- Australia

- /

- Capital Markets

- /

- ASX:IFL

October 2024's Top Undervalued Small Caps With Insider Actions

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global economic indicators, small-cap stocks have shown resilience, with the Russell 2000 Index outperforming larger counterparts in recent weeks. This environment presents potential opportunities for investors seeking undervalued small caps, especially those with notable insider actions that may signal confidence in their growth prospects.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Rogers Sugar | 15.3x | 0.6x | 48.36% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -42.26% | ★★★★☆☆ |

| Freehold Royalties | 14.1x | 6.5x | 49.37% | ★★★★☆☆ |

| HighPeak Energy | 11.8x | 1.5x | 36.43% | ★★★★☆☆ |

| German American Bancorp | 14.3x | 4.8x | 45.51% | ★★★☆☆☆ |

| Guardian Pharmacy Services | 76.5x | 1.0x | 43.68% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.3x | -99.42% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.6x | -193.52% | ★★★☆☆☆ |

| Essentra | 727.3x | 1.4x | 14.56% | ★★☆☆☆☆ |

Let's explore several standout options from the results in the screener.

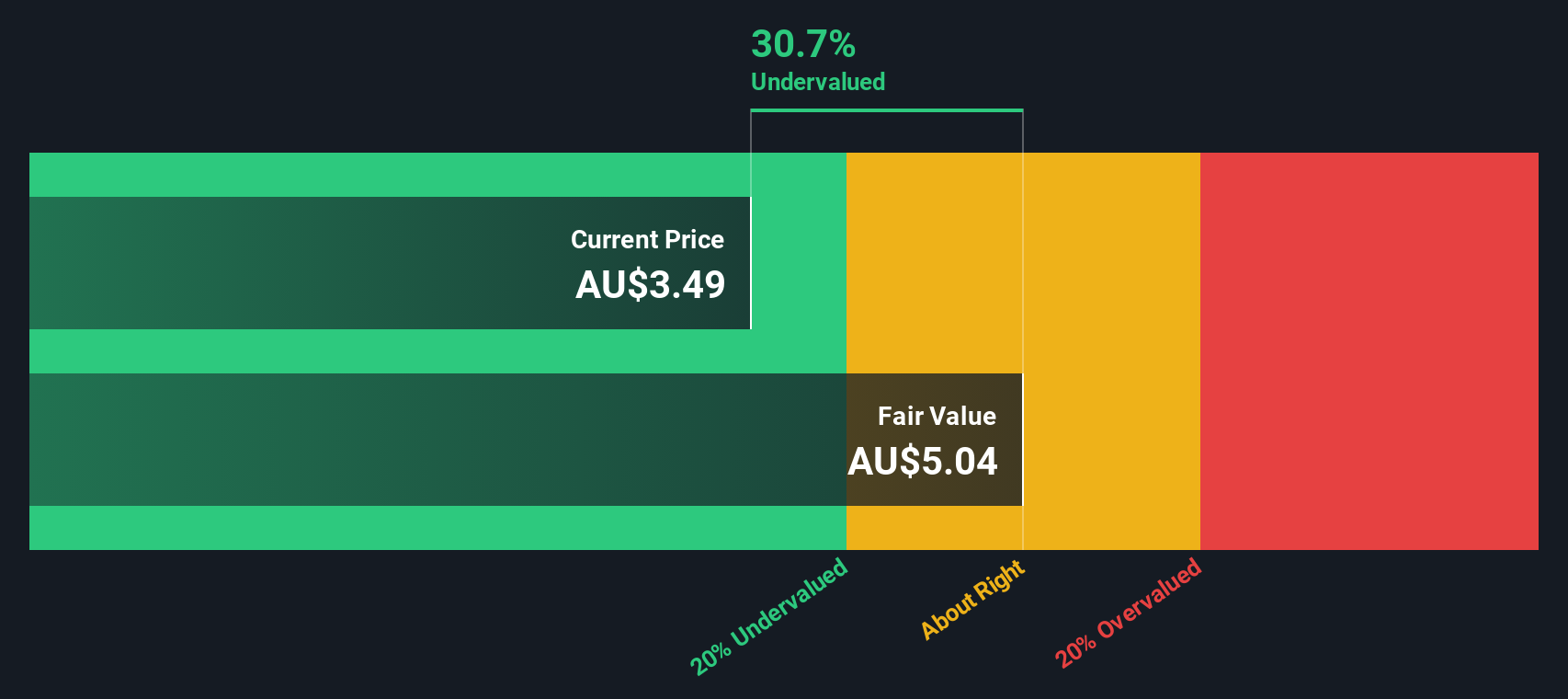

Insignia Financial (ASX:IFL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Insignia Financial operates in the financial services industry, offering advice, platforms, and asset management solutions with a market capitalization of A$2.34 billion.

Operations: Insignia Financial generates revenue primarily from its Platforms and Advice segments, with significant contributions from Asset Management. The company's gross profit margin has shown a notable trend, reaching 36.72% by the latest period. Operating expenses have been a substantial part of the cost structure, impacting net income outcomes in recent periods.

PE: -11.7x

Insignia Financial, a small-cap company, faces challenges with a net loss of A$185.3 million for the year ending June 2024, compared to a previous net income of A$51.4 million. Despite this setback, earnings are projected to grow by 58.6% annually. The company's funding is entirely from external borrowing, posing higher risks without customer deposits as security. Recent executive changes include Joseph Volpe's appointment as Company Secretary in August 2024, reflecting ongoing internal restructuring efforts.

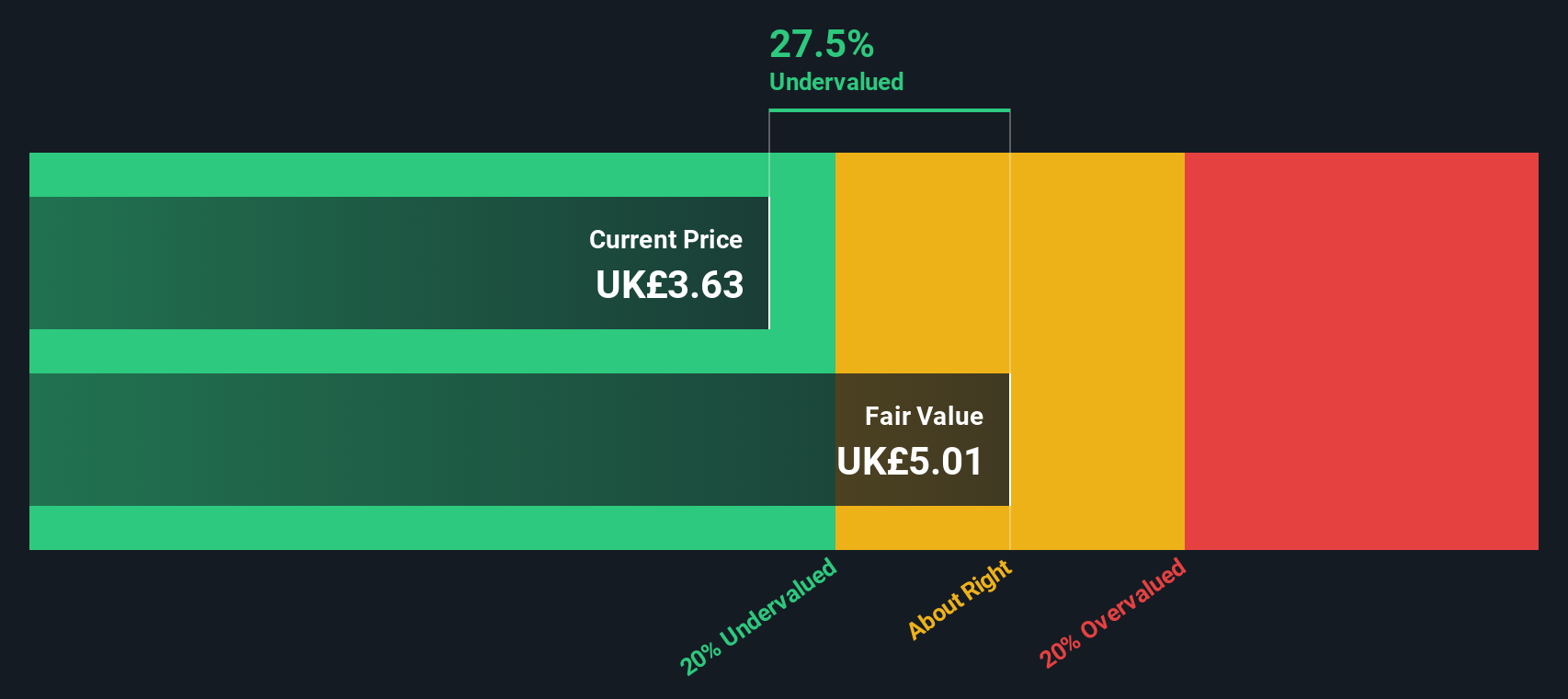

Bytes Technology Group (LSE:BYIT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bytes Technology Group is an IT solutions provider with a focus on delivering software, security, and cloud services, and it has a market capitalization of approximately £1.07 billion.

Operations: The company generates revenue primarily from IT solutions, with a recent gross profit margin of 74.86%. Operating expenses have been consistently rising, impacting net income margins, which reached 25.47% in the latest period.

PE: 23.1x

Bytes Technology Group, a small-cap player in the tech industry, showcases potential with a 7.38% annual earnings growth forecast. Despite relying entirely on external borrowing for funding, the company has demonstrated resilience by increasing its interim dividend by 14.8% to 3.1 pence per share for the six months ending August 31, 2024. Recent earnings reveal net income growth to £30.45 million from £25.39 million last year, suggesting operational improvements amidst stable sales figures of £105.47 million compared to £108.7 million previously reported.

- Unlock comprehensive insights into our analysis of Bytes Technology Group stock in this valuation report.

Gain insights into Bytes Technology Group's past trends and performance with our Past report.

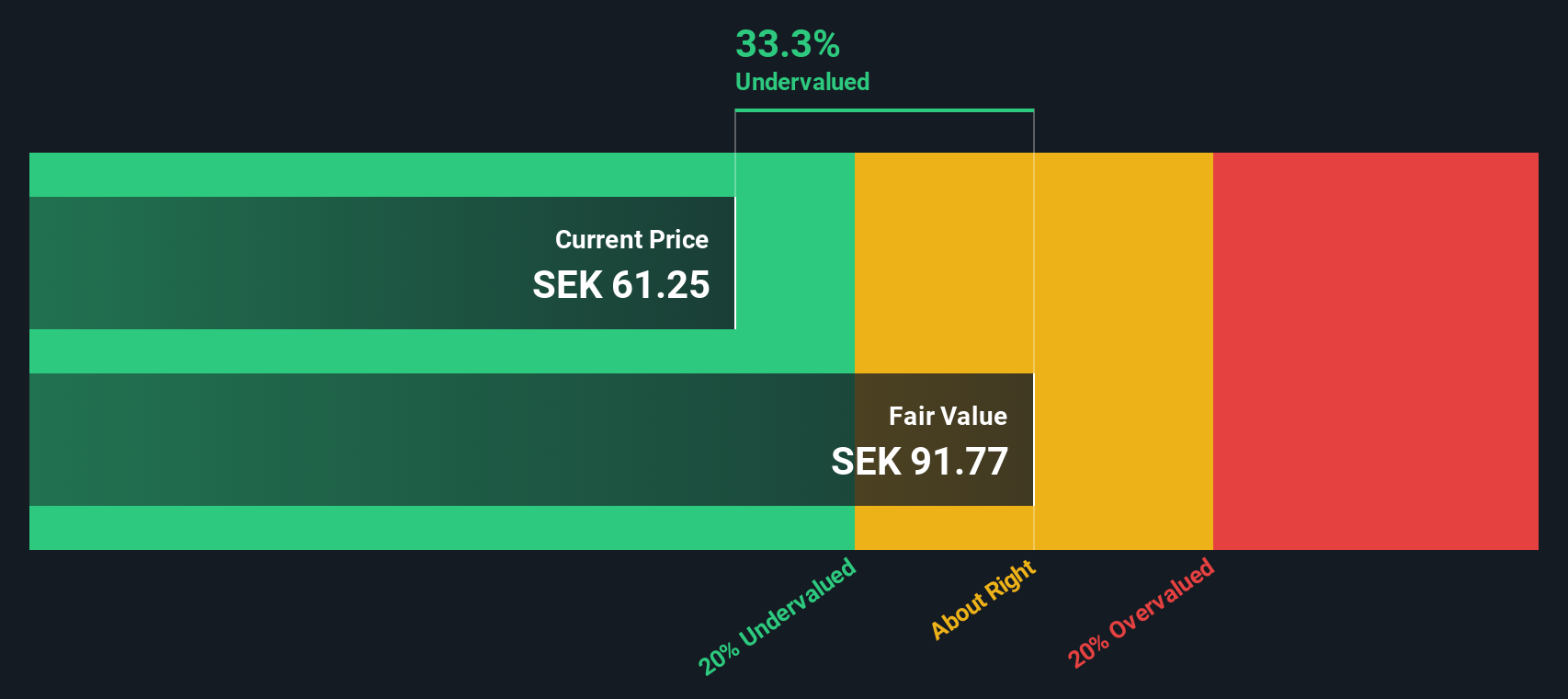

Truecaller (OM:TRUE B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Truecaller is a communications software company specializing in caller identification and spam blocking services, with a market capitalization of approximately SEK 14.79 billion.

Operations: The company generates revenue primarily from communications software, with recent figures showing SEK 1.72 billion. Its cost structure is significantly impacted by operating expenses, which include general and administrative costs and sales & marketing expenses. The net income margin has shown variability, reaching up to 31.48%.

PE: 33.5x

Truecaller, a company known for its innovative communication solutions, is gaining attention in the investment community. With earnings projected to grow 21.76% annually, it presents a compelling case for investors seeking growth potential. Recent insider confidence has been evident with share purchases over the last quarter, signaling belief in the company's trajectory. The strategic partnership with Halan enhances Truecaller's market position by integrating its Verified Business Caller ID solution into financial services, bolstering brand trust and user safety.

- Click to explore a detailed breakdown of our findings in Truecaller's valuation report.

Explore historical data to track Truecaller's performance over time in our Past section.

Key Takeaways

- Embark on your investment journey to our 189 Undervalued Small Caps With Insider Buying selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IFL

Insignia Financial

Provides financial advice, platforms, and asset management services in Australia.

Undervalued with moderate growth potential.