- United Kingdom

- /

- Biotech

- /

- LSE:GNS

Exploring 3 High Growth Tech Stocks in the United Kingdom

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faltered, closing 0.4 percent lower at 7,527.42 amid weak trade data from China, indicating global economic uncertainties that have impacted market sentiment. In this challenging environment, identifying high-growth tech stocks with strong fundamentals and innovative potential becomes crucial for investors looking to navigate the volatile landscape effectively.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Oxford Biomedica | 20.98% | 106.13% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our UK High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

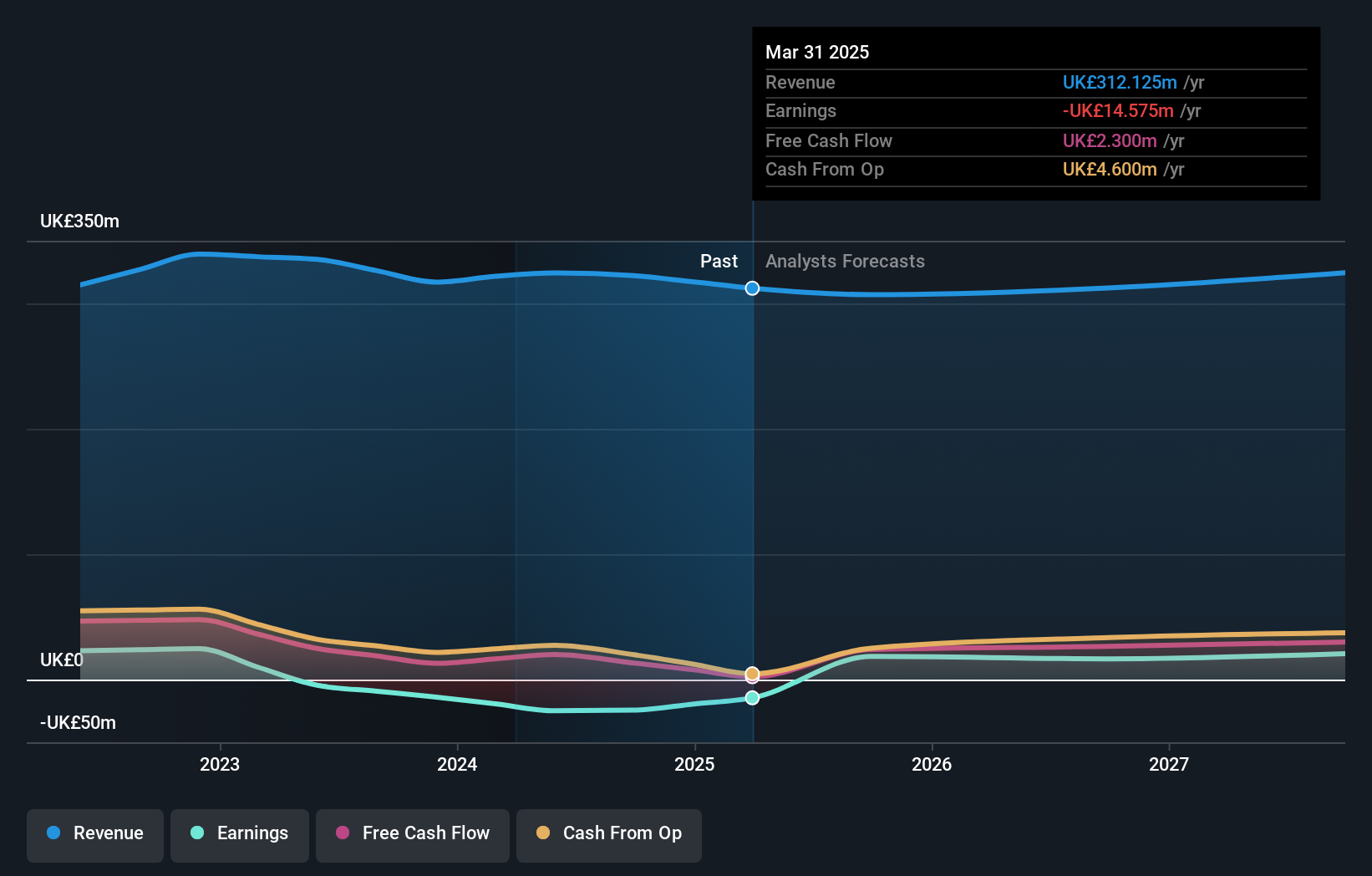

Genus (LSE:GNS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genus plc is an animal genetics company with operations spanning North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia and has a market cap of approximately £1.31 billion.

Operations: Genus plc generates revenue primarily from its Genus ABS and Genus PIC segments, contributing £314.90 million and £352.50 million respectively. The company operates globally across various regions including North America, Latin America, the UK, Europe, the Middle East, Russia, Africa, and Asia.

Despite a challenging year marked by a significant one-off loss of £47.4M, Genus plc is positioned for robust recovery with expected earnings growth of 39.4% per annum, outpacing the UK market forecast of 14.4%. This resilience is underscored by a steady dividend proposal and an R&D focus that continues to innovate in biotechnology, essential for future competitiveness. With revenue growth projections slightly above the national average at 4.1%, Genus balances current adversities with promising financial health indicators and strategic investments in research, ensuring its relevance in the evolving tech landscape.

- Take a closer look at Genus' potential here in our health report.

Gain insights into Genus' historical performance by reviewing our past performance report.

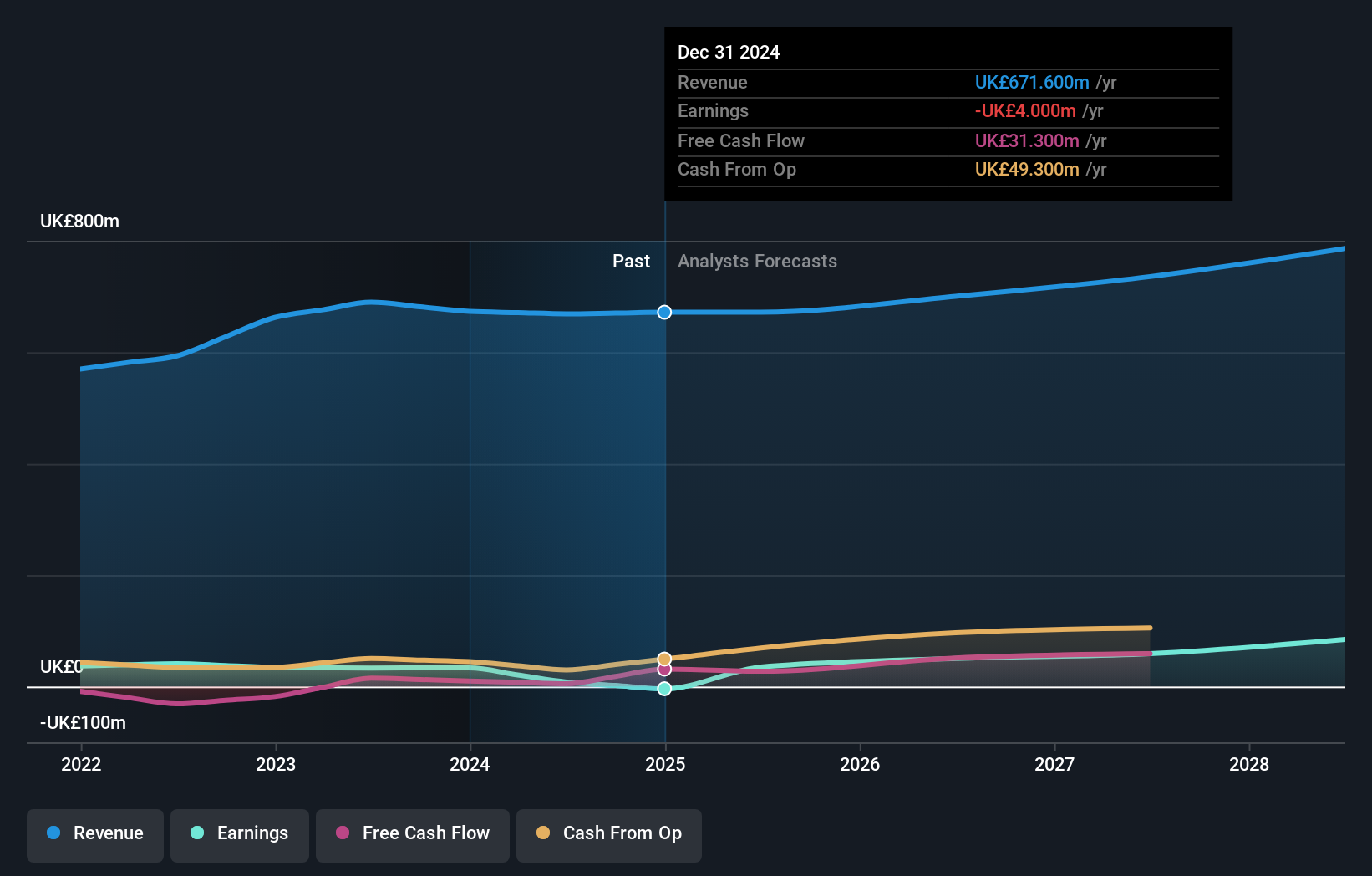

NCC Group (LSE:NCC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NCC Group plc operates in the cyber and software resilience sector across the United Kingdom, the Asian-Pacific, North America, and Europe, with a market cap of £557.75 million.

Operations: NCC Group plc generates revenue primarily from its Cyber Security segment (£258.50 million) and Escode segment (£65.90 million). The company operates in multiple regions, including the UK, Asia-Pacific, North America, and Europe.

Amidst recent additions to the FTSE indices, NCC Group's strategic focus on R&D is pivotal, with expenses aimed at fortifying cybersecurity solutions. This investment, crucial for maintaining competitive edge in tech security, aligns with their 4.5% revenue growth rate and an impressive forecast of 87.4% earnings growth annually. Despite a challenging financial year marked by a £24.9 million net loss, these developments suggest a potential turnaround fueled by innovative practices and market adaptation strategies—key for future profitability and sector influence.

- Click here and access our complete health analysis report to understand the dynamics of NCC Group.

Assess NCC Group's past performance with our detailed historical performance reports.

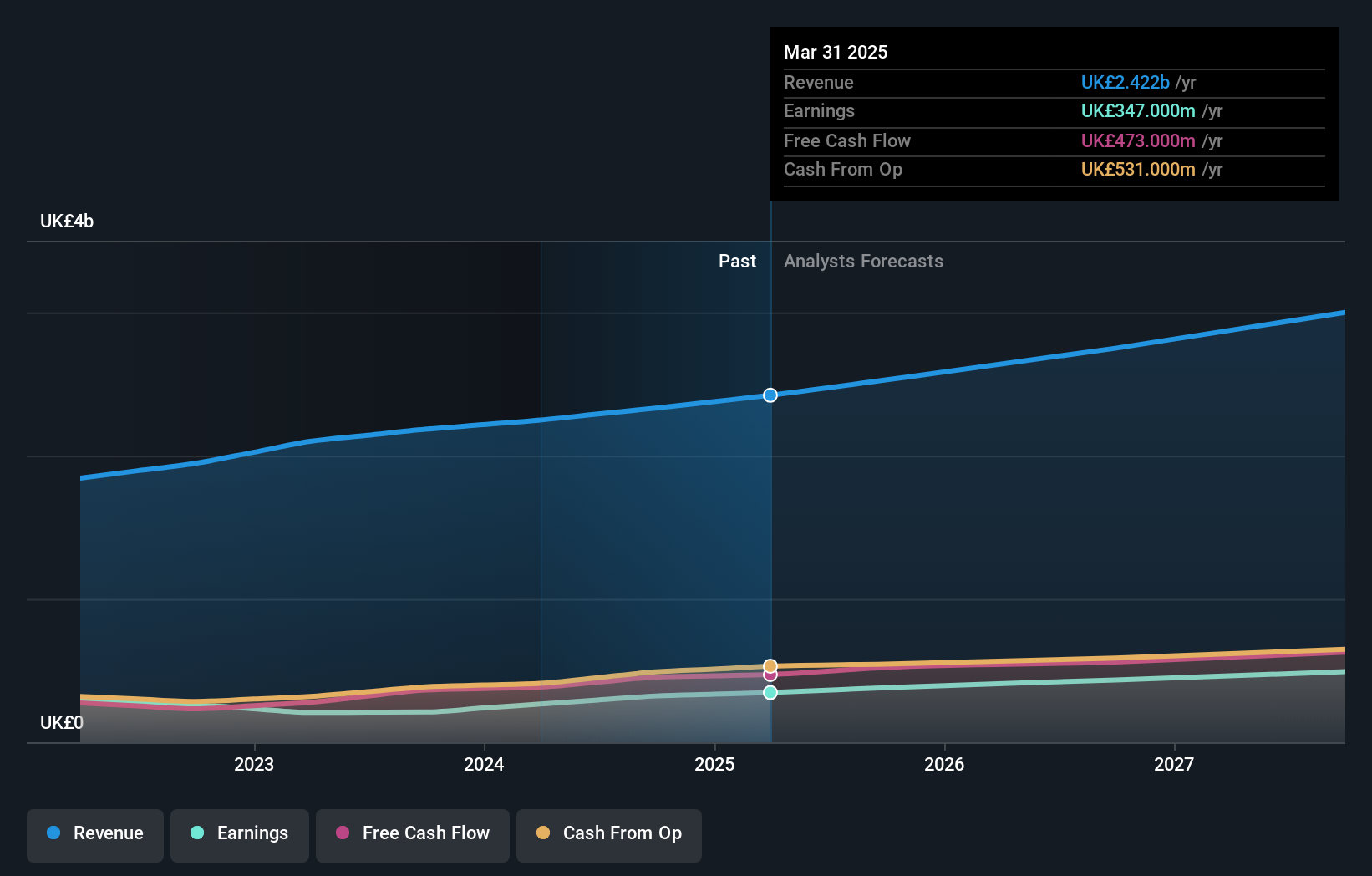

Sage Group (LSE:SGE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Sage Group plc, along with its subsidiaries, offers technology solutions and services for small and medium businesses across the United States, the United Kingdom, France, and other international markets, with a market cap of £10.22 billion.

Operations: The company generates revenue primarily from technology solutions and services, with significant contributions from North America (£1.01 billion) and Europe (£595 million). The net profit margin stands at 17%.

Sage Group is making significant strides in the tech landscape, evidenced by a robust 7.7% annual revenue growth and an even more impressive 15.1% expected earnings growth per annum, outpacing the UK market's average. The firm's commitment to innovation is underscored by its R&D expenditure, which has been strategically increased to enhance its software solutions, particularly within the Sage Business Cloud portfolio. This focus not only addresses operational efficiencies for SMBs but also aligns with industry shifts towards integrated financial management systems, as highlighted by their recent partnership with VoPay. This collaboration introduces advanced payment functionalities that streamline payroll processes—a critical development given that 27% of businesses cite inefficiency as a major hurdle. With £1.74 billion in revenue over nine months and strategic initiatives poised to capitalize on digital transformation trends, Sage's trajectory suggests a promising fusion of growth and technological advancement in business software solutions.

Where To Now?

- Gain an insight into the universe of 47 UK High Growth Tech and AI Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GNS

Genus

Operates as an animal genetics company in North America, Latin America, the United Kingdom, rest of Europe, the Middle East, Russia, Africa, and Asia.

Reasonable growth potential and slightly overvalued.