- United Kingdom

- /

- Entertainment

- /

- AIM:LBG

3 UK Stocks That Could Be Undervalued By Up To 40.3%

Reviewed by Simply Wall St

The United Kingdom's stock market has recently experienced a downturn, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over weak trade data from China, which is impacting companies heavily tied to its economic performance. In such challenging conditions, identifying undervalued stocks can offer potential opportunities for investors seeking to capitalize on discrepancies between a company's intrinsic value and its current market price.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| AstraZeneca (LSE:AZN) | £118.28 | £221.25 | 46.5% |

| On the Beach Group (LSE:OTB) | £1.544 | £3.06 | 49.5% |

| Watches of Switzerland Group (LSE:WOSG) | £4.334 | £8.46 | 48.8% |

| S&U (LSE:SUS) | £19.00 | £36.53 | 48% |

| Gulf Keystone Petroleum (LSE:GKP) | £1.289 | £2.47 | 47.8% |

| Foxtons Group (LSE:FOXT) | £0.596 | £1.19 | 49.9% |

| BATM Advanced Communications (LSE:BVC) | £0.18725 | £0.37 | 49.7% |

| Auction Technology Group (LSE:ATG) | £4.405 | £8.41 | 47.6% |

| St. James's Place (LSE:STJ) | £8.625 | £16.46 | 47.6% |

| Genel Energy (LSE:GENL) | £0.762 | £1.51 | 49.7% |

Let's take a closer look at a couple of our picks from the screened companies.

Keywords Studios (AIM:KWS)

Overview: Keywords Studios plc offers creative and technical services to the global video game industry, with a market cap of £1.97 billion.

Operations: The company's revenue segments consist of €365.56 million from Create, €180.43 million from Engage, and €261.61 million from Globalize services.

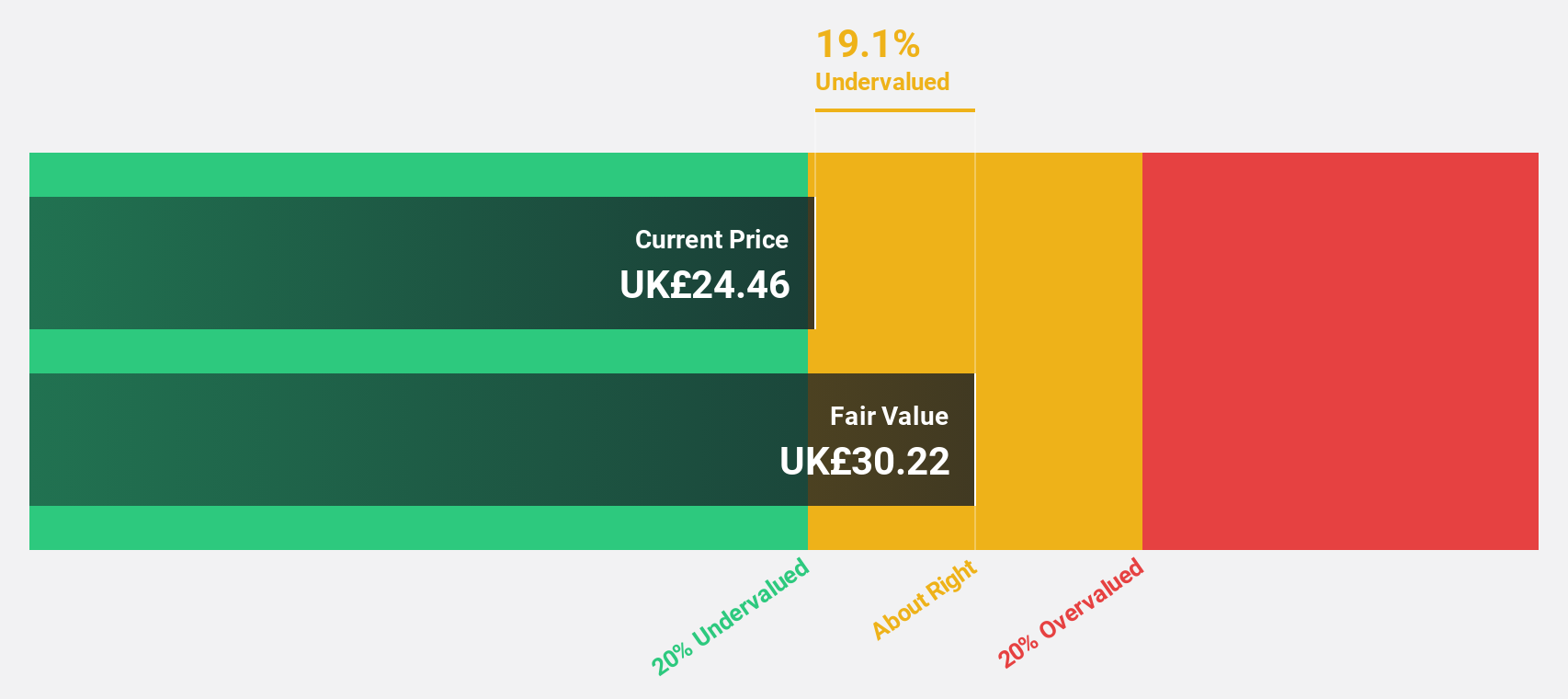

Estimated Discount To Fair Value: 19.1%

Keywords Studios is trading at £24.46, below its estimated fair value of £30.22, indicating it may be undervalued based on cash flows. Despite a recent net loss of €30.88 million for the half year ending June 2024, earnings are forecast to grow significantly by 59.13% annually and revenue at 10.2% per year, outpacing the UK market's growth rate of 3.5%. The company is expected to become profitable within three years, although return on equity remains low at a forecasted 11.1%.

