- United Kingdom

- /

- Diversified Financial

- /

- AIM:PCIP

Some PCI-PAL Shareholders Have Copped A Big 56% Share Price Drop

Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

PCI-PAL PLC (LON:PCIP) shareholders should be happy to see the share price up 19% in the last month. But that's not enough to compensate for the decline over the last twelve months. During that time the share price has sank like a stone, descending 56%. It's not that amazing to see a bounce after a drop like that. Arguably, the fall was overdone.

View our latest analysis for PCI-PAL

PCI-PAL isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last twelve months, PCI-PAL increased its revenue by 14%. While that may seem decent it isn't great considering the company is still making a loss. Without profits, and with revenue growth sluggish, you get a 56% loss for shareholders, over the year. Like many holders, we really want to see better revenue growth in companies that lose money. When a stock falls hard like this, it can signal an over-reaction. Our preference is to wait for a fundamental improvements before buying, but now could be a good time for some research.

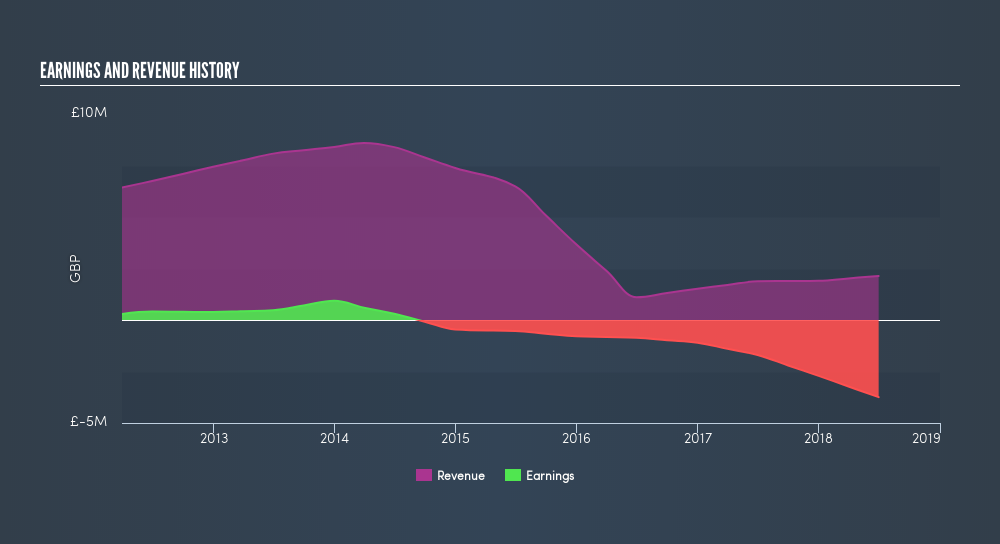

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

This free interactive report on PCI-PAL's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between PCI-PAL's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) and any discounted capital raisings offered to shareholders. PCI-PAL's TSR of was a loss of 56% for the year. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

PCI-PAL shareholders are down 56% for the year, but the market itself is up 1.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 1.2% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. If you would like to research PCI-PAL in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

We will like PCI-PAL better if we see some big insider buys. While we wait, check out this freelist of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About AIM:PCIP

PCI-PAL

Through its subsidiaries, engages in the provision of payment card industry (PCI) compliance solutions and telephony services primarily in the United Kingdom, the United States, Canada, rest of Europe, and the Asia Pacific.

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives