- United Kingdom

- /

- Biotech

- /

- LSE:GNS

Undervalued Small Caps With Insider Action In United Kingdom For September 2024

Reviewed by Simply Wall St

The United Kingdom market has been experiencing turbulence, with the FTSE 100 index closing lower amid weak trade data from China and broader global economic concerns. Despite these challenges, there are opportunities to be found in undervalued small-cap stocks, particularly those that have seen insider action, which can often signal confidence from within the company.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Domino's Pizza Group | 14.9x | 1.7x | 39.77% | ★★★★★☆ |

| Genus | 158.0x | 1.9x | 3.84% | ★★★★★☆ |

| GB Group | NA | 2.8x | 36.77% | ★★★★★☆ |

| Bytes Technology Group | 26.4x | 6.0x | 5.94% | ★★★★☆☆ |

| NWF Group | 8.6x | 0.1x | 35.78% | ★★★★☆☆ |

| CVS Group | 22.7x | 1.3x | 40.30% | ★★★★☆☆ |

| Essentra | 700.7x | 1.4x | 39.49% | ★★★★☆☆ |

| Harworth Group | 11.9x | 6.2x | -588.15% | ★★★☆☆☆ |

| Oxford Instruments | 23.1x | 2.5x | -29.30% | ★★★☆☆☆ |

| Rank Group | 31.6x | 0.5x | 38.65% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Bytes Technology Group (LSE:BYIT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bytes Technology Group is an IT solutions provider with a market cap of approximately £1.20 billion.

Operations: The company's revenue is primarily derived from its IT solutions segment, amounting to £207.02 million. For the period ending February 29, 2024, it reported a gross profit margin of 70.42% and a net income of £46.85 million with operating expenses at £89.07 million and non-operating expenses at £9.86 million

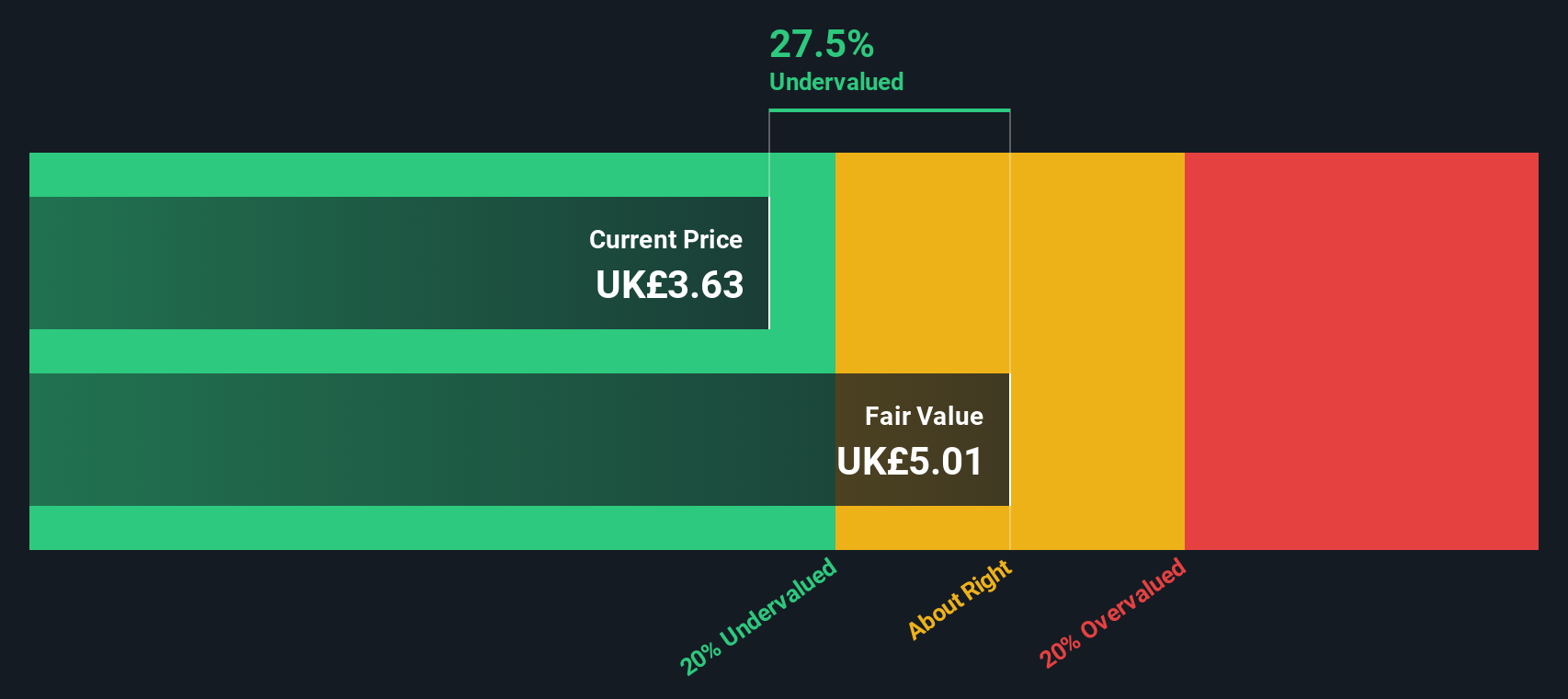

PE: 26.4x

Bytes Technology Group, a small-cap player in the UK, recently approved both a final dividend of 6.0 pence per share and a special dividend of 8.7 pence per share at their AGM on July 11, 2024. These dividends were paid out on August 2, reflecting strong financial health despite relying entirely on external borrowing for funding. Insider confidence is evident with significant share purchases over the past six months. Earnings are projected to grow by nearly 9% annually, suggesting potential for future value appreciation.

- Click here and access our complete valuation analysis report to understand the dynamics of Bytes Technology Group.

Gain insights into Bytes Technology Group's past trends and performance with our Past report.

Genus (LSE:GNS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Genus is a biotechnology company specializing in animal genetics, with a market cap of approximately £2.50 billion.

Operations: Genus generates revenue primarily from its Genus ABS and Genus PIC segments, with significant contributions from both. The company has seen varying net income margins over the periods, with a notable trend of gross profit margin peaking at 68.02% in March 2024. Operating expenses and R&D costs are substantial components of its cost structure, impacting overall profitability.

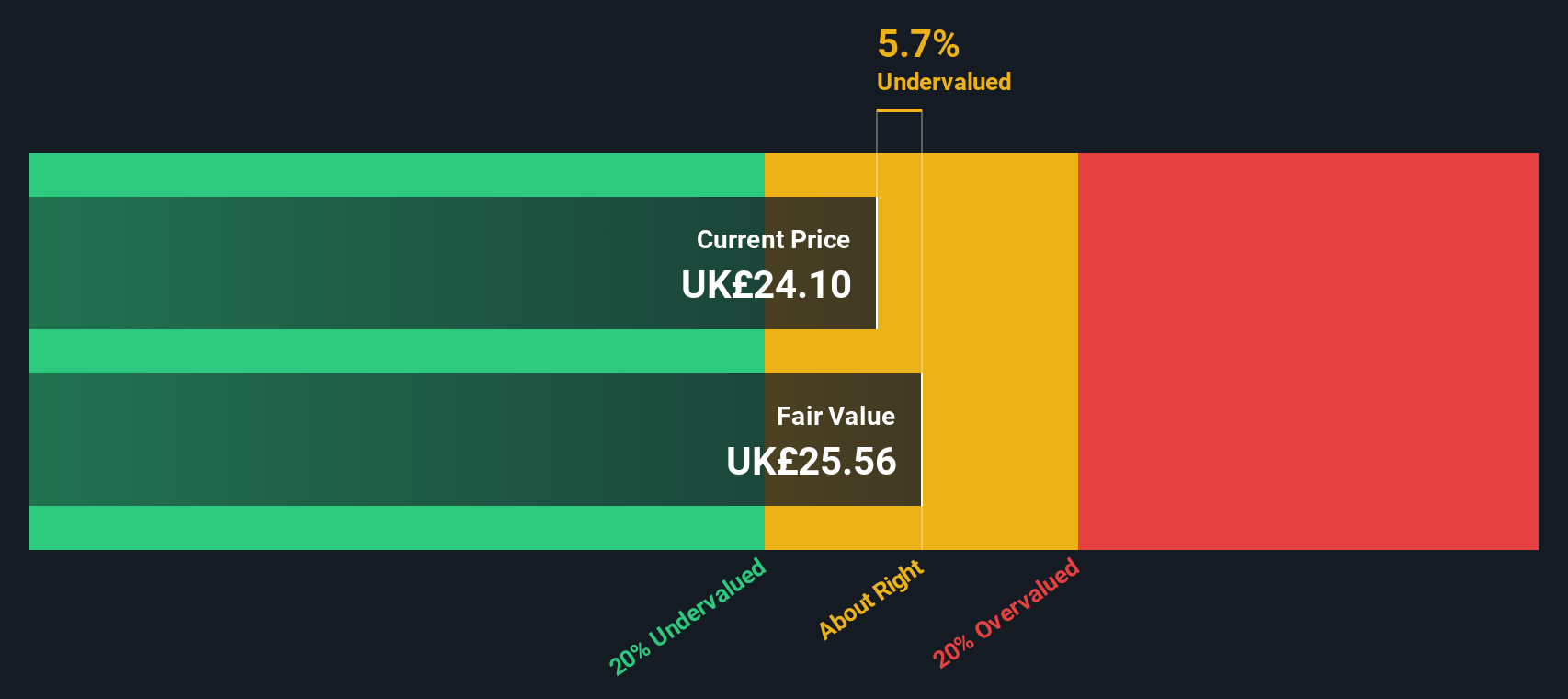

PE: 158.0x

Genus, a small UK company, reported full-year sales of £668.8 million for June 2024, down from £689.7 million the previous year. Net income dropped to £7.9 million from £33.3 million due to large one-off items affecting results and lower profit margins (1.2% vs 4.8%). Despite these challenges, insider confidence remains high with recent share purchases by executives in August 2024, suggesting optimism about future growth prospects and earnings forecasted to grow annually by 39%.

- Delve into the full analysis valuation report here for a deeper understanding of Genus.

Examine Genus' past performance report to understand how it has performed in the past.

Rank Group (LSE:RNK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Rank Group operates in the gaming and betting industry, managing digital platforms and physical venues including Mecca, Enracha, and Grosvenor, with a market cap of approximately £0.42 billion.

Operations: Rank Group generates revenue from its Digital, Mecca Venues, Enracha Venues, and Grosvenor Venues segments. The company's gross profit margin has shown variation over the periods, with a recent figure of 42.05% for the quarter ending December 31, 2023. Operating expenses and non-operating expenses have had significant impacts on net income margins across different periods.

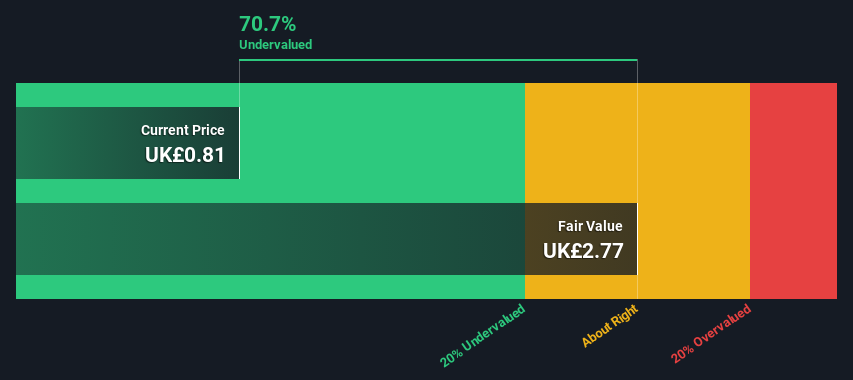

PE: 31.6x

Rank Group has shown promising signs of being undervalued within the UK small-cap sector. For the year ending June 30, 2024, they reported sales of £734.7 million and a net income turnaround to £12.5 million from a previous loss of £96.2 million. CFO Richard Harris recently purchased approximately 102,100 shares, reflecting insider confidence in the company's future prospects. Additionally, Rank Group recommended a final dividend of 0.85p per share on August 15, 2024, underscoring their financial stability and commitment to shareholders despite external borrowing as their primary funding source.

- Click here to discover the nuances of Rank Group with our detailed analytical valuation report.

Gain insights into Rank Group's historical performance by reviewing our past performance report.

Next Steps

- Embark on your investment journey to our 25 Undervalued UK Small Caps With Insider Buying selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GNS

Genus

Operates as an animal genetics company in North America, Latin America, the United Kingdom, rest of Europe, the Middle East, Russia, Africa, and Asia.

Reasonable growth potential and slightly overvalued.