- United Kingdom

- /

- Tech Hardware

- /

- AIM:CNC

Has Concurrent Technologies Plc's (LON:CNC) Impressive Stock Performance Got Anything to Do With Its Fundamentals?

Concurrent Technologies' (LON:CNC) stock is up by a considerable 11% over the past week. Given that stock prices are usually aligned with a company's financial performance in the long-term, we decided to study its financial indicators more closely to see if they had a hand to play in the recent price move. Specifically, we decided to study Concurrent Technologies' ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Concurrent Technologies

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Concurrent Technologies is:

13% = UK£5.0m ÷ UK£38m (Based on the trailing twelve months to June 2024).

The 'return' is the income the business earned over the last year. One way to conceptualize this is that for each £1 of shareholders' capital it has, the company made £0.13 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Concurrent Technologies' Earnings Growth And 13% ROE

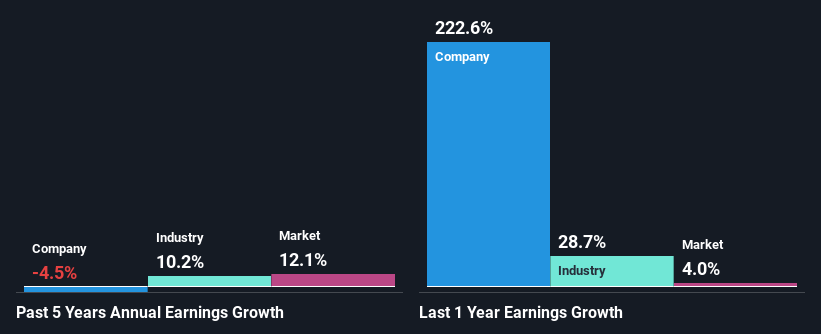

To start with, Concurrent Technologies' ROE looks acceptable. Even when compared to the industry average of 12% the company's ROE looks quite decent. However, while Concurrent Technologies has a pretty respectable ROE, its five year net income decline rate was 4.5% . We reckon that there could be some other factors at play here that are preventing the company's growth. For example, it could be that the company has a high payout ratio or the business has allocated capital poorly, for instance.

So, as a next step, we compared Concurrent Technologies' performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 10% over the last few years.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. Has the market priced in the future outlook for CNC? You can find out in our latest intrinsic value infographic research report.

Is Concurrent Technologies Making Efficient Use Of Its Profits?

With a high three-year median payout ratio of 56% (implying that 44% of the profits are retained), most of Concurrent Technologies' profits are being paid to shareholders, which explains the company's shrinking earnings. The business is only left with a small pool of capital to reinvest - A vicious cycle that doesn't benefit the company in the long-run.

In addition, Concurrent Technologies has been paying dividends over a period of at least ten years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth. Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to drop to 19% over the next three years. However, the company's ROE is not expected to change by much despite the lower expected payout ratio.

Conclusion

Overall, we feel that Concurrent Technologies certainly does have some positive factors to consider. Yet, the low earnings growth is a bit concerning, especially given that the company has a high rate of return. Investors could have benefitted from the high ROE, had the company been reinvesting more of its earnings. As discussed earlier, the company is retaining a small portion of its profits. Having said that, looking at current analyst estimates, we found that the company's earnings growth rate is expected to see a huge improvement. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CNC

Concurrent Technologies

Designs, develops, manufactures, and markets single board computers for system integrators and original equipment manufacturers.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Promigas E.S.P looks to a promising future with 35% revenue growth

Kratos Defense & Security Solutions (KTOS): Scaling "Attritable" Dominance in a New Era of Aerial Conflict.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks