- United Kingdom

- /

- Software

- /

- LSE:RM.

Shareholders in RM (LON:RM.) have lost 45%, as stock drops 12% this past week

The main aim of stock picking is to find the market-beating stocks. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in RM plc (LON:RM.), since the last five years saw the share price fall 48%. The falls have accelerated recently, with the share price down 14% in the last three months. Of course, this share price action may well have been influenced by the 8.5% decline in the broader market, throughout the period.

Since RM has shed UK£11m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

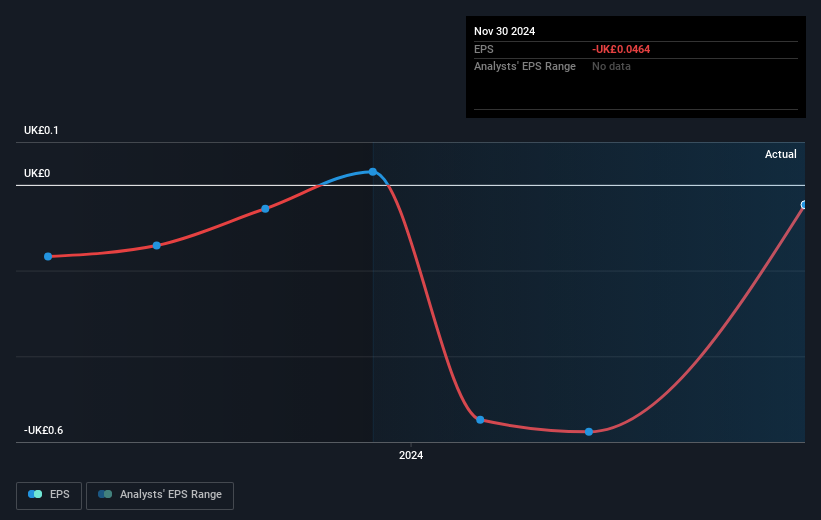

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over five years RM's earnings per share dropped significantly, falling to a loss, with the share price also lower. This was, in part, due to extraordinary items impacting earnings. At present it's hard to make valid comparisons between EPS and the share price. But we would generally expect a lower price, given the situation.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on RM's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between RM's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that RM's TSR, which was a 45% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

We're pleased to report that RM shareholders have received a total shareholder return of 43% over one year. There's no doubt those recent returns are much better than the TSR loss of 8% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that RM is showing 2 warning signs in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:RM.

RM

Supplies products, services, and solutions to educational markets in the United Kingdom, Europe, North America, Asia, the Middle East, and internationally.

Fair value with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion