Simon Tucker became the CEO of SRT Marine Systems plc (LON:SRT) in 2008, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for SRT Marine Systems.

See our latest analysis for SRT Marine Systems

Comparing SRT Marine Systems plc's CEO Compensation With the industry

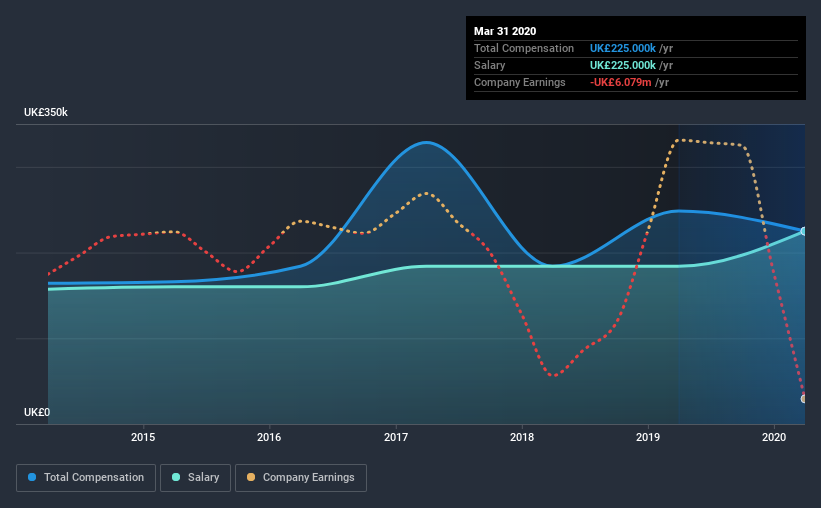

According to our data, SRT Marine Systems plc has a market capitalization of UK£58m, and paid its CEO total annual compensation worth UK£225k over the year to March 2020. Notably, that's a decrease of 9.4% over the year before. It is worth noting that the CEO compensation consists entirely of the salary, worth UK£225k.

In comparison with other companies in the industry with market capitalizations under UK£150m, the reported median total CEO compensation was UK£256k. This suggests that SRT Marine Systems remunerates its CEO largely in line with the industry average. What's more, Simon Tucker holds UK£954k worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£225k | UK£184k | 100% |

| Other | - | UK£64k | - |

| Total Compensation | UK£225k | UK£248k | 100% |

Speaking on an industry level, nearly 77% of total compensation represents salary, while the remainder of 23% is other remuneration. Speaking on a company level, SRT Marine Systems prefers to tread along a traditional path, disbursing all compensation through a salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

SRT Marine Systems plc's Growth

Over the past three years, SRT Marine Systems plc has seen its earnings per share (EPS) grow by 4.8% per year. In the last year, its revenue is down 8.0%.

We would prefer it if there was revenue growth, but the modest improvement in EPS is good. It's hard to reach a conclusion about business performance right now. This may be one to watch. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has SRT Marine Systems plc Been A Good Investment?

With a three year total loss of 6.6% for the shareholders, SRT Marine Systems plc would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

SRT Marine Systems pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. As we noted earlier, SRT Marine Systems pays its CEO in line with similar-sized companies belonging to the same industry. This doesn't look good when you place it against the backdrop of negative shareholder returns and flat EPS growth. CEO pay isn't exceptionally high, but considering poor performance, shareholders will likely hold off support for a raise until results improve.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 5 warning signs for SRT Marine Systems (2 are concerning!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade SRT Marine Systems, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:SRT

SRT Marine Systems

Develops and supplies automatic identification system (AIS) based maritime domain awareness technologies, products, and systems.

Exceptional growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026