- United Kingdom

- /

- Trade Distributors

- /

- LSE:HWDN

Top UK Dividend Stocks To Consider: Computacenter And 2 More

Reviewed by Simply Wall St

In the current economic climate, the United Kingdom's FTSE 100 index has faced challenges, particularly due to weak trade data from China, which has impacted companies tied to global demand. As market volatility persists, investors may find dividend stocks appealing for their potential to provide steady income streams amidst broader market fluctuations.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 7.22% | ★★★★★★ |

| Man Group (LSE:EMG) | 7.65% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.82% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 8.95% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.67% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.98% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.41% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.55% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.78% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 7.63% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top UK Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

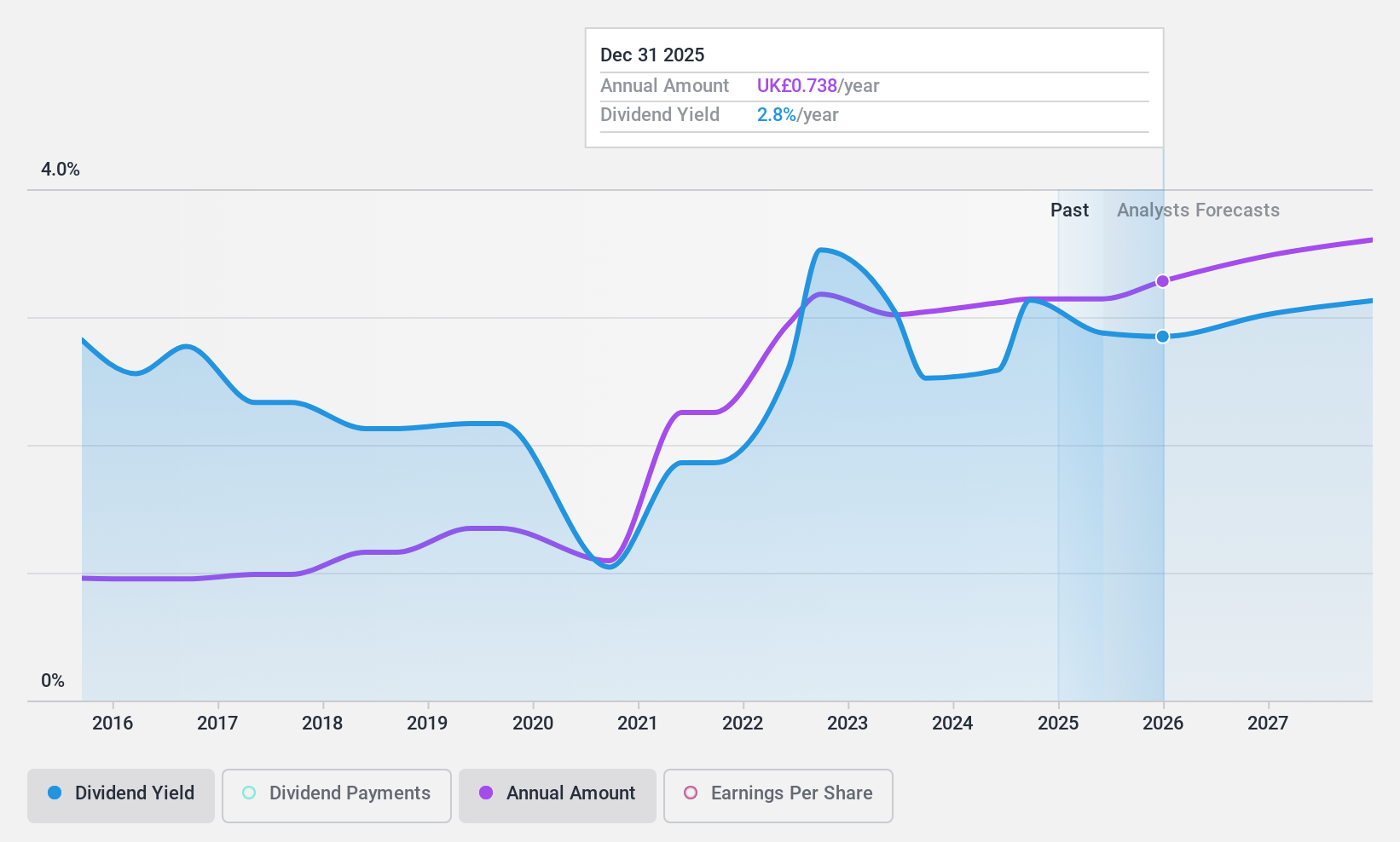

Computacenter (LSE:CCC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Computacenter plc offers technology solutions and services to corporate and public sector clients across the UK, Germany, France, North America, and internationally, with a market cap of £2.38 billion.

Operations: Computacenter plc's revenue from Computer Services amounts to £6.96 billion.

Dividend Yield: 3.1%

Computacenter's dividends are well-covered by earnings, with a payout ratio of 45.8%, and cash flows, at a cash payout ratio of 19.2%. The company has maintained dividend growth over the past decade, though payments have been volatile. Recent announcements include a proposed final dividend for 2024 of 47.4 pence per share, marking a slight increase from the previous year. Computacenter's strategic partnerships and share buybacks further support its financial stability in the dividend landscape.

- Delve into the full analysis dividend report here for a deeper understanding of Computacenter.

- Upon reviewing our latest valuation report, Computacenter's share price might be too pessimistic.

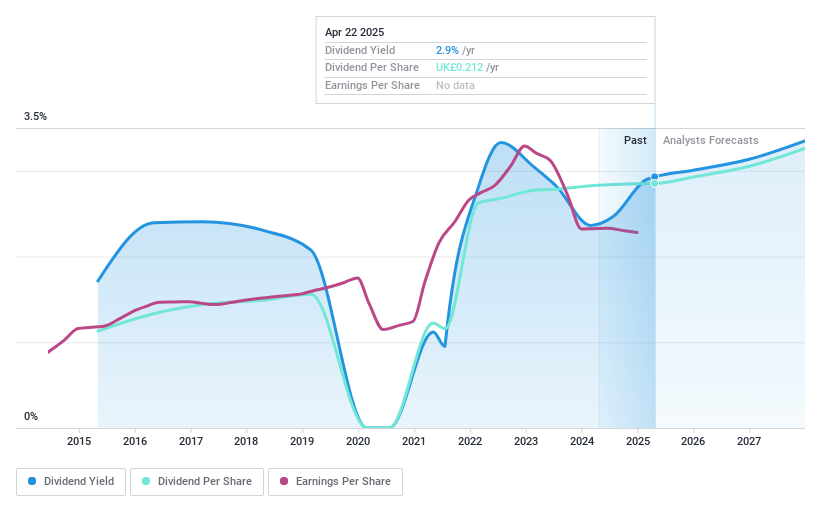

Howden Joinery Group (LSE:HWDN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Howden Joinery Group Plc is a supplier of kitchen, joinery, and hardware products operating in the United Kingdom, France, Belgium, and the Republic of Ireland with a market cap of £3.74 billion.

Operations: Howden Joinery Group Plc generates its revenue primarily from the Howden Joinery segment, which accounted for £2.32 billion.

Dividend Yield: 3.1%

Howden Joinery Group's dividends are covered by earnings and cash flows, with payout ratios of 46.5% and 41.9%, respectively, despite a history of volatility over the past decade. The proposed final dividend for 2024 is slightly increased to 16.3 pence per share, totaling 21.2 pence for the year. A £100 million share buyback program has been announced to reduce share capital, complementing its dividend strategy amidst a challenging earnings environment with net income slightly down from last year at £249.3 million.

- Take a closer look at Howden Joinery Group's potential here in our dividend report.

- Our expertly prepared valuation report Howden Joinery Group implies its share price may be lower than expected.

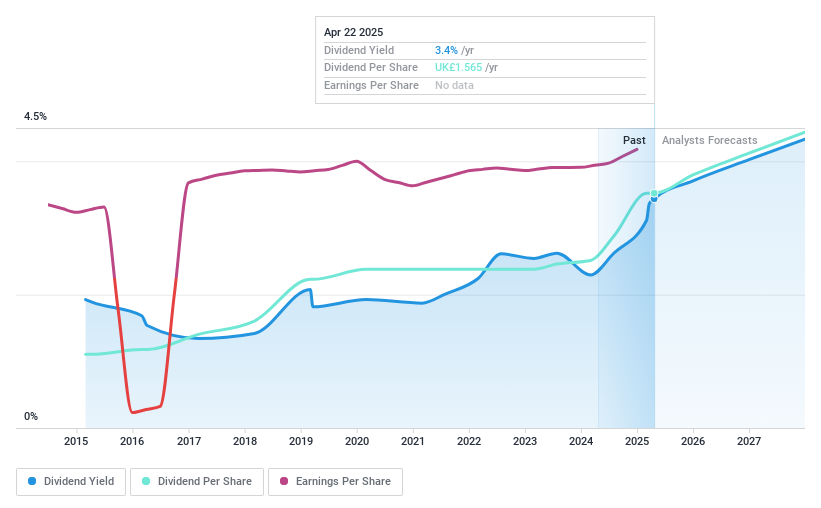

Intertek Group (LSE:ITRK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Intertek Group plc offers quality assurance solutions across multiple industries globally, with a market capitalization of approximately £7.31 billion.

Operations: Intertek Group plc generates revenue through several key segments: World of Energy (£757.30 million), Consumer Products (£958.80 million), Health and Safety (£337.20 million), Corporate Assurance (£496.30 million), and Industry and Infrastructure (£843.60 million).

Dividend Yield: 3.4%

Intertek Group's dividends have been reliable and stable over the past decade, supported by a reasonable earnings payout ratio of 73% and cash flow coverage at 54.5%. The dividend yield of 3.45% is lower than the top UK payers, but recent increases to a proposed final dividend of 102.6 pence per share for 2024 demonstrate growth. Intertek's strategic focus includes M&A opportunities and a £350 million share buyback program, enhancing shareholder value amidst robust earnings growth.

- Navigate through the intricacies of Intertek Group with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Intertek Group is trading behind its estimated value.

Key Takeaways

- Investigate our full lineup of 60 Top UK Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Howden Joinery Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HWDN

Howden Joinery Group

Supplies various kitchen, joinery, and hardware products in the United Kingdom, France, Belgium, and the Republic of Ireland.

Flawless balance sheet and fair value.

Market Insights

Community Narratives