FDM Group (Holdings) plc (LON:FDM), is not the largest company out there, but it saw a double-digit share price rise of over 10% in the past couple of months on the LSE. With many analysts covering the stock, we may expect any price-sensitive announcements have already been factored into the stock’s share price. However, what if the stock is still a bargain? Today I will analyse the most recent data on FDM Group (Holdings)’s outlook and valuation to see if the opportunity still exists.

Check out our latest analysis for FDM Group (Holdings)

What's the opportunity in FDM Group (Holdings)?

The share price seems sensible at the moment according to my price multiple model, where I compare the company's price-to-earnings ratio to the industry average. In this instance, I’ve used the price-to-earnings (PE) ratio given that there is not enough information to reliably forecast the stock’s cash flows. I find that FDM Group (Holdings)’s ratio of 42.52x is trading slightly below its industry peers’ ratio of 43.15x, which means if you buy FDM Group (Holdings) today, you’d be paying a decent price for it. And if you believe that FDM Group (Holdings) should be trading at this level in the long run, then there’s not much of an upside to gain over and above other industry peers. So, is there another chance to buy low in the future? Given that FDM Group (Holdings)’s share is fairly volatile (i.e. its price movements are magnified relative to the rest of the market) this could mean the price can sink lower, giving us an opportunity to buy later on. This is based on its high beta, which is a good indicator for share price volatility.

Can we expect growth from FDM Group (Holdings)?

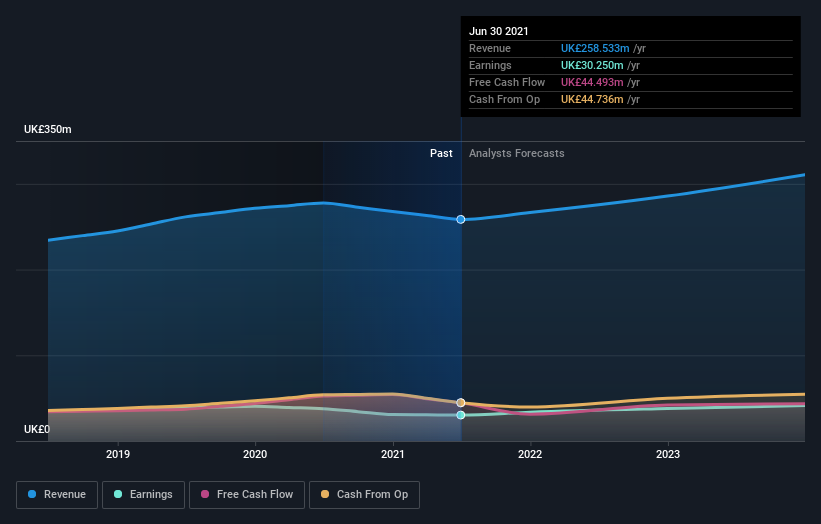

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company's future expectations. FDM Group (Holdings)'s earnings over the next few years are expected to increase by 48%, indicating a highly optimistic future ahead. This should lead to more robust cash flows, feeding into a higher share value.

What this means for you:

Are you a shareholder? It seems like the market has already priced in FDM’s positive outlook, with shares trading around industry price multiples. However, there are also other important factors which we haven’t considered today, such as the financial strength of the company. Have these factors changed since the last time you looked at FDM? Will you have enough confidence to invest in the company should the price drop below the industry PE ratio?

Are you a potential investor? If you’ve been keeping an eye on FDM, now may not be the most optimal time to buy, given it is trading around industry price multiples. However, the positive outlook is encouraging for FDM, which means it’s worth further examining other factors such as the strength of its balance sheet, in order to take advantage of the next price drop.

With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. In terms of investment risks, we've identified 1 warning sign with FDM Group (Holdings), and understanding this should be part of your investment process.

If you are no longer interested in FDM Group (Holdings), you can use our free platform to see our list of over 50 other stocks with a high growth potential.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:FDM

FDM Group (Holdings)

Provides information technology (IT) services in the United Kingdom, North America, Europe, the Middle East, Africa, rest of Europe, and the Asia Pacific.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion