- United Kingdom

- /

- Software

- /

- AIM:NET

Discovering Opportunities: Netcall And 2 Other Promising Penny Stocks On The UK Exchange

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic interdependencies. In such a climate, identifying stocks with strong financial foundations becomes crucial for investors seeking potential growth opportunities. Despite its outdated name, the penny stock category still offers intriguing prospects; these smaller or newer companies can present significant value when backed by robust balance sheets and strategic potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.07 | £780M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.934 | £148.85M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.71 | £432.46M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.45 | £343.12M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £4.48 | £85.44M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.065 | £90.69M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.825 | £182.42M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.384 | £213.45M | ★★★★★☆ |

| Helios Underwriting (AIM:HUW) | £2.08 | £148.39M | ★★★★★☆ |

Click here to see the full list of 445 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Netcall (AIM:NET)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Netcall plc is a UK-based company specializing in the design, development, sale, and support of software products and services with a market cap of £173.98 million.

Operations: The company generates revenue of £39.06 million from its activities in designing, developing, selling, and supporting software products and services.

Market Cap: £173.98M

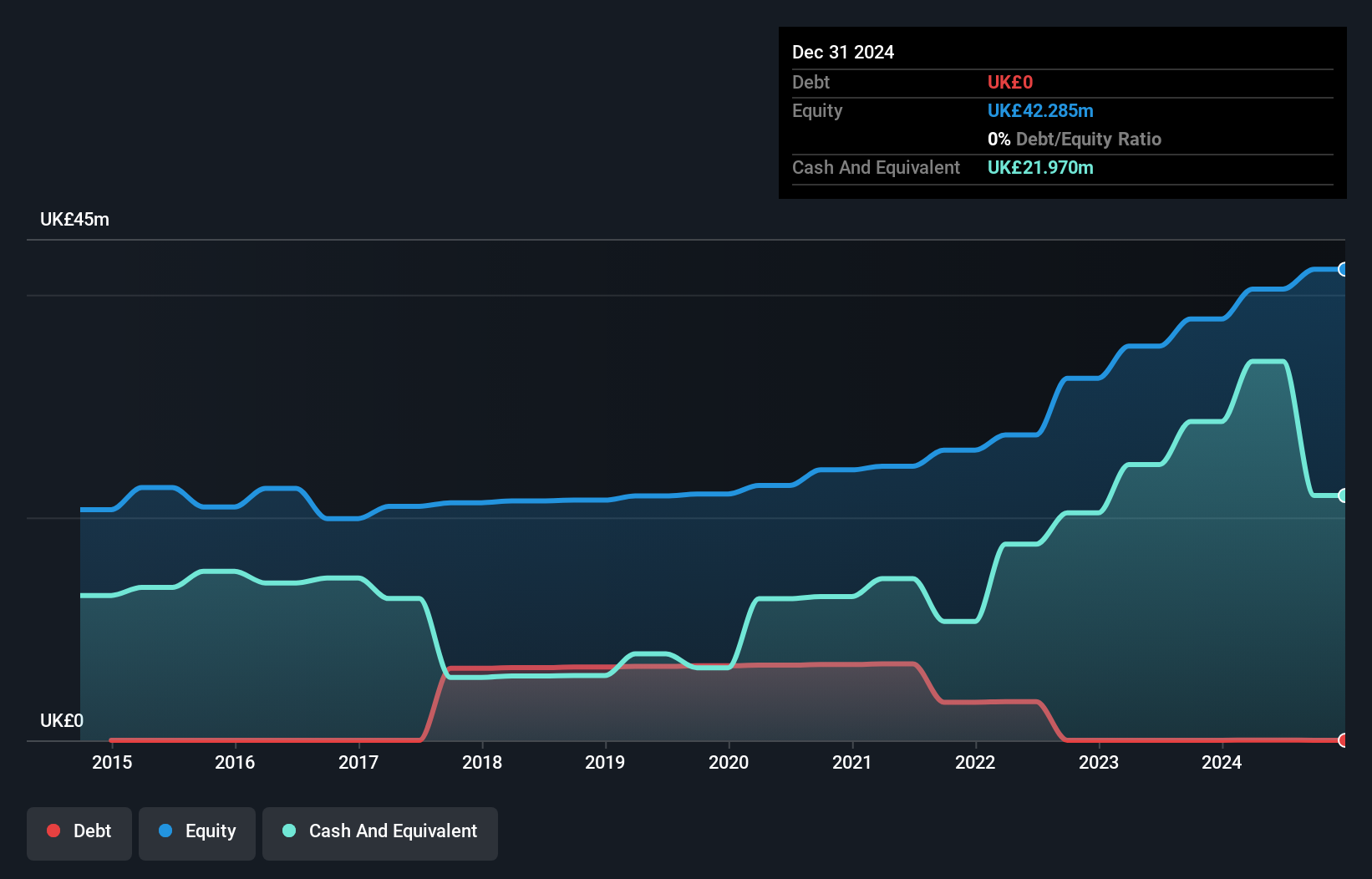

Netcall plc, with a market cap of £173.98 million and revenue of £39.06 million, shows a mixed profile for investors considering penny stocks. The company has demonstrated significant earnings growth over the past five years at 48% annually, although recent growth has slowed to 39.2%. Its profit margins have improved from last year and are higher than the industry average. Netcall's financial health is robust, with short-term assets exceeding liabilities and debt well-covered by cash flow. However, insider selling in recent months may raise concerns despite its experienced management team and stable volatility profile.

- Click to explore a detailed breakdown of our findings in Netcall's financial health report.

- Gain insights into Netcall's outlook and expected performance with our report on the company's earnings estimates.

City of London Investment Group (LSE:CLIG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: City of London Investment Group PLC is a publicly owned investment manager with a market cap of £177.32 million.

Operations: The company generates revenue of $69.45 million from its asset management operations.

Market Cap: £177.32M

City of London Investment Group, with a market cap of £177.32 million and revenue of US$69.45 million, presents a mixed outlook for penny stock investors. The company is debt-free, alleviating concerns about interest coverage, and its short-term assets significantly exceed liabilities. Despite high-quality past earnings and no recent shareholder dilution, the firm's recent negative earnings growth contrasts with its 5-year average growth rate of 9.3%. The dividend yield is not well-covered by earnings or cash flow, which may be a concern for income-focused investors despite the experienced board and management team.

- Jump into the full analysis health report here for a deeper understanding of City of London Investment Group.

- Review our growth performance report to gain insights into City of London Investment Group's future.

Zotefoams (LSE:ZTF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zotefoams plc, along with its subsidiaries, is engaged in the manufacturing, distribution, and sale of polyolefin block foams across the United Kingdom, Europe, North America, and other international markets with a market cap of £160.41 million.

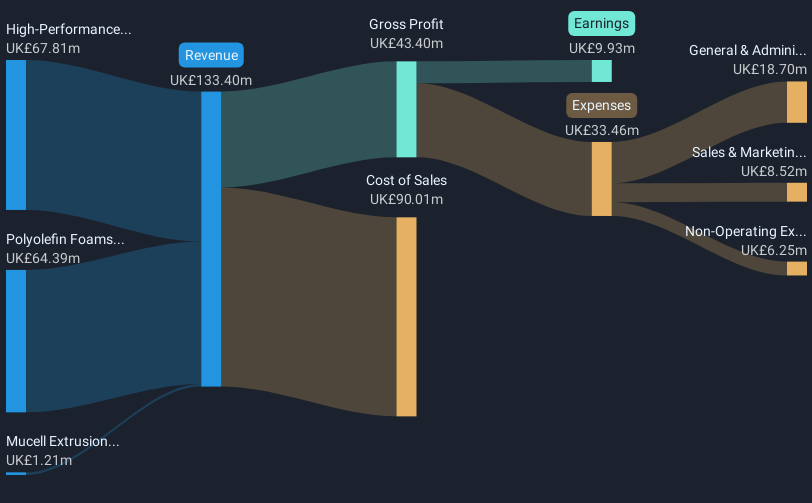

Operations: The company's revenue is primarily derived from High-Performance Products (£67.81 million), Polyolefin Foams (£64.39 million), and Mucell Extrusion LLC (£1.21 million).

Market Cap: £160.41M

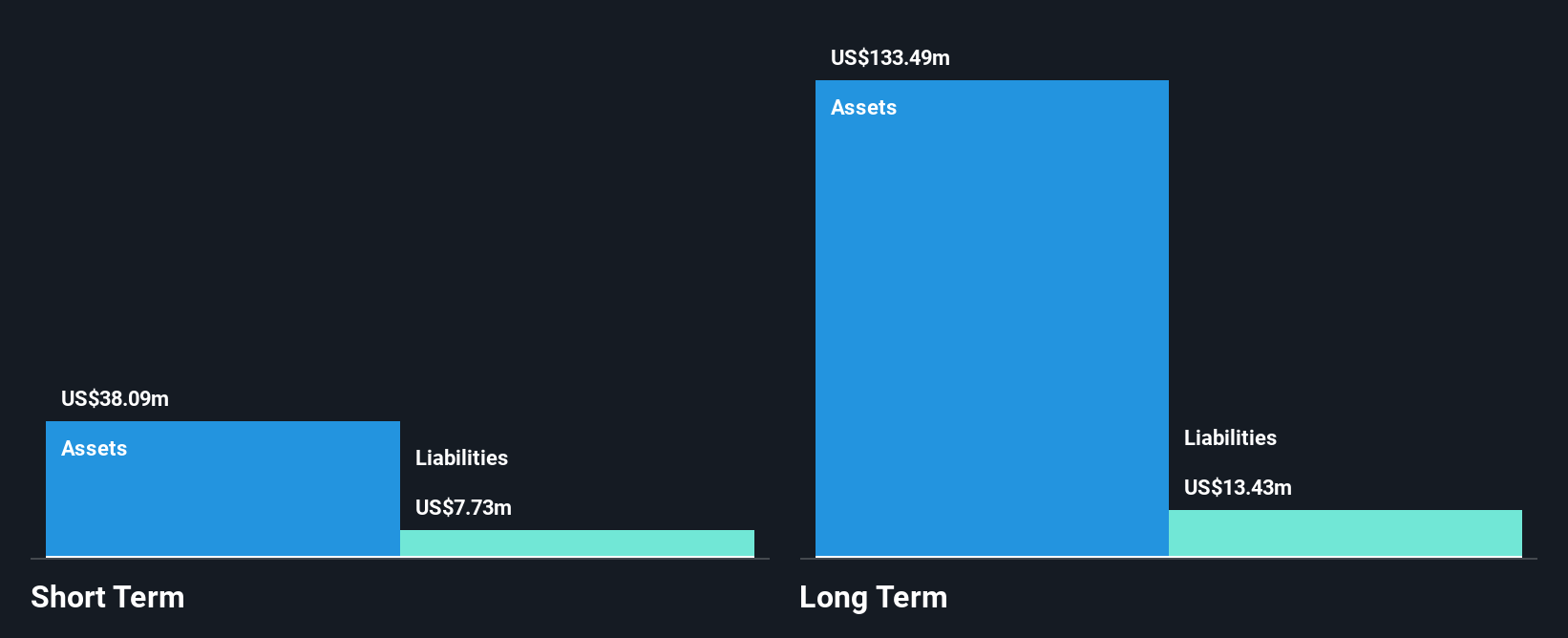

Zotefoams plc, with a market cap of £160.41 million, offers a complex picture for penny stock investors. Recent sales growth of 54% in the third quarter indicates strong performance, though earnings have declined by 9.9% over the past year compared to industry averages. The company's debt levels are satisfactory, with net debt to equity at 29.2%, and interest payments well covered by EBIT at 6.4x coverage. Despite negative earnings growth recently, Zotefoams has grown earnings by 7.1% annually over five years and maintains high-quality earnings alongside experienced management and board teams, suggesting potential resilience amid demand volatility concerns.

- Unlock comprehensive insights into our analysis of Zotefoams stock in this financial health report.

- Learn about Zotefoams' future growth trajectory here.

Next Steps

- Jump into our full catalog of 445 UK Penny Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Netcall might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NET

Netcall

Engages in the design, development, sale, and support of software products and services in the United Kingdom.

Excellent balance sheet with questionable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)