- Australia

- /

- Metals and Mining

- /

- ASX:AME

ASX Penny Stocks To Watch In October 2024

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has remained flat, while over the past year it has risen by 20%, with earnings forecasted to grow annually by 12%. In this context, penny stocks—often associated with smaller or newer companies—remain a niche yet intriguing area for investors seeking growth opportunities. When these stocks are supported by strong financial health and solid fundamentals, they can offer potential upside without many of the risks typically linked to this segment of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$99.57M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.845 | A$292.36M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$334.88M | ★★★★★☆ |

| LaserBond (ASX:LBL) | A$0.61 | A$74.43M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$823.33M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.19 | A$1.1B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$59.91M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$93.09M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.915 | A$117.4M | ★★★★★★ |

Click here to see the full list of 1,031 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Alto Metals (ASX:AME)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alto Metals Limited is focused on exploring gold properties in Western Australia with a market capitalization of A$50.51 million.

Operations: The company's revenue is derived from mineral exploration, amounting to A$0.07 million.

Market Cap: A$50.51M

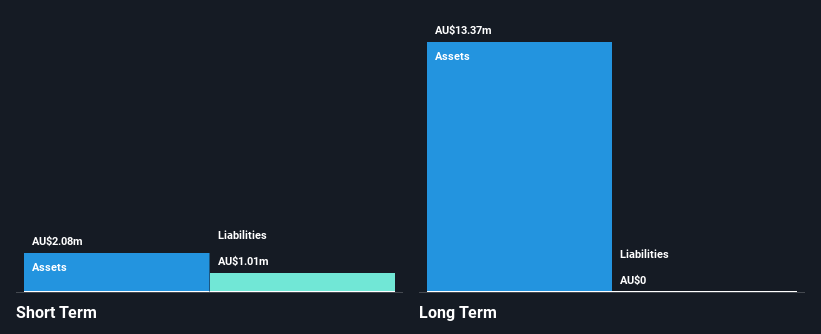

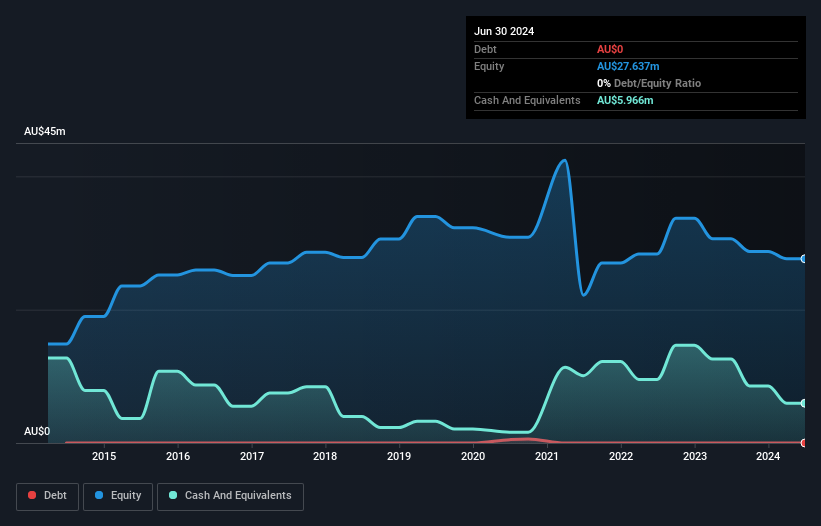

Alto Metals Limited, with a market capitalization of A$50.51 million, is a pre-revenue company focused on gold exploration in Western Australia. Despite being debt-free and having short-term assets exceeding liabilities, the company faces challenges with increased volatility and less than a year of cash runway. Recent developments include a proposed acquisition by Brightstar Resources Limited for A$43.3 million, expected to close in December 2024, subject to shareholder approval and court orders. The scheme has been deemed reasonable by BDO Corporate Finance Australia Pty Ltd., despite not being fair in absence of superior proposals.

- Click here to discover the nuances of Alto Metals with our detailed analytical financial health report.

- Gain insights into Alto Metals' historical outcomes by reviewing our past performance report.

Invion (ASX:IVX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Invion Limited is a clinical-stage life-sciences company in Australia that focuses on researching and developing Photosoft technology for treating cancers, atherosclerosis, and infectious diseases, with a market cap of A$16.92 million.

Operations: The company generates revenue from its Clinical-Stage Life Sciences segment, amounting to A$3.69 million.

Market Cap: A$16.92M

Invion Limited, with a market cap of A$16.92 million, is a clinical-stage life-sciences company focusing on Photosoft technology for cancer treatment. Despite generating A$3.69 million in revenue, the company remains unprofitable and has seen its losses increase over the past five years by 14.1% annually. It faces financial constraints with less than a year of cash runway and recent shareholder dilution of 5.4%. Recent board changes include appointing Melanie Leydin as Non-Executive Director, bringing extensive experience in corporate governance and compliance to guide Invion through its financial challenges and strategic initiatives.

- Dive into the specifics of Invion here with our thorough balance sheet health report.

- Assess Invion's previous results with our detailed historical performance reports.

Pure Hydrogen (ASX:PH2)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pure Hydrogen Corporation Limited focuses on developing hydrogen fuel and fuel cell businesses in Australia and Botswana, with a market cap of A$54.15 million.

Operations: The company generates revenue from its Energy Development segment, amounting to A$1.36 million.

Market Cap: A$54.15M

Pure Hydrogen Corporation Limited, with a market cap of A$54.15 million, focuses on hydrogen fuel development in Australia and Botswana. Despite generating A$1.36 million in revenue from its Energy Development segment, the company remains pre-revenue and unprofitable, reporting a net loss of A$3.92 million for the year ended June 30, 2024. Short-term assets of A$12.4 million comfortably cover both short-term (A$2.2M) and long-term liabilities (A$2.6M), but shareholder dilution has occurred with a recent follow-on equity offering raising A$1.5 million by issuing 10 million shares at A$0.15 each.

- Unlock comprehensive insights into our analysis of Pure Hydrogen stock in this financial health report.

- Explore historical data to track Pure Hydrogen's performance over time in our past results report.

Key Takeaways

- Unlock our comprehensive list of 1,031 ASX Penny Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AME

Adequate balance sheet slight.