- United Kingdom

- /

- IT

- /

- AIM:MTEC

Arecor Therapeutics Among 3 UK Penny Stocks To Monitor

Reviewed by Simply Wall St

The London stock market has recently experienced turbulence, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over weak trade data from China, impacting companies tied to its economic fortunes. In such fluctuating conditions, identifying stocks with solid fundamentals becomes crucial for investors seeking potential opportunities. Penny stocks, though often seen as a niche area of investment, can still offer growth prospects when they are backed by strong financial health and strategic positioning.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.50 | £12.57M | ✅ 3 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.69 | £535.61M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.16 | £174.5M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.93 | £14.04M | ✅ 2 ⚠️ 3 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.075 | £14.79M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.30 | £29.18M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.56 | $325.54M | ✅ 4 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.723 | £267.35M | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.125 | £179.55M | ✅ 4 ⚠️ 2 View Analysis > |

| ME Group International (LSE:MEGP) | £1.75 | £661.02M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 296 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Arecor Therapeutics (AIM:AREC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Arecor Therapeutics plc is a clinical-stage biotechnology company in the United Kingdom that develops innovative medicines to address significant unmet patient needs, with a market cap of £28.32 million.

Operations: The company's revenue is derived entirely from its biotechnology segment, amounting to £5.06 million.

Market Cap: £28.32M

Arecor Therapeutics plc, with a market cap of £28.32 million, is navigating the challenges typical of penny stocks in the biotech sector. Despite being unprofitable and having less than a year of cash runway, it has made strategic moves to bolster its position. Recent developments include securing US and European patents for its lead insulin program AT278, enhancing its intellectual property portfolio. A co-development agreement with Sequel Med Tech LLC aims to integrate AT278 into advanced insulin delivery systems, potentially unlocking significant market opportunities. The board's experience is bolstered by recent appointments, including Simon Ormiston as Director and Chair of Audit & Risk Committee.

- Unlock comprehensive insights into our analysis of Arecor Therapeutics stock in this financial health report.

- Assess Arecor Therapeutics' future earnings estimates with our detailed growth reports.

Logistics Development Group (AIM:LDG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Logistics Development Group plc operates as an investment company with a market capitalization of £58.97 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: £58.97M

Logistics Development Group plc, with a market cap of £58.97 million, has recently transitioned to profitability, reporting a significant increase in net income for the half-year ended June 2025. Despite being pre-revenue with no substantial revenue streams, its financial health is bolstered by zero debt and strong short-term assets (£29.7M) exceeding liabilities (£1.1M). The company's Price-To-Earnings ratio (3.4x) suggests good value compared to the UK market average (16.1x). However, its Return on Equity remains low at 14.9%, and the board's limited experience may impact strategic direction moving forward.

- Jump into the full analysis health report here for a deeper understanding of Logistics Development Group.

- Understand Logistics Development Group's track record by examining our performance history report.

Made Tech Group (AIM:MTEC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Made Tech Group Plc provides digital, data, and technology services to the UK public sector and has a market cap of £48.16 million.

Operations: The company's revenue segment includes Computer Graphics, generating £46.43 million.

Market Cap: £48.16M

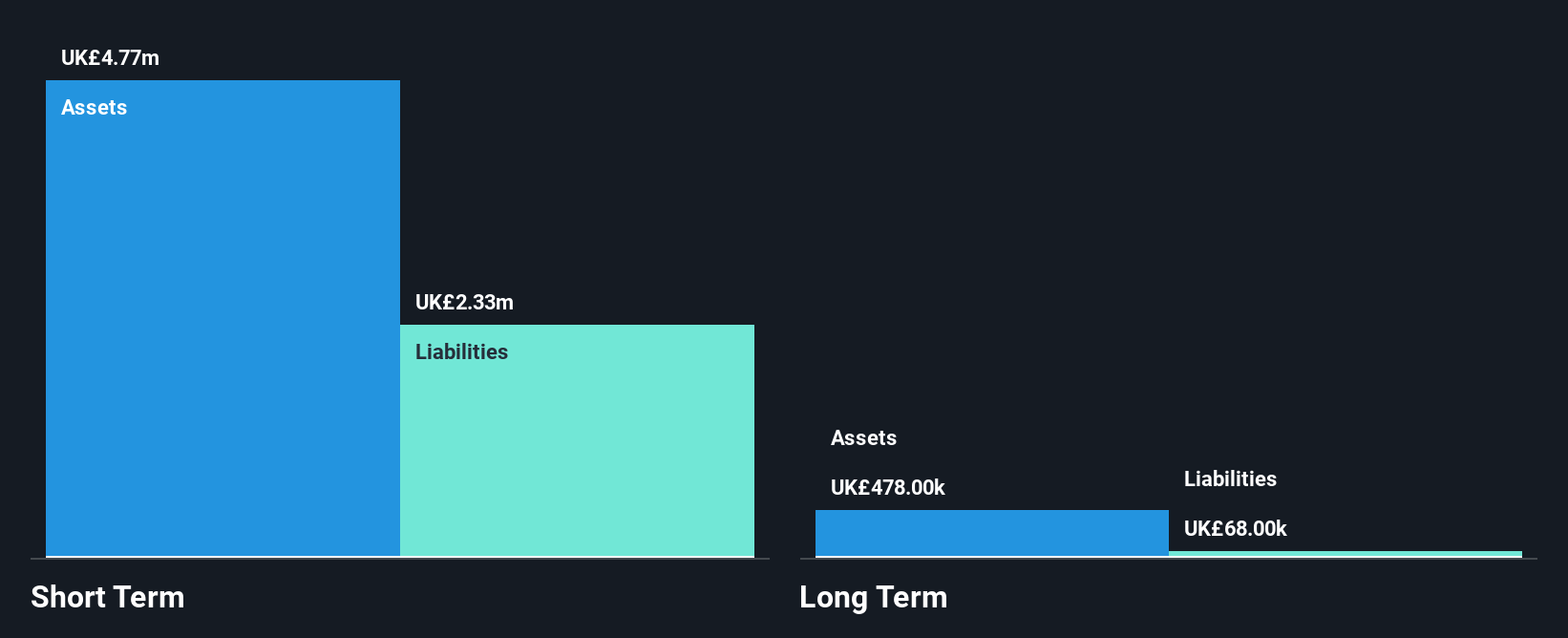

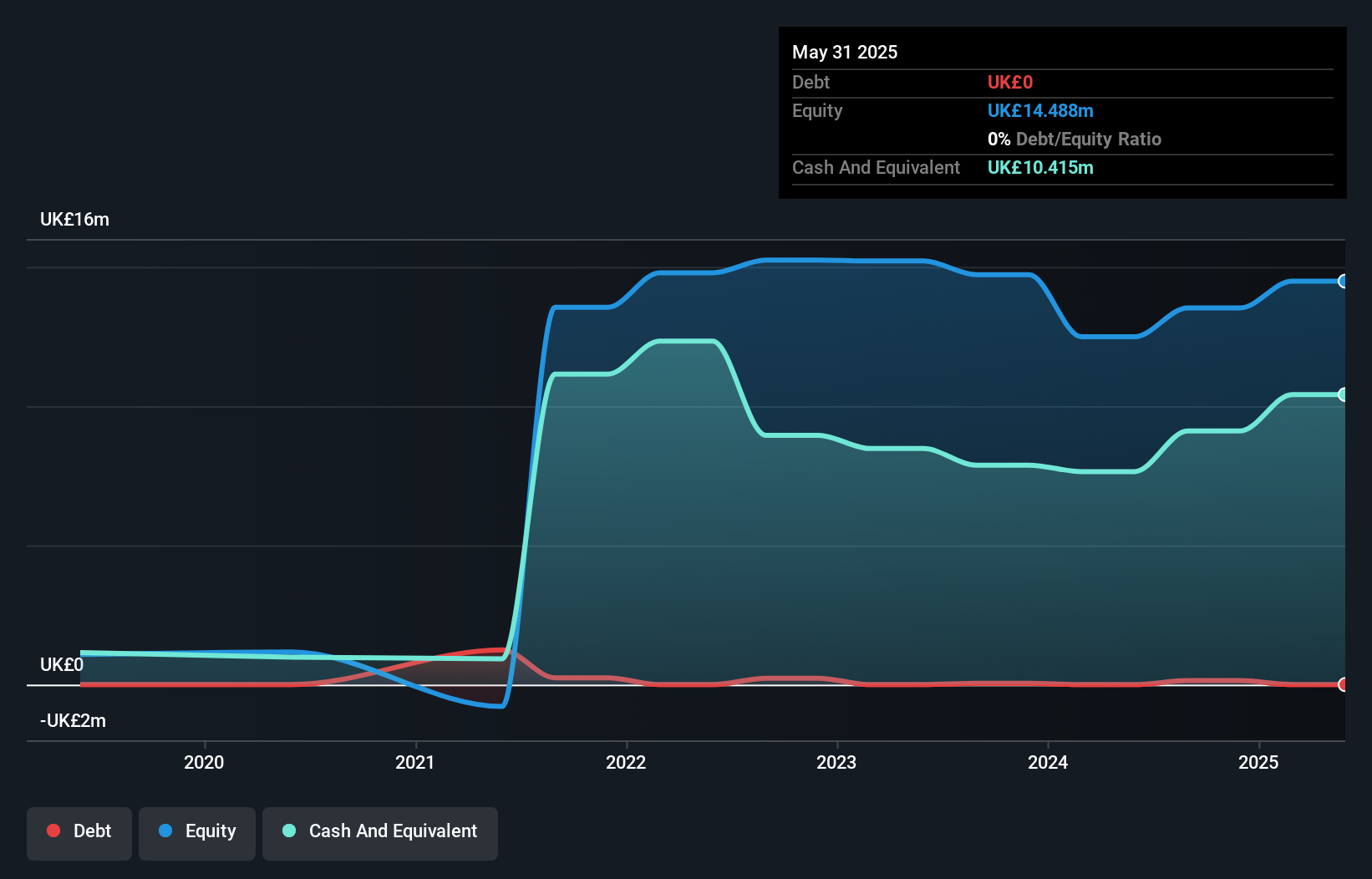

Made Tech Group Plc, with a market cap of £48.16 million, has shown financial progress by becoming profitable this year, reporting net income of £1.4 million for the full year ended May 31, 2025. The company benefits from being debt-free and having strong short-term assets (£17.4M) that exceed both its short-term (£4.3M) and long-term liabilities (£630K). Despite these positives, Made Tech's Return on Equity is relatively low at 9.6%, and its management team lacks experience with an average tenure of just 0.8 years, which could influence future strategic decisions amidst recent executive changes including the CFO stepping down.

- Get an in-depth perspective on Made Tech Group's performance by reading our balance sheet health report here.

- Learn about Made Tech Group's future growth trajectory here.

Summing It All Up

- Unlock more gems! Our UK Penny Stocks screener has unearthed 293 more companies for you to explore.Click here to unveil our expertly curated list of 296 UK Penny Stocks.

- Curious About Other Options? AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MTEC

Made Tech Group

Through its subsidiaries, engages in the provision of digital, data, and technology services to the public sector in the United Kingdom.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives