- United Kingdom

- /

- Professional Services

- /

- LSE:ITRK

3 UK Dividend Stocks To Watch With Up To 6% Yield

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faced downward pressure, influenced by weak trade data from China and global economic uncertainties. As the market navigates these challenges, dividend stocks with attractive yields can offer investors a potential source of income stability amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 6.68% | ★★★★★★ |

| Man Group (LSE:EMG) | 7.74% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.43% | ★★★★★☆ |

| Treatt (LSE:TET) | 3.30% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.57% | ★★★★★☆ |

| DCC (LSE:DCC) | 4.05% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.02% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.41% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 7.55% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 6.99% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top UK Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

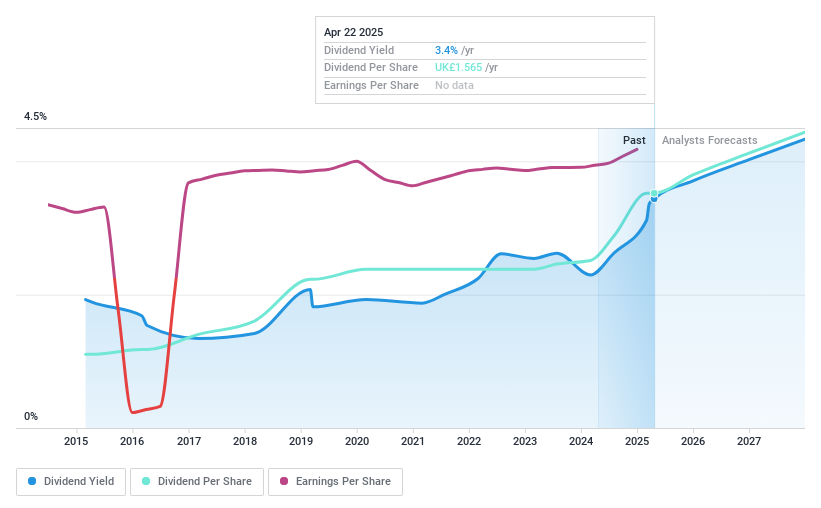

Intertek Group (LSE:ITRK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Intertek Group plc offers quality assurance solutions across multiple industries globally, with a market capitalization of £7.39 billion.

Operations: Intertek Group plc generates revenue across several segments, including World of Energy (£757.30 million), Consumer Products (£958.80 million), Health and Safety (£337.20 million), Corporate Assurance (£496.30 million), and Industry and Infrastructure (£843.60 million).

Dividend Yield: 3.4%

Intertek Group's dividend stability is supported by a consistent payout history over the past decade, with dividends covered by both earnings and cash flows. The company's payout ratio stands at 73%, indicating sustainable dividend payments. Despite a relatively modest yield of 3.37%, Intertek offers reliable growth potential, underpinned by recent initiatives like SupplyTek and EUDR solutions, which enhance its market presence and operational capabilities amidst evolving global trade dynamics.

- Take a closer look at Intertek Group's potential here in our dividend report.

- According our valuation report, there's an indication that Intertek Group's share price might be on the cheaper side.

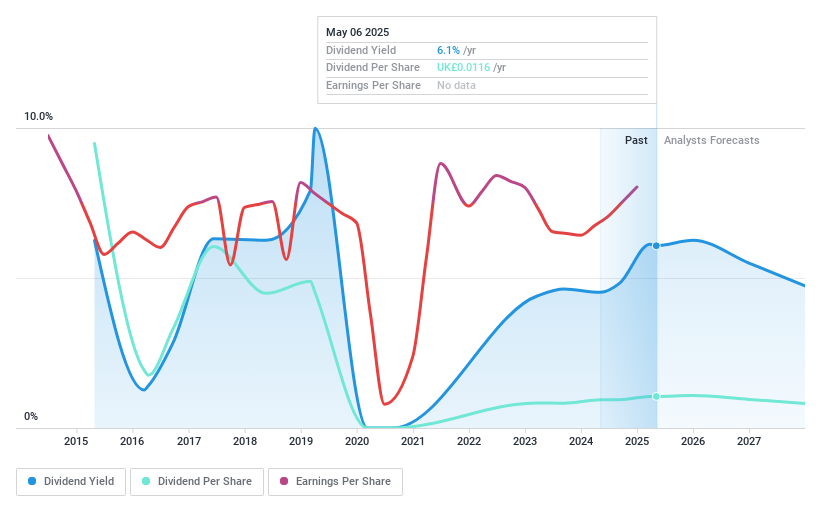

Pharos Energy (LSE:PHAR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pharos Energy plc is an independent energy company focused on the exploration, development, and production of oil and gas in Vietnam, Egypt, and China with a market cap of £78.21 million.

Operations: Pharos Energy's revenue is primarily derived from its operations in SE Asia, contributing $115.40 million, and Egypt, which adds $20.70 million.

Dividend Yield: 6.1%

Pharos Energy's dividend is well covered by earnings and cash flows, with payout ratios of 26.8% and 20.9%, respectively, despite a historically volatile dividend history. The proposed final dividend for 2024 is set at 1.21 pence per share, marking a 10% increase from the previous year. Although Pharos became profitable this year with net income of $23.6 million, its earnings are forecasted to decline significantly over the next three years, raising concerns about future dividend sustainability amidst executive changes and share buybacks totaling $6 million since January 2023.

- Dive into the specifics of Pharos Energy here with our thorough dividend report.

- The analysis detailed in our Pharos Energy valuation report hints at an deflated share price compared to its estimated value.

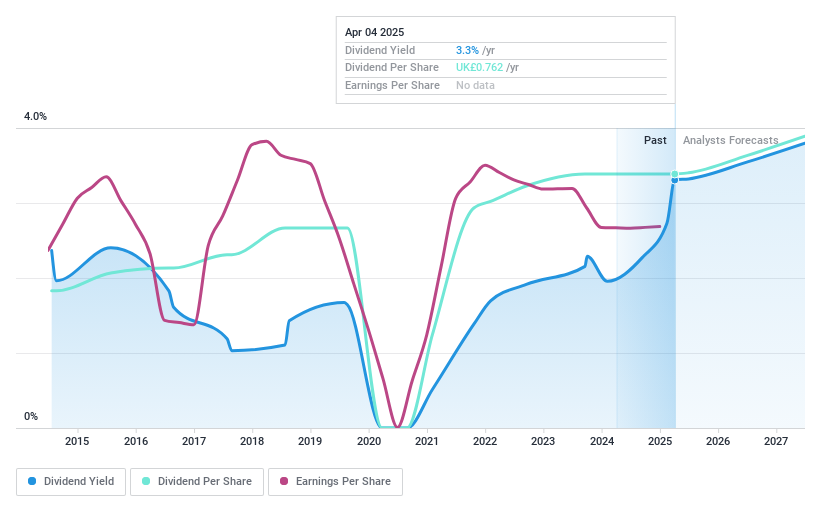

Renishaw (LSE:RSW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Renishaw plc is an engineering and scientific technology company that designs, manufactures, distributes, sells, and services technological products, analytical instruments, and medical devices globally with a market cap of £1.66 billion.

Operations: Renishaw plc generates revenue primarily from its Manufacturing Technologies segment, which accounts for £659.62 million, and its Analytical Instruments and Medical Devices segment, contributing £42.60 million.

Dividend Yield: 3.3%

Renishaw's dividend yield of 3.33% is below the UK's top dividend payers, and its track record has been unstable with past volatility. However, recent earnings growth and a sustainable payout ratio of 56.8% suggest dividends are currently well-covered by earnings and cash flows. The company confirmed an interim dividend of 16.8 pence per share for April 2025, maintaining last year's level amidst a projected revenue range of £695 million to £735 million for fiscal year 2025.

- Delve into the full analysis dividend report here for a deeper understanding of Renishaw.

- Our comprehensive valuation report raises the possibility that Renishaw is priced lower than what may be justified by its financials.

Where To Now?

- Embark on your investment journey to our 60 Top UK Dividend Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ITRK

Intertek Group

Provides quality assurance solutions to various industries in the United Kingdom, the United States, China, Australia, and internationally.

Very undervalued with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives