- United Kingdom

- /

- Consumer Durables

- /

- AIM:SPR

3 Promising UK Penny Stocks With Market Caps Under £200M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting ongoing global economic uncertainties. In such a climate, identifying stocks with solid fundamentals becomes crucial for investors seeking potential growth opportunities. While the term "penny stock" may seem outdated, these smaller or newer companies can still offer significant potential when backed by strong financials. We'll explore three promising UK penny stocks that combine balance sheet strength with long-term growth prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.675 | £534.05M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.11 | £170.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.83 | £12.53M | ✅ 2 ⚠️ 3 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.08 | £14.86M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.57 | $331.36M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.53 | £259.36M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.445 | £69.79M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.10 | £175.56M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.785 | £10.81M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 296 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Springfield Properties (AIM:SPR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Springfield Properties Plc, with a market cap of £133.33 million, is involved in residential housebuilding and land development across the United Kingdom through its subsidiaries.

Operations: The company's revenue primarily stems from its housing building activity, generating £280.56 million.

Market Cap: £133.33M

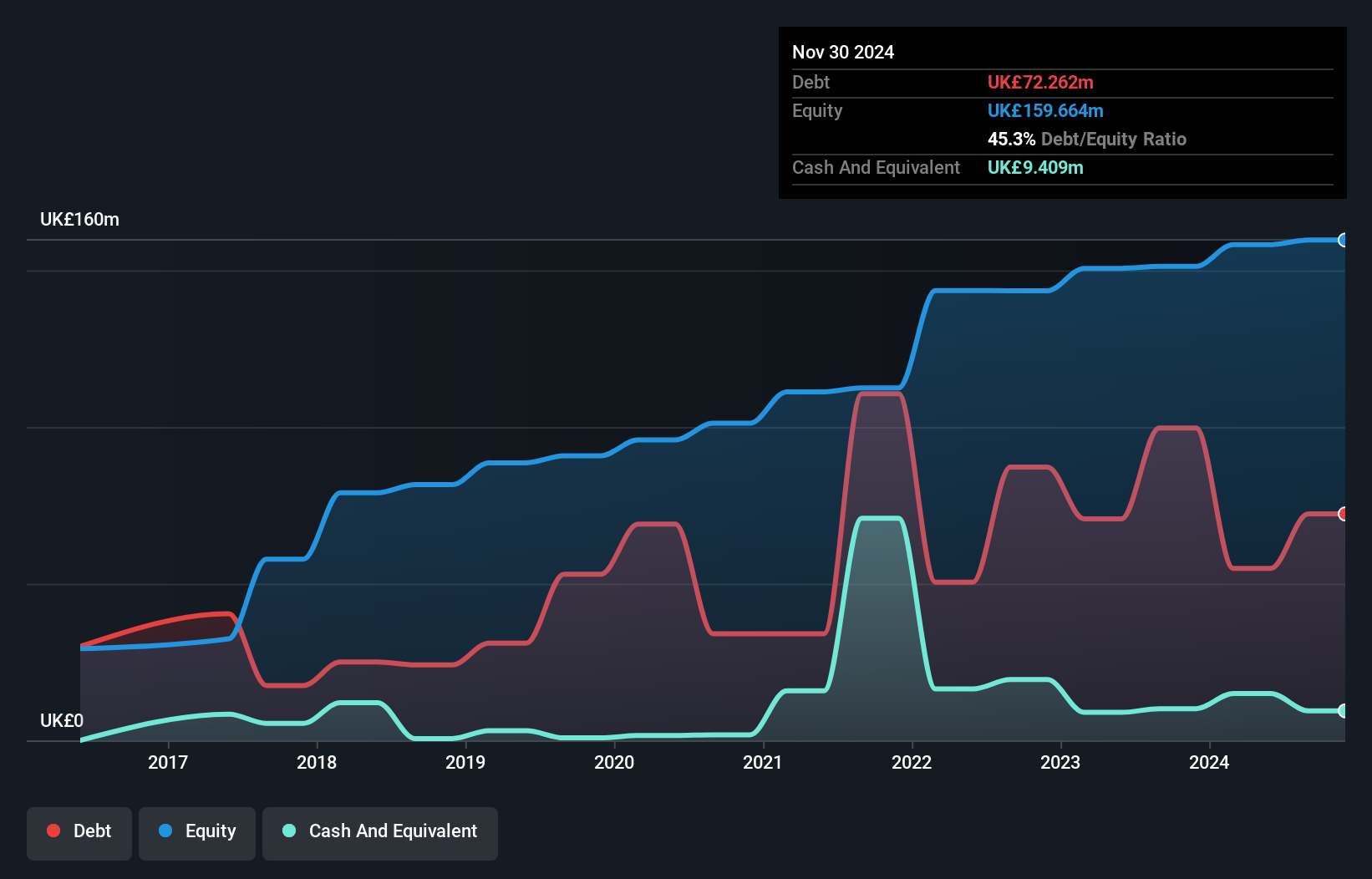

Springfield Properties Plc, with a market cap of £133.33 million, presents an intriguing option within the penny stock category due to its solid financial footing and recent performance. The company reported revenue of £280.56 million and net income of £14.1 million for the year ended May 31, 2025, showing significant improvement from previous figures. Its debt is well managed with a net debt to equity ratio at a satisfactory level of 12.2%, supported by strong operating cash flow coverage (99%). Recent board changes include the appointment of Alasdair Gardner as Non-executive Director, adding extensive financial expertise to its leadership team.

- Navigate through the intricacies of Springfield Properties with our comprehensive balance sheet health report here.

- Learn about Springfield Properties' future growth trajectory here.

SRT Marine Systems (AIM:SRT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SRT Marine Systems plc, with a market cap of £192.31 million, develops and supplies AIS-based maritime domain awareness technologies, products, and systems.

Operations: The Marine Technology Business segment generated £78.02 million in revenue.

Market Cap: £192.31M

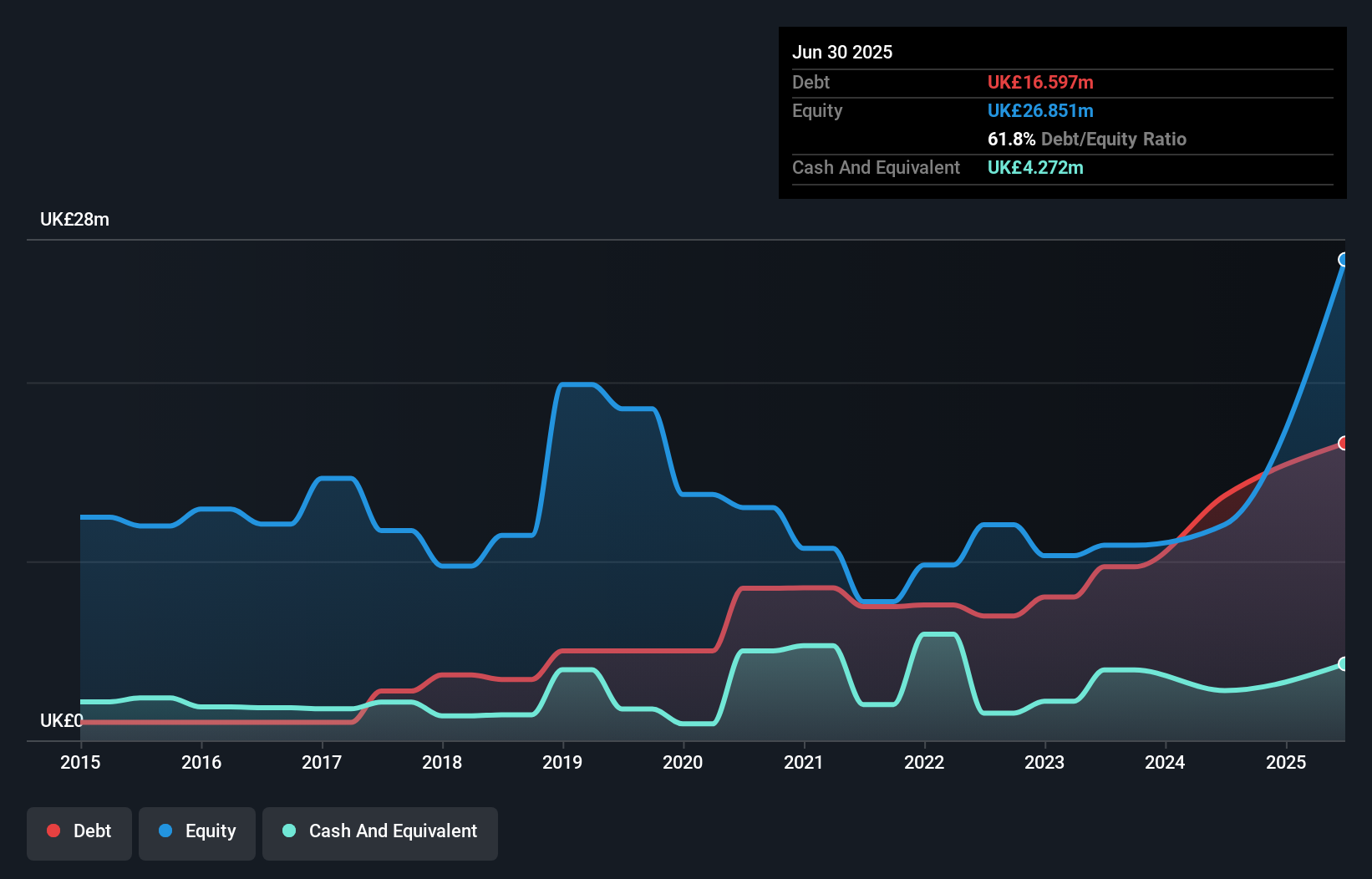

SRT Marine Systems plc, with a market cap of £192.31 million, has shown promising developments in the penny stock sector. The company reported sales of £78.02 million and net income of £2.03 million for the fiscal year ending June 30, 2025, marking its transition to profitability. A recent contract worth approximately US$200 million from a sovereign customer highlights potential revenue growth, though it remains contingent on project and financing completion. Despite a high net debt to equity ratio (45.9%), SRT's short-term assets exceed both short- and long-term liabilities, indicating solid financial positioning amidst industry challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of SRT Marine Systems.

- Assess SRT Marine Systems' future earnings estimates with our detailed growth reports.

Record (LSE:REC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Record plc, with a market cap of £116.33 million, operates through its subsidiaries to offer currency and asset management services across the United Kingdom, North America, Switzerland, Europe, Australia, and other international markets.

Operations: The company's revenue is derived from two primary segments: Currency Management, which contributes £34.14 million, and Asset Management, accounting for £7.48 million.

Market Cap: £116.33M

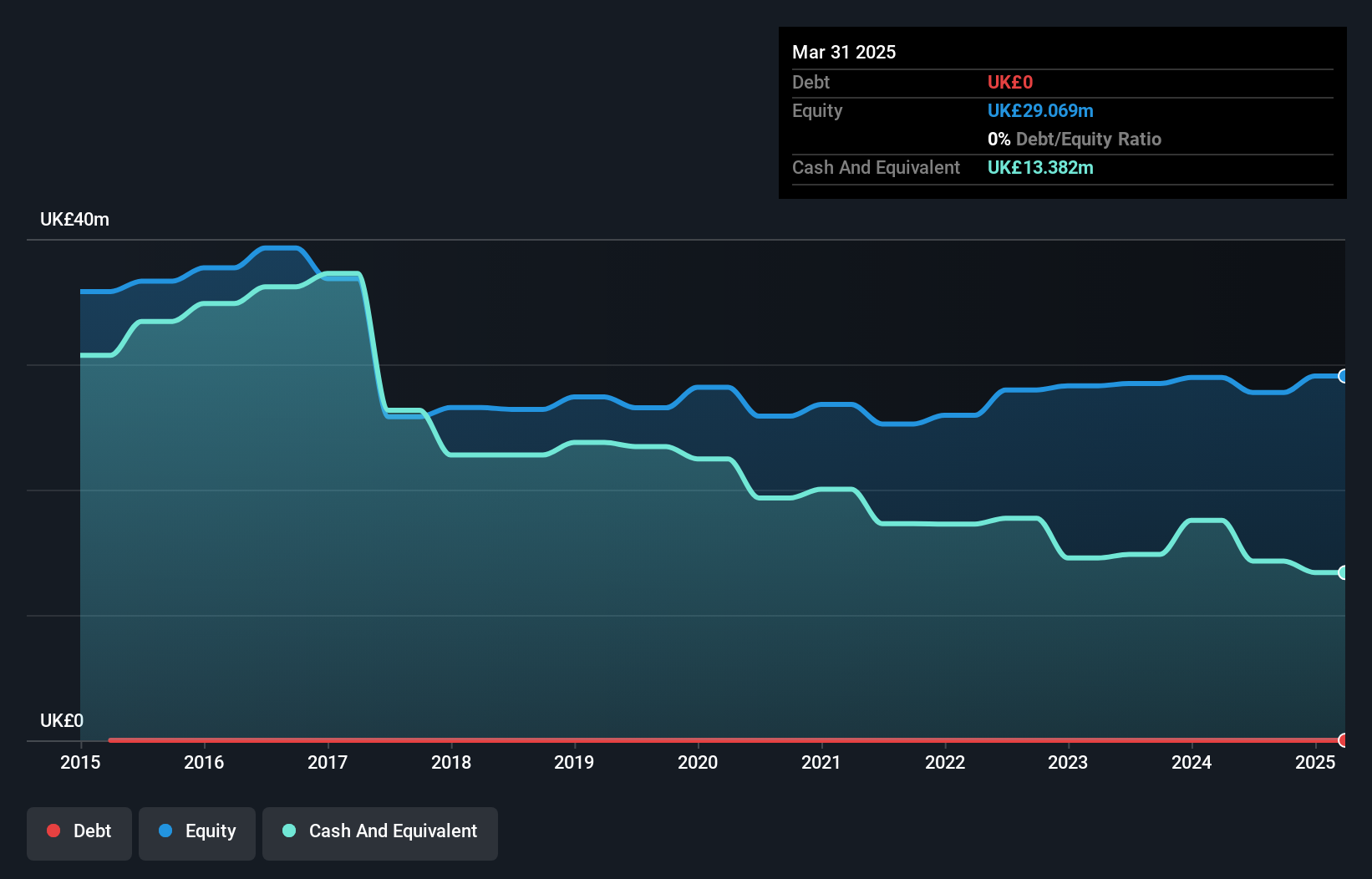

Record plc, with a market cap of £116.33 million, operates in currency and asset management sectors, generating £34.14 million and £7.48 million respectively from these segments. The company is debt-free, enhancing its financial stability, while its earnings have grown by 11.1% annually over five years but slowed to 5.2% last year. Trading at a discount to estimated fair value and showing high return on equity at 31.5%, Record's net profit margins improved to 23.4%. However, recent board changes may affect strategic continuity as the management team averages only 1.5 years in tenure.

- Jump into the full analysis health report here for a deeper understanding of Record.

- Review our growth performance report to gain insights into Record's future.

Make It Happen

- Gain an insight into the universe of 296 UK Penny Stocks by clicking here.

- Want To Explore Some Alternatives? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SPR

Springfield Properties

Engages in the residential housebuilding and land development in the United Kingdom.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives