We Think Croma Security Solutions Group's (LON:CSSG) Solid Earnings Are Understated

The market seemed underwhelmed by last week's earnings announcement from Croma Security Solutions Group plc (LON:CSSG) despite the healthy numbers. We did some digging, and we think that investors are missing some encouraging factors in the underlying numbers.

View our latest analysis for Croma Security Solutions Group

Examining Cashflow Against Croma Security Solutions Group's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

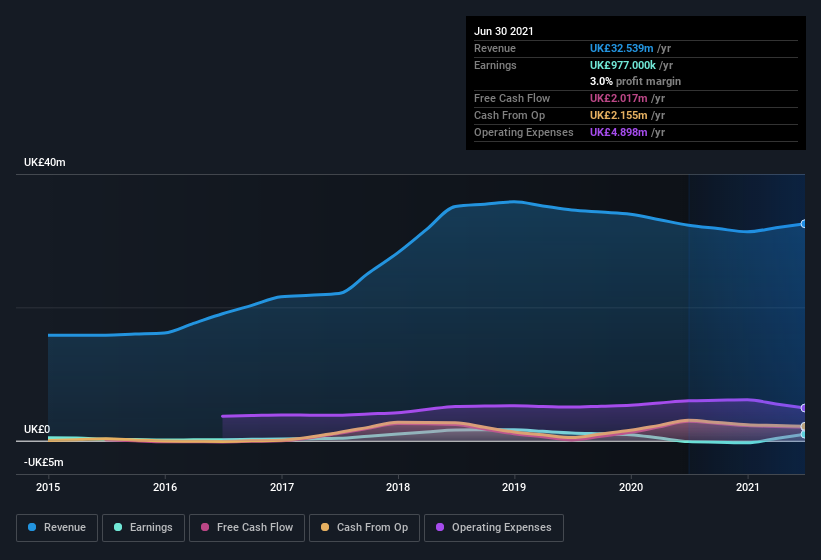

For the year to June 2021, Croma Security Solutions Group had an accrual ratio of -0.14. Therefore, its statutory earnings were very significantly less than its free cashflow. Indeed, in the last twelve months it reported free cash flow of UK£2.0m, well over the UK£977.0k it reported in profit. Croma Security Solutions Group's free cash flow actually declined over the last year, which is disappointing, like non-biodegradable balloons.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Croma Security Solutions Group.

Our Take On Croma Security Solutions Group's Profit Performance

Croma Security Solutions Group's accrual ratio is solid, and indicates strong free cash flow, as we discussed, above. Based on this observation, we consider it likely that Croma Security Solutions Group's statutory profit actually understates its earnings potential! And it's also positive that the company showed enough improvement to book a profit this year, after losing money last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. When we did our research, we found 3 warning signs for Croma Security Solutions Group (1 is a bit concerning!) that we believe deserve your full attention.

Today we've zoomed in on a single data point to better understand the nature of Croma Security Solutions Group's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:CSSG

Croma Security Solutions Group

Provides security services in the United Kingdom.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Hotel101 Global: A Scalable Hospitality Platform Built to Compound

Tesla’s Nvidia Moment – The AI & Robotics Inflection Point

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion