This article will reflect on the compensation paid to Luke Jeffrey who has served as CEO of Crimson Tide plc (LON:TIDE) since 2018. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for Crimson Tide

Comparing Crimson Tide plc's CEO Compensation With the industry

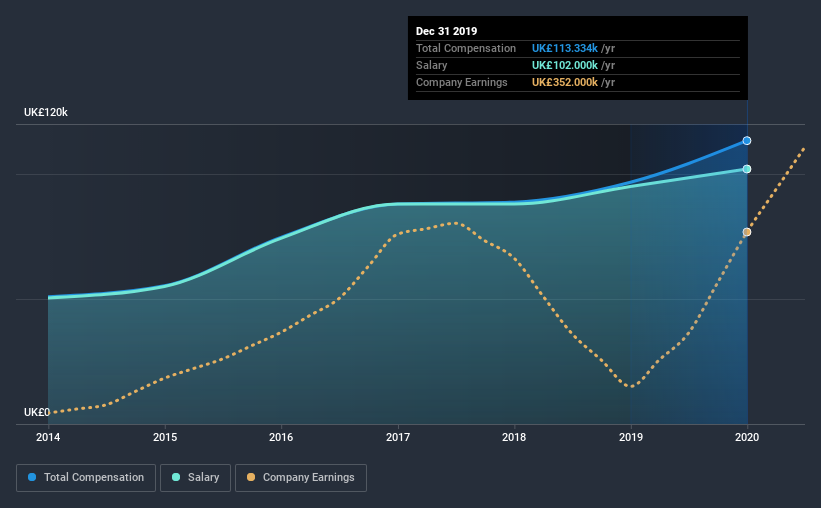

According to our data, Crimson Tide plc has a market capitalization of UK£16m, and paid its CEO total annual compensation worth UK£113k over the year to December 2019. We note that's an increase of 17% above last year. We note that the salary portion, which stands at UK£102.0k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below UK£149m, we found that the median total CEO compensation was UK£252k. Accordingly, Crimson Tide pays its CEO under the industry median. Furthermore, Luke Jeffrey directly owns UK£69k worth of shares in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | UK£102k | UK£95k | 90% |

| Other | UK£11k | UK£1.7k | 10% |

| Total Compensation | UK£113k | UK£97k | 100% |

On an industry level, around 67% of total compensation represents salary and 33% is other remuneration. According to our research, Crimson Tide has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Crimson Tide plc's Growth

Crimson Tide plc has seen its earnings per share (EPS) increase by 11% a year over the past three years. It achieved revenue growth of 39% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Crimson Tide plc Been A Good Investment?

Crimson Tide plc has not done too badly by shareholders, with a total return of 2.2%, over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

As previously discussed, Luke is compensated less than what is normal for CEOs of companies of similar size, and which belong to the same industry. At the same time, EPS growth has been exceptional over the past three years. Unfortunately, although shareholder returns are growing, they haven't impressed us as much in comparison, over the same period. We would wish for better returns (whether dividends or capital gains) but we do admire the solidEPS growth on show here. So considering these factors, we think Luke is modestly compensated.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 2 warning signs for Crimson Tide that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Crimson Tide or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:TIDE

Crimson Tide

Provides mobility solutions and related software development services primarily in the United Kingdom, the United States, and Ireland.

Adequate balance sheet with low risk.

Market Insights

Community Narratives