- United Kingdom

- /

- Diversified Financial

- /

- LSE:WISE

The Key Drivers in Wise plc's (LON:WISE) Current Valuation and Business Model

Wise plc (LON:WISE) started trading on the London Stock Exchange through a direct listing in London on 7 July 2021. The company has adopted a sustainable and profitable model, with an emphasis on cutting costs for customers that seek to transfer funds and hold an international low-cost account. Today, we will go over their business, and estimate what investors can expect going forward from the stock.

Introduction

Wise offers money transfer services for personal and business clients, as well as a Wise account which allows clients to hold money in 56 currencies and get real bank account numbers in 10 currencies. Customers can also order a Wise card to withdraw, spend, send money, etc.

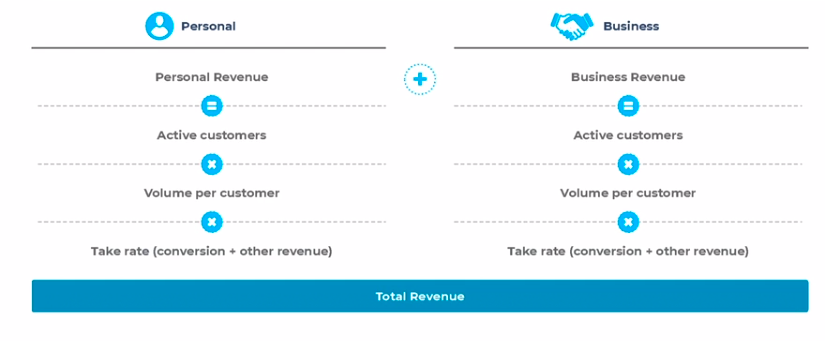

How does Wise make money?

When people transfer funds from the platform, they pay a small fee. These fees and other transaction income are called a "Take Rate", and represent the % of income which Wise takes from transactions per customer.

For example, we see that the trailing 12-month revenue at WISE was GBP485.1m, and the last Q3 reported take rate is 0.73%, which means that the company is working towards minimizing costs for customers.

While it may seem somewhat counterintuitive from an investor perspective, the company strives to lower the take rates on the long-term. They are attempting to make their services widely accessible and decrease the costs for people that are transferring, transacting etc. This leaves them with increasing market share or offering new services as a main business strategy.

The company is in its young growth phase, and bares all the benefits and risks associated with that. Currently, they have about 6 million customers, and GBP54b in volume in 2021 - The company considers these to be starting numbers and estimates that there is a lot more market share that it can capture.

Check out our latest analysis for Wise

So, let's take a look at their business model, and see if it makes sense for investors.

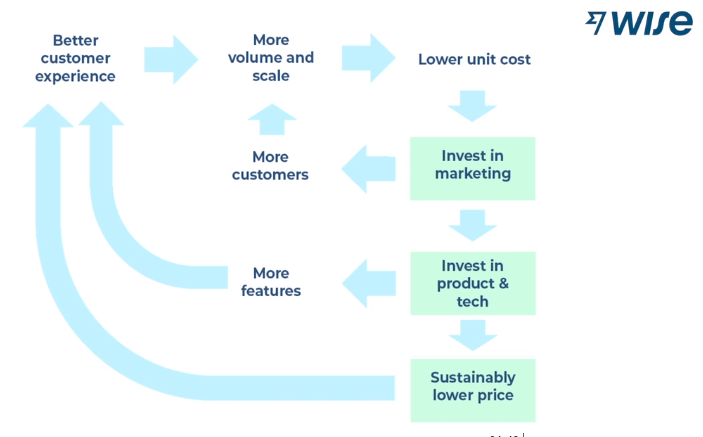

In the chart taken from their video presentation, they outline their strategy for re-investing their income. It seems that management focuses on disciplined spending, market share + product expansion, and heavy price competition.

Let's break it down:

The central point is a lower cost for customers. Their benevolent cycle consists of investing in marketing and product development, which should drive more customers on the platform, allowing the company to lower the price even more.

The company is also in the early stages of growth, so there are a few challenges to note:

- They are positioned in an industry with high barriers to entry - especially regulations and compliance

- Competition is tight and involves traditional banks, new banks, payment transferring and processing platforms

- The technology is rapidly evolving, and new trends can allow even more competitors to enter the landscape

On the other hand, Wise is indeed one of the cheaper platforms for transferring funds, and the company seems to also be targeting debit cards, and business payment processing services. The customers are currently quite satisfied with the service, and WISE has a 4.3 rating on the Google App Store (as of 17.February) with over 10 million installations. The company also has a 4.6 score on Trustpilot. While these ratings may seem unimportant to financial value, we can argue that growth necessitates quality, and in a highly competitive environment, quality may be a key factor in a company's success.

Fundamentals & Value

While older stocks have a rich base of fundamentals, in young-growth companies we are frequently confined to the top line, growth rates and market share capacity.

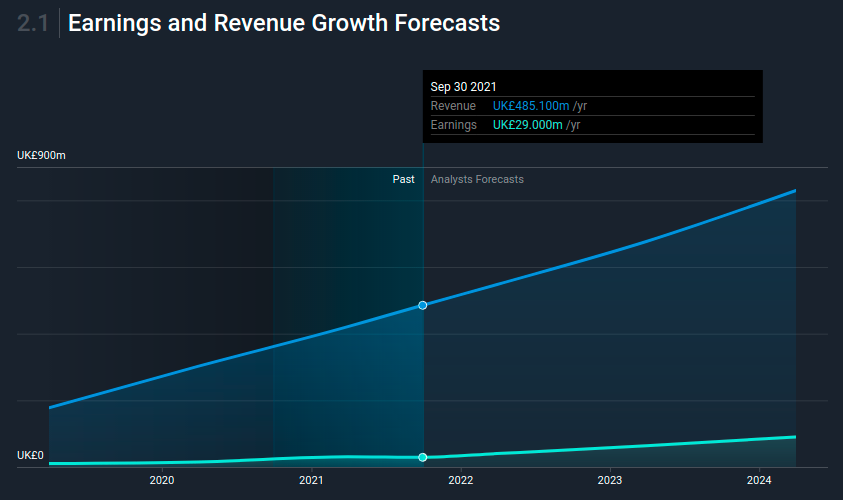

For Wise, we have data on revenue and earnings, with analyst estimates up to 2024.

The chart above helps us understand the company on the short run. The projected growth rates come from analysts, who in turn, rarely deviate from management's outlook.

For WISE, analysts are projecting an annual growth rate of 44%, while management estimates a growth of 30% from FY 2021 to FY 2022 and has not given further guidance.

What we can notice, is that while the company is profitable, it is barely above 0, and has earnings of GBP29m. The issue here is that the company is already trading at a GBP7.4b market cap, which puts it close to par with Western Union (NYSE:WU), who is making US$800m in yearly earnings. As it stands today, the current valuation seems reasonable if investors trust the company to surpass WU in earnings in the next 5 to 10 years.

Conclusion

It seems that WISE has a great opportunity to expand market share, gain recognition, but may ultimately have to leverage its brand to expand horizontally and enter more profitable fields in order to justify a growing valuation. While somewhat out in the future, this is achievable, and management seem to have gotten a right mix of quality and growth behind the company.

For investors, this is a high risk company, and if bought they might want to consider allocating it to a smaller portion of their portfolio, additionally they can mix it with other stocks withing the industry, in order to spread the risk. - I emphasize spreading the risk, as many young companies have a possibility to not survive over the long run, and picking a mix of winners and losers can offset the possible loss of an investment.

Next Steps:

Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Wise you should know about.

Also, if you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you're looking to trade Wise, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About LSE:WISE

Wise

Provides cross-border and domestic financial services for personal and business customers in the United Kingdom, rest of Europe, the Asia-Pacific, North America, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives