- United Kingdom

- /

- Machinery

- /

- AIM:AVG

UK Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

The UK market has been experiencing challenges, with the FTSE 100 index recently faltering due to weak trade data from China, highlighting global economic interdependencies. Despite these broader market concerns, there remain opportunities within niche investment areas like penny stocks. Although the term 'penny stock' might seem outdated, it still signifies potential growth in smaller or newer companies that are financially robust and capable of offering significant returns.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.98 | £480.06M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.932 | £148.53M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.71 | £421.59M | ★★★★★★ |

| RTC Group (AIM:RTC) | £0.975 | £13.27M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.83 | £309.02M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.185 | £823.34M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.27 | £161.95M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.45 | £84.87M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.18 | £316.27M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

Click here to see the full list of 447 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Avingtrans (AIM:AVG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Avingtrans plc, with a market cap of £117.60 million, provides engineered components, systems, and services to the energy, medical, and infrastructure industries across various global regions including the UK, Europe, USA, Africa, Middle East, Americas, Caribbean, China and Asia Pacific.

Operations: The company's revenue is primarily derived from Energy Advanced Engineering Systems, contributing £132.94 million, and Medical and Industrial Imaging, which adds £3.68 million.

Market Cap: £117.6M

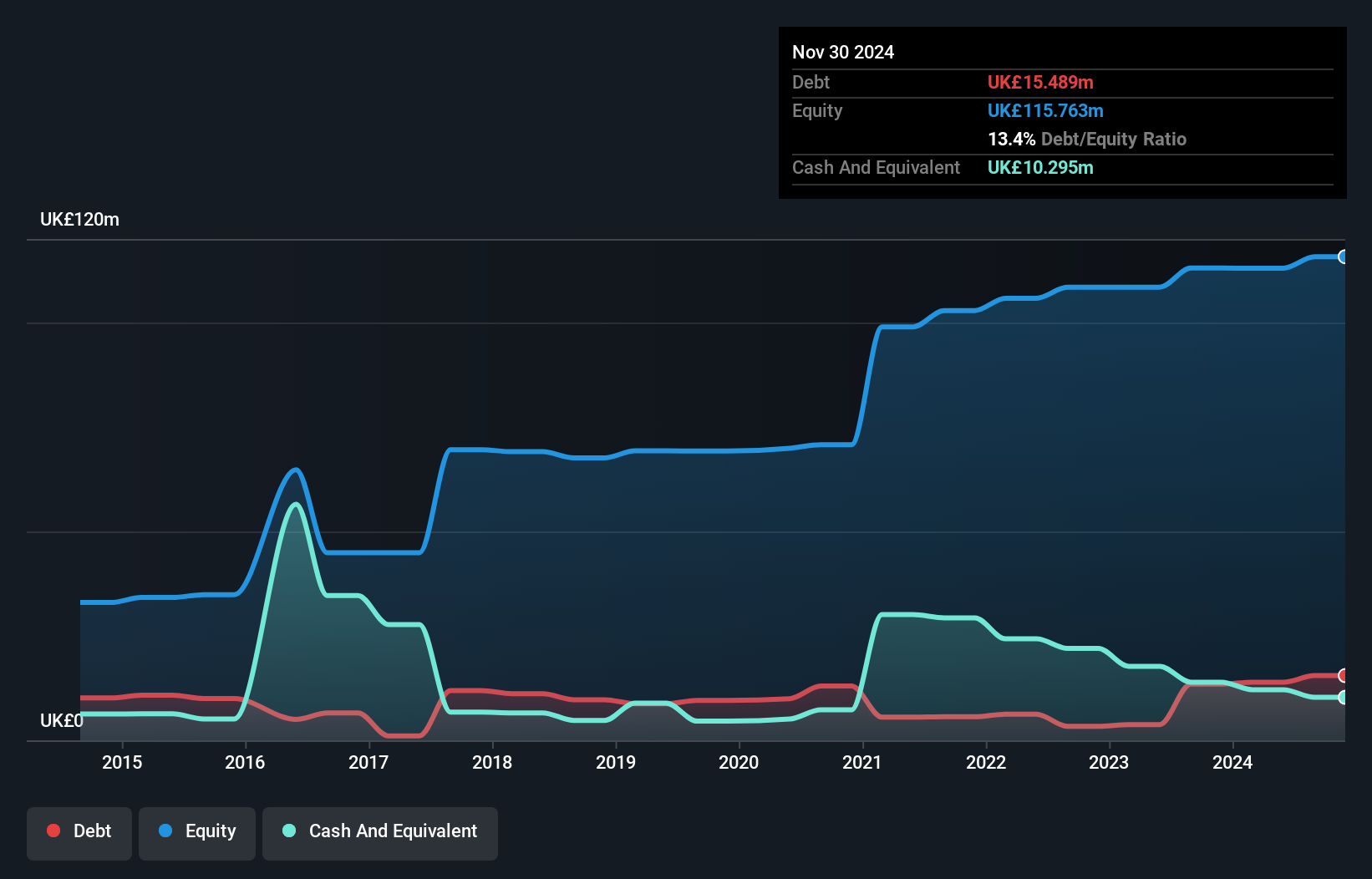

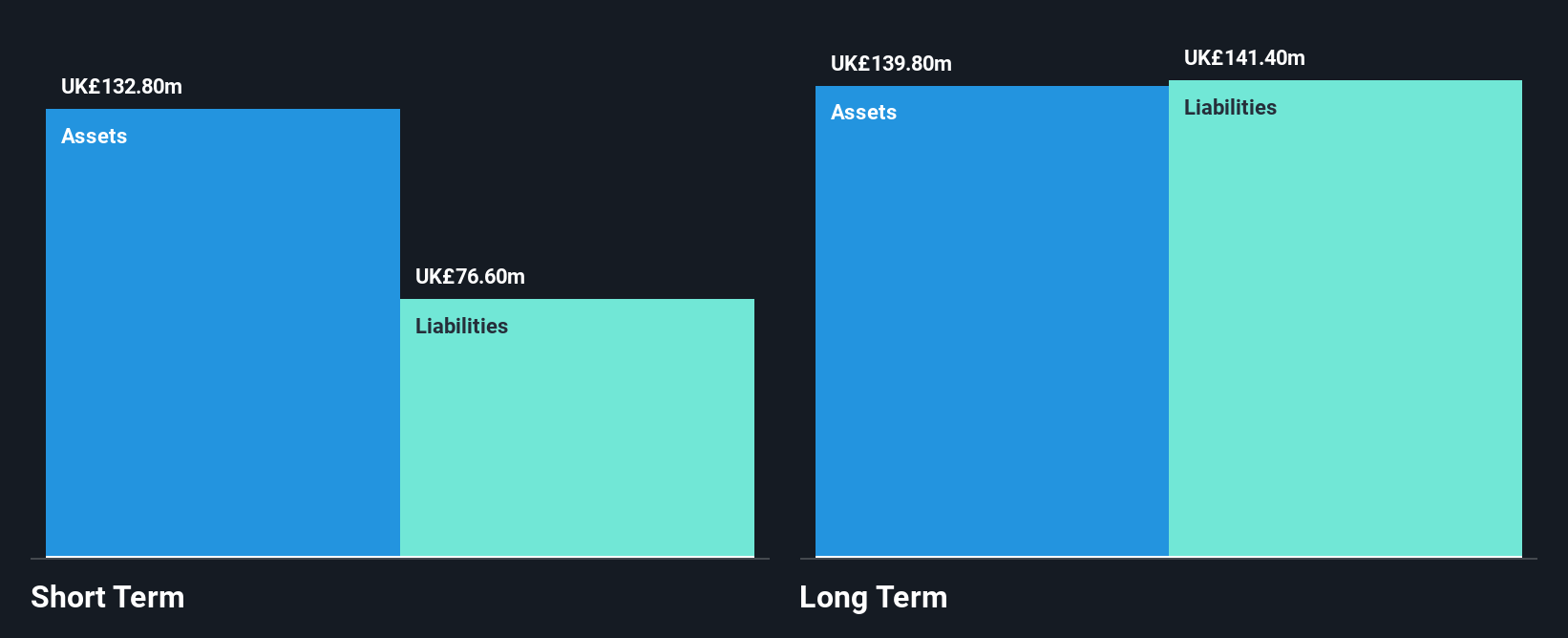

Avingtrans plc, with a market cap of £117.60 million, primarily generates revenue from Energy Advanced Engineering Systems (£132.94 million) and Medical and Industrial Imaging (£3.68 million). The management team and board are seasoned, averaging 7.6 and 8.7 years in tenure respectively, which may provide stability in leadership decisions. While the company has not diluted shareholders recently, its Return on Equity is low at 3.2%. Despite negative earnings growth last year (-42.4%), Avingtrans maintains satisfactory debt levels with a net debt to equity ratio of 1.6% and strong interest coverage (6.6x EBIT).

- Dive into the specifics of Avingtrans here with our thorough balance sheet health report.

- Gain insights into Avingtrans' future direction by reviewing our growth report.

Renold (AIM:RNO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Renold plc manufactures and sells high precision engineered products and solutions across various international markets, with a market cap of £102.66 million.

Operations: The company's revenue is derived from two main segments: Chain, contributing £191 million, and Torque Transmission, generating £53.9 million.

Market Cap: £102.66M

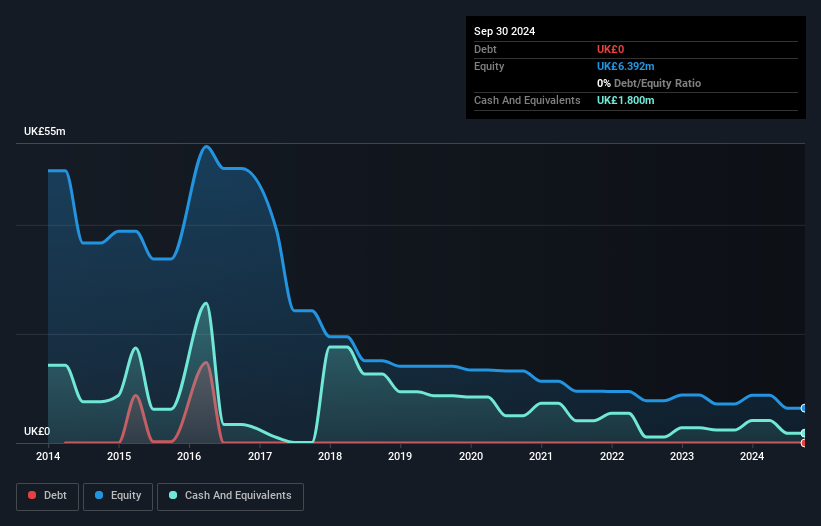

Renold plc, with a market cap of £102.66 million, operates in the machinery sector and has shown mixed financial performance. The company reported half-year sales of £123.4 million, slightly down from the previous year, with net income also decreasing to £6.5 million. Despite high debt levels and short-term assets not covering long-term liabilities, Renold's operating cash flow covers its debt well (56.1%). The board and management are experienced, which may aid strategic decisions moving forward. While earnings have grown significantly over five years (30.3% annually), recent negative earnings growth poses challenges amidst forecasts for future growth.

- Click here to discover the nuances of Renold with our detailed analytical financial health report.

- Evaluate Renold's prospects by accessing our earnings growth report.

Thruvision Group (AIM:THRU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Thruvision Group plc develops, manufactures, and sells walk-through security technology across the UK, Europe, the US, the Middle East, Africa, and internationally with a market cap of £5.59 million.

Operations: The company's revenue from its security technology business amounts to £6.20 million.

Market Cap: £5.59M

Thruvision Group plc, with a market cap of £5.59 million, is navigating financial challenges as it remains unprofitable with a negative return on equity of -59.12%. Despite having no debt and short-term assets (£7.7M) exceeding both short and long-term liabilities, its cash runway is limited to six months without additional capital or significant new orders. The company is exploring strategic alternatives, including potential sales or partnerships, to leverage its security technology business forecasted for revenue growth of 31.44% annually. Recent executive changes aim to stabilize operations while seeking opportunities in entrance security and retail distribution sectors.

- Navigate through the intricacies of Thruvision Group with our comprehensive balance sheet health report here.

- Examine Thruvision Group's earnings growth report to understand how analysts expect it to perform.

Key Takeaways

- Jump into our full catalog of 447 UK Penny Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Avingtrans, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:AVG

Avingtrans

Provides engineered components, systems, and services to the energy, medical, and infrastructure industries in the United Kingdom, rest of Europe, the United States of America, Africa, the Middle East, the Americas, the Carribean, China, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives