Top Penny Stocks To Watch On The UK Exchange In February 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting concerns about global economic recovery. Despite these broader market fluctuations, investors often find potential in smaller or newer companies known as penny stocks. While the term might seem outdated, these stocks can offer unique opportunities for growth at lower price points when they possess strong balance sheets and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.70 | £174.08M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.80 | £455.09M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.905 | £468.49M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.918 | £146.62M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.185 | £812.03M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.23 | £158.38M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.31 | £81.05M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| QinetiQ Group (LSE:QQ.) | £3.646 | £2.03B | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.435 | £183.39M | ★★★★★☆ |

Click here to see the full list of 444 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Image Scan Holdings (AIM:IGE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Image Scan Holdings Plc, through its subsidiary 3DX-Ray Limited, manufactures and sells portable X-ray systems across various regions including the United Kingdom, Europe, the Middle East, Africa, Asia, the Indian Subcontinent, and the Americas with a market cap of £4.11 million.

Operations: The company generates £2.86 million in revenue from the ongoing development of advanced X-ray imaging techniques.

Market Cap: £4.11M

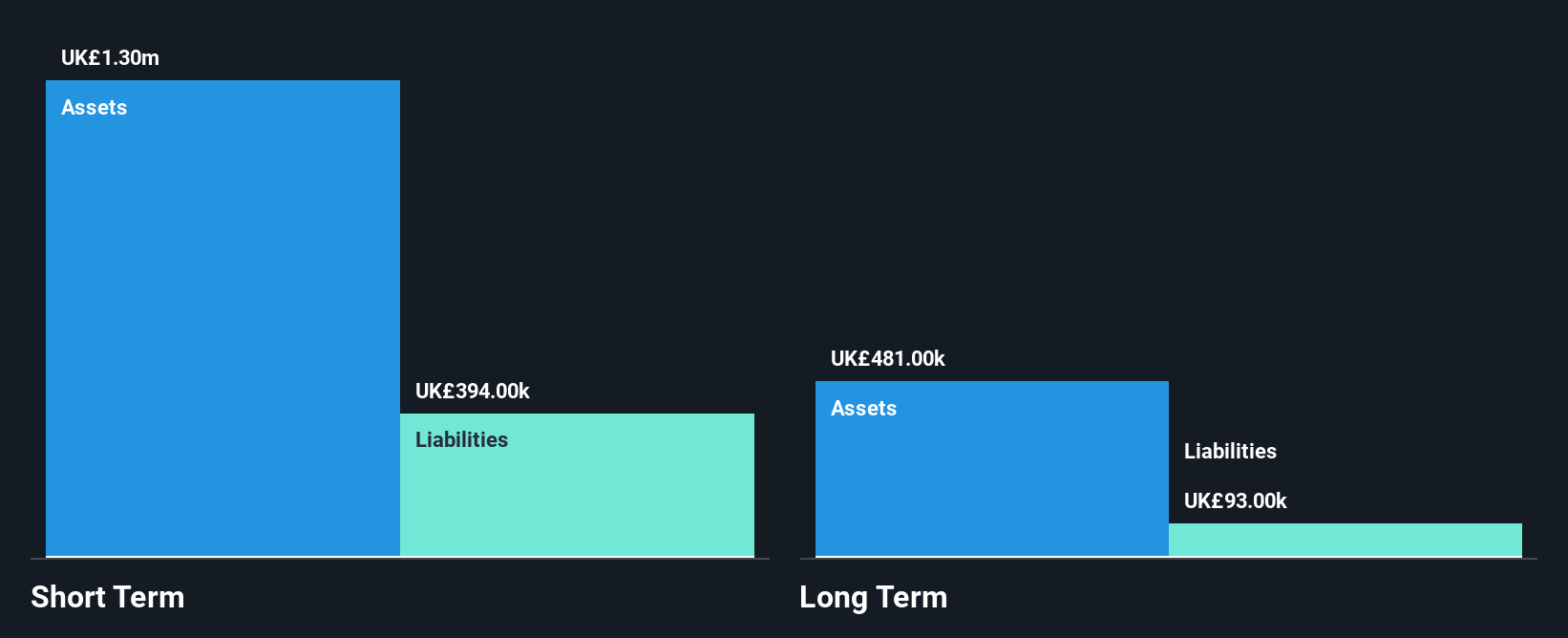

Image Scan Holdings Plc, with a market cap of £4.11 million, reported revenue of £2.86 million for the year ending September 2024. Despite its small size, the company demonstrates financial stability with no debt and adequate short-term assets to cover liabilities. Earnings have grown significantly by 67% over the past year, outpacing industry averages and improving net profit margins from 4.2% to 7.2%. While trading below estimated fair value suggests potential undervaluation, investors should consider its low return on equity at 12% and high non-cash earnings when evaluating investment suitability in this penny stock category.

- Jump into the full analysis health report here for a deeper understanding of Image Scan Holdings.

- Assess Image Scan Holdings' previous results with our detailed historical performance reports.

Walker Crips Group (LSE:WCW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Walker Crips Group plc provides financial products and services to private and professional clients in the United Kingdom, with a market cap of £5.54 million.

Operations: The company's revenue is primarily generated from Investment Management (£28.88 million), with additional contributions from Financial Planning & Wealth Management (£3.02 million) and Software as a Service (SaaS) (£0.015 million).

Market Cap: £5.54M

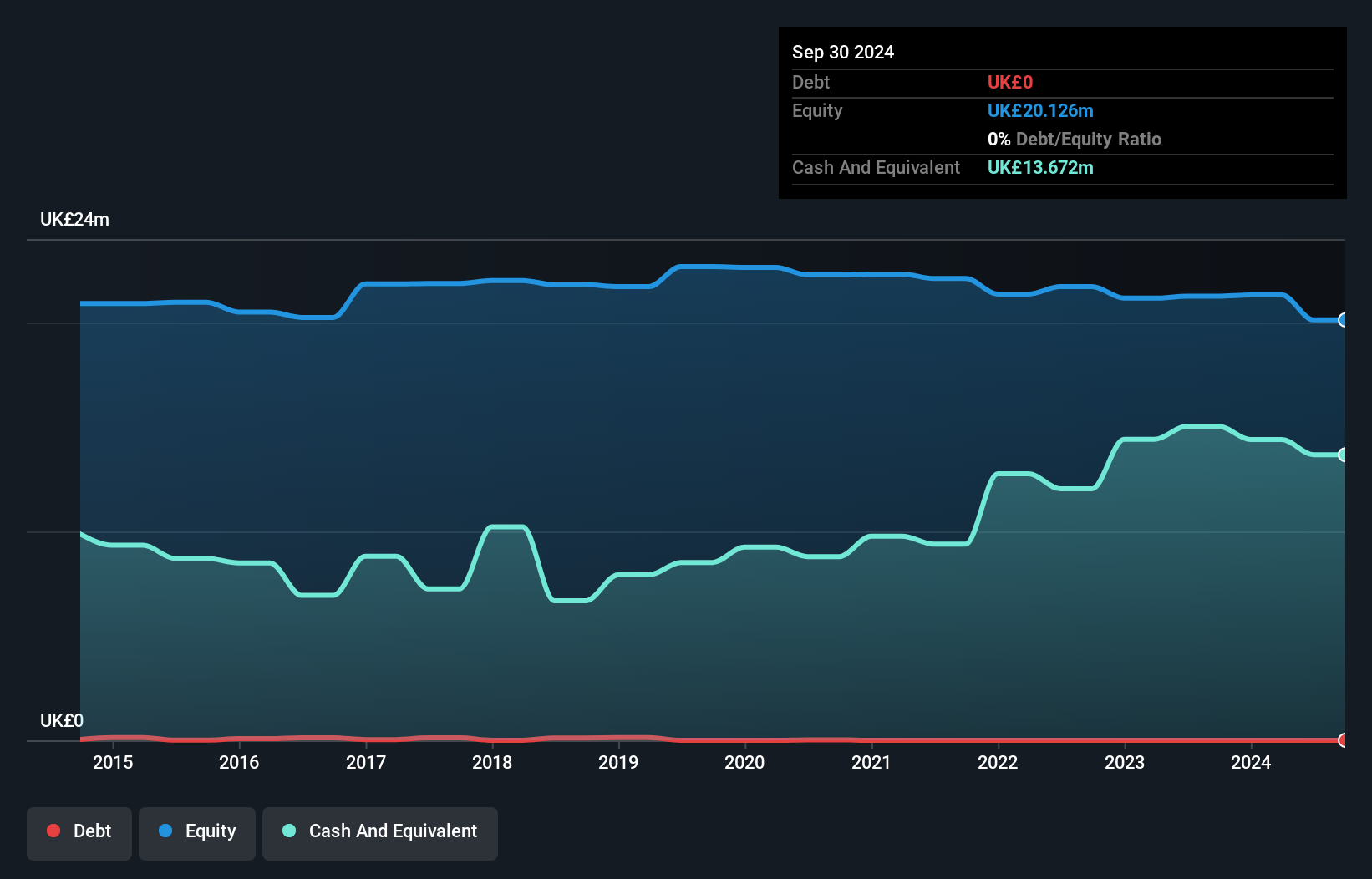

Walker Crips Group plc, with a market cap of £5.54 million, primarily generates revenue from Investment Management (£28.88 million). Despite its debt-free status and strong asset position, the company reported a net loss of £1.09 million for the half year ended September 2024, contrasting with a net income in the prior year. The management team and board are experienced, but ongoing unprofitability and negative return on equity (-4.58%) highlight financial challenges. Although there has been no shareholder dilution recently, earnings have declined by 23% annually over five years, indicating persistent profitability issues within this penny stock segment.

- Unlock comprehensive insights into our analysis of Walker Crips Group stock in this financial health report.

- Gain insights into Walker Crips Group's historical outcomes by reviewing our past performance report.

Tectonic Gold (OFEX:TTAU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tectonic Gold Plc focuses on the exploration, research, and development of mineral assets in Australia with a market cap of £1.44 million.

Operations: Tectonic Gold Plc has not reported any revenue segments.

Market Cap: £1.44M

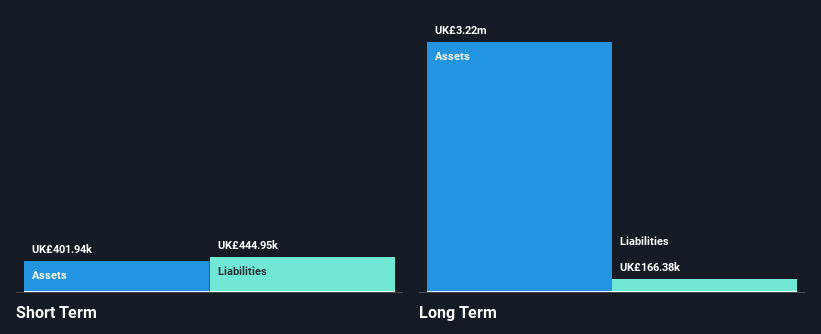

Tectonic Gold Plc, with a market cap of £1.44 million, is a pre-revenue company focused on mineral exploration in Australia. The firm reported a reduced net loss of £0.15 million for the year ending June 2024, down from £0.52 million the previous year, reflecting some progress in managing costs despite ongoing unprofitability. The management and board are experienced with average tenures of 6.3 and 8.9 years respectively, which may provide stability during its developmental phase. However, short-term liabilities exceed short-term assets by approximately £43K, posing liquidity challenges despite having sufficient cash runway for over a year under stable conditions.

- Click to explore a detailed breakdown of our findings in Tectonic Gold's financial health report.

- Understand Tectonic Gold's track record by examining our performance history report.

Summing It All Up

- Explore the 444 names from our UK Penny Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:IGE

Image Scan Holdings

Through its subsidiary 3DX-Ray Limited, engages in the manufacture and sale of portable X-ray systems in the United Kingdom, Europe, the Middle East, Africa, Asia, Indian Subcontinent, and the Americas.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives