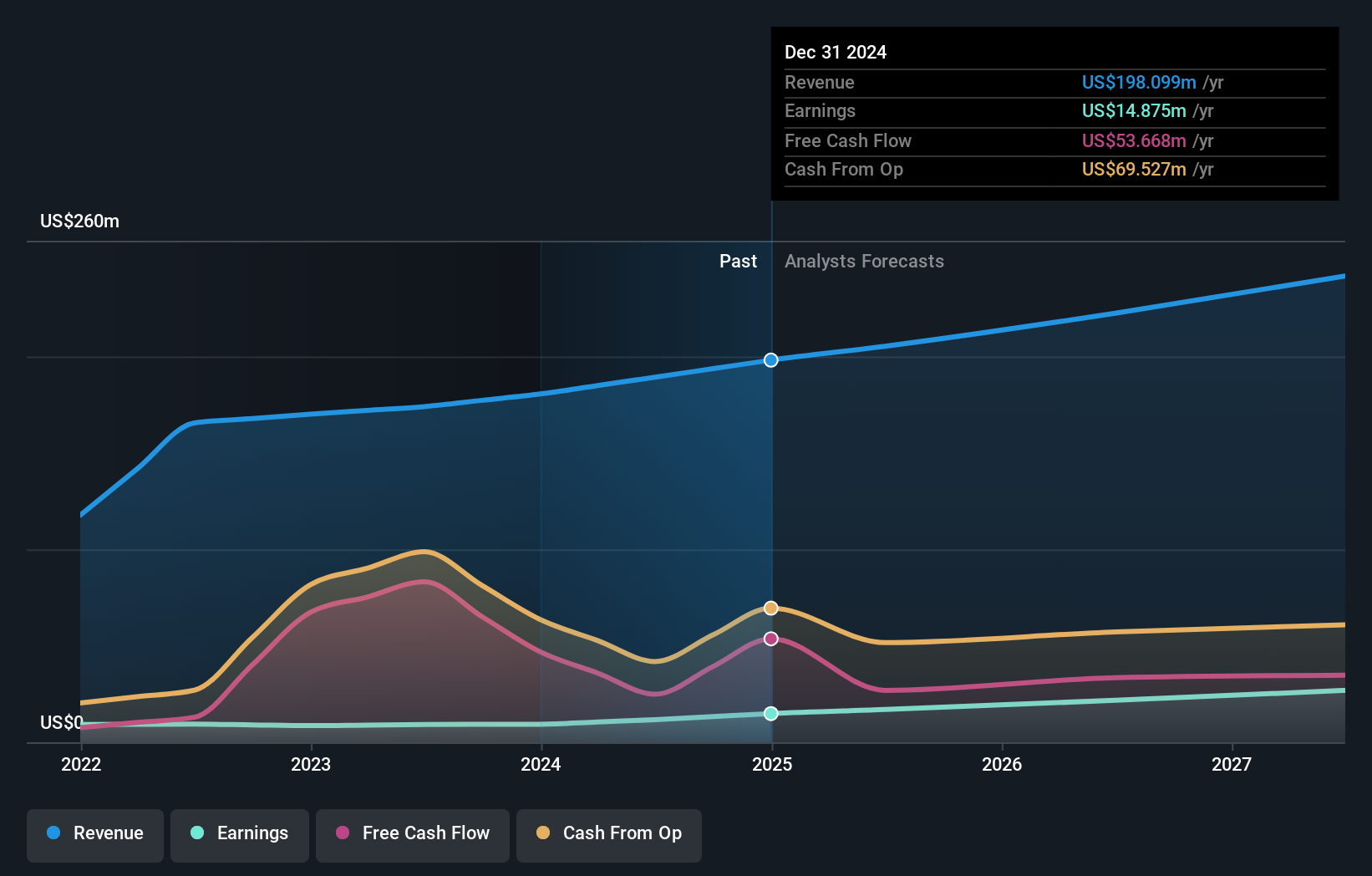

Overview: Craneware plc, along with its subsidiaries, specializes in developing, licensing, and supporting computer software for the healthcare sector in the United States, with a market capitalization of £623.32 million.

Operations: The company generates revenue primarily from its healthcare software segment, which contributed $198.10 million.

Craneware plc, a key player in the healthcare software sector, showcases robust financial and operational growth. With a notable 58.9% earnings increase over the past year outpacing its industry's -9.9% downturn, Craneware is setting benchmarks in financial performance. Recent half-year results further underscore this trend with sales rising to $100.05 million from $91.21 million and net income improving significantly to $7.24 million from $4.06 million previously. The firm also announced a dividend increase to 13.5 pence per share, reflecting confidence in ongoing fiscal health and commitment to shareholder returns amidst an evolving healthcare landscape where technology plays an increasingly critical role.

- Take a closer look at Craneware's potential here in our health report.

Understand Craneware's track record by examining our Past report.

Redcentric (AIM:RCN)

Simply Wall St Growth Rating: ★★★★★☆

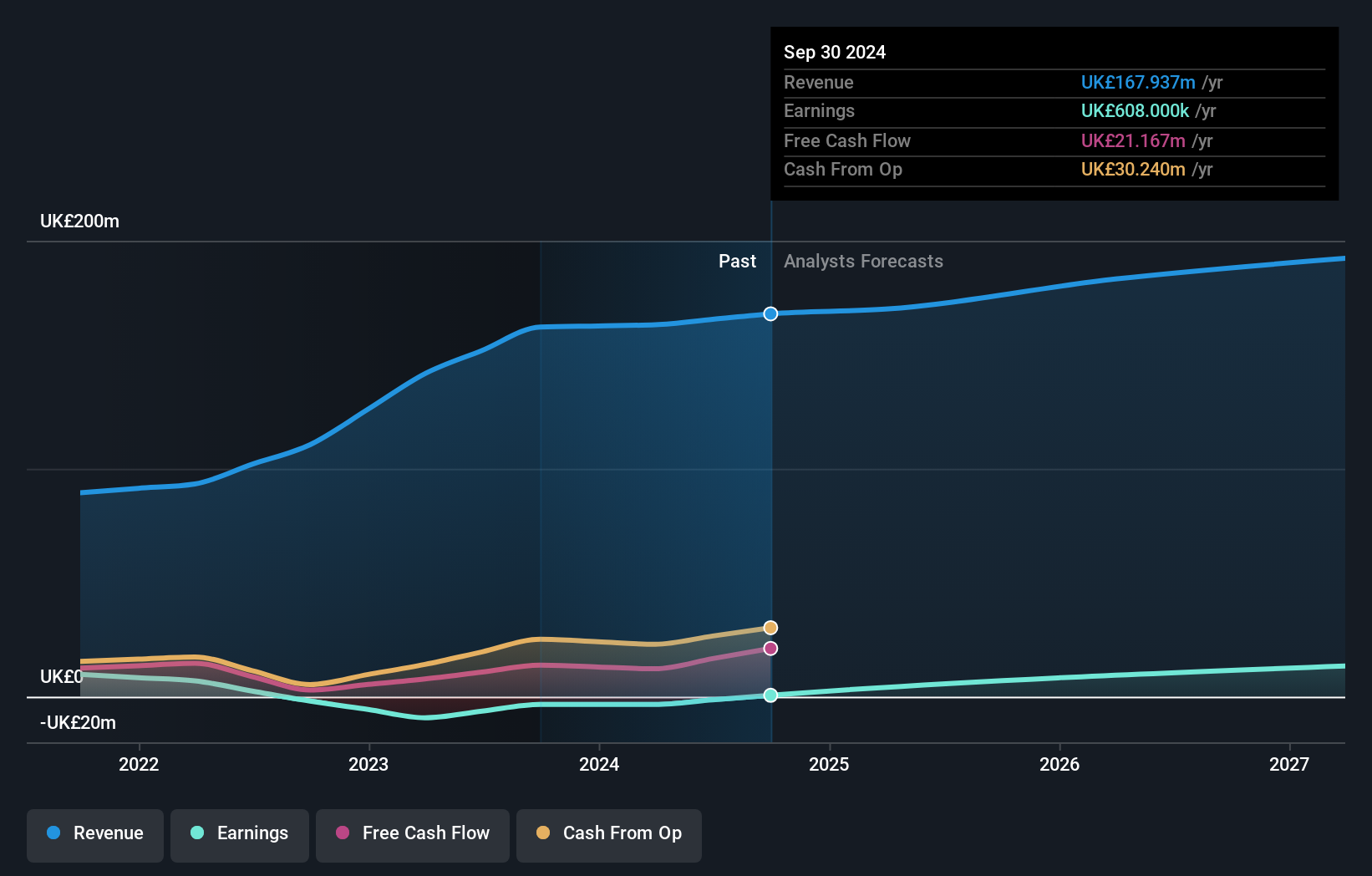

Overview: Redcentric plc offers IT managed services to both public and private sectors in the United Kingdom, with a market capitalization of £195.04 million.

Operations: With a revenue of £167.94 million, Redcentric plc focuses on providing IT managed services across the public and private sectors in the UK.

Redcentric plc, navigating through executive transitions, has positioned itself for strategic growth with the appointment of Brian Woodford as CEO. This shift comes at a time when the company's financial metrics show promise; earnings are expected to surge by 67.9% annually, outpacing the UK market's 14.3%. Despite a challenging past marked by a significant one-off loss of £3.4M, Redcentric's revenue growth forecasts remain optimistic at 5.3% yearly, slightly ahead of the broader UK market's 3.8%. These developments suggest that Redcentric is adapting well to industry demands while aligning its leadership to drive innovation and client-focused solutions in its next growth phase.

- Navigate through the intricacies of Redcentric with our comprehensive health report here.

Explore historical data to track Redcentric's performance over time in our Past section.

Spirent Communications (LSE:SPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Spirent Communications plc is a company that offers automated test and assurance solutions across various regions including the Americas, Asia Pacific, Europe, the Middle East, and Africa, with a market cap of £1.09 billion.

Operations: Spirent Communications generates revenue primarily from its Networks & Security segment, contributing $279.20 million, and Lifecycle Service Assurance segment, which adds $181 million.

Spirent Communications, amid a challenging year with a net income drop to $12.9 million from $25.2 million, still projects robust future growth with an expected annual revenue increase of 7.2% and earnings growth at an impressive 29.6%. This optimism is bolstered by their strategic collaboration with CEWiT to spearhead advancements in 6G technology, positioning them as pivotal in India's telecom expansion and innovation in next-gen network functionalities. Their commitment to R&D is evident as they navigate through the complexities of emerging technologies, ensuring their place at the forefront of the telecommunications sector's evolution.

Seize The Opportunity

- Gain an insight into the universe of 41 UK High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:RCN

Redcentric

Provides IT managed services for public and private sector in the United Kingdom.

Undervalued slight.

Market Insights

Community Narratives