- The growth report we've compiled suggests that Keywords Studios' future prospects could be on the up.

- Click here to discover the nuances of Keywords Studios with our detailed financial health report.

LBG Media (AIM:LBG)

Overview: LBG Media plc is an online media publisher operating in the United Kingdom, Ireland, Australia, the United States, and internationally with a market cap of £282.26 million.

Operations: The company generates £82.54 million in revenue from its online media publishing industry across various regions, including the UK, Ireland, Australia, and the US.

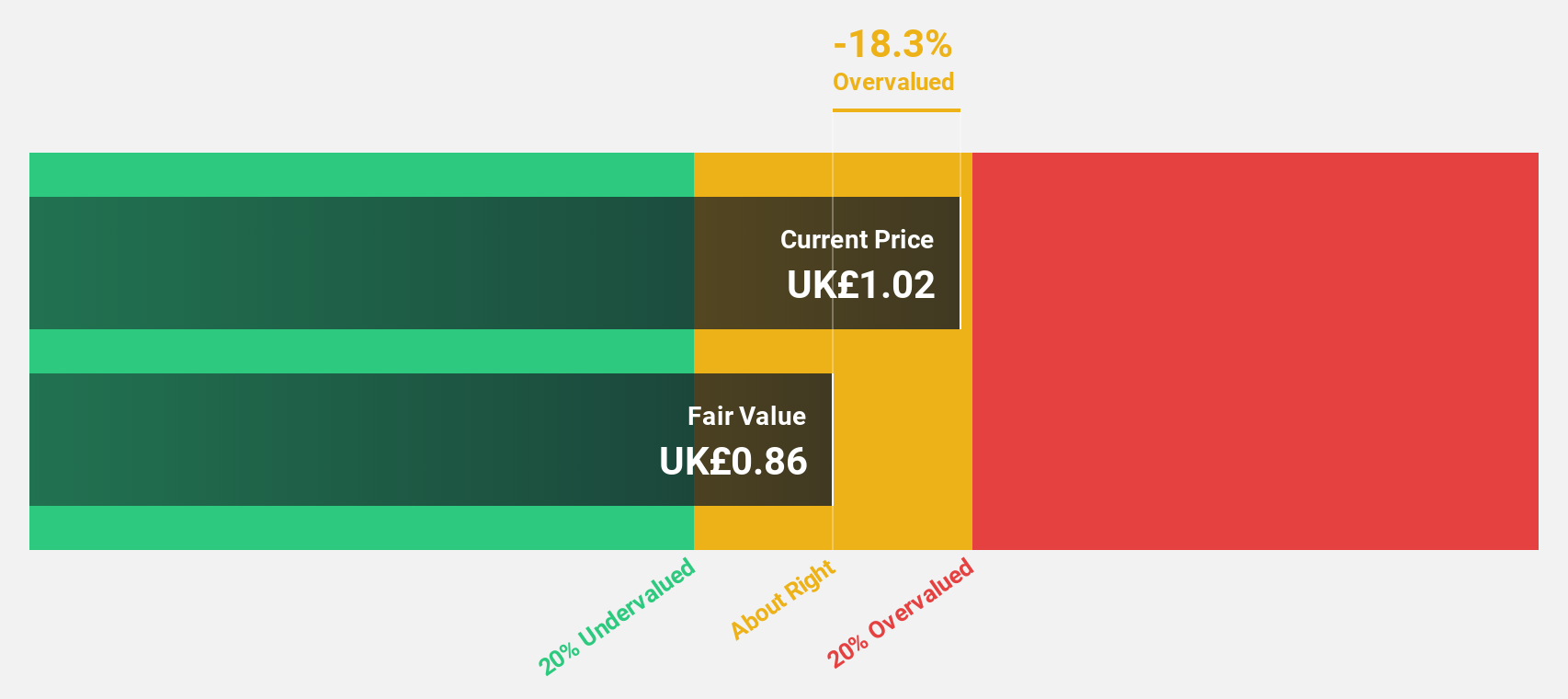

Estimated Discount To Fair Value: 15.6%

LBG Media is trading at £1.35, below its estimated fair value of £1.6, suggesting it is undervalued based on cash flows. Recent earnings for the half year show a turnaround with sales up to £42.28 million and net income reaching £4.75 million from a previous loss, highlighting improved financial health. Earnings are projected to grow significantly by 24.2% annually, outpacing the UK market's growth rate of 14%, though revenue growth remains moderate at 9.5% per year.

- Insights from our recent growth report point to a promising forecast for LBG Media's business outlook.

- Navigate through the intricacies of LBG Media with our comprehensive financial health report here.

Avon Technologies (LSE:AVON)

Overview: Avon Technologies Plc specializes in providing respiratory and head protection solutions for military and first responder agencies across the UK, Europe, and the US, with a market cap of £374.36 million.

Operations: The company's revenue segments include Team Wendy, generating $113.60 million, and a segment adjustment of $155.70 million.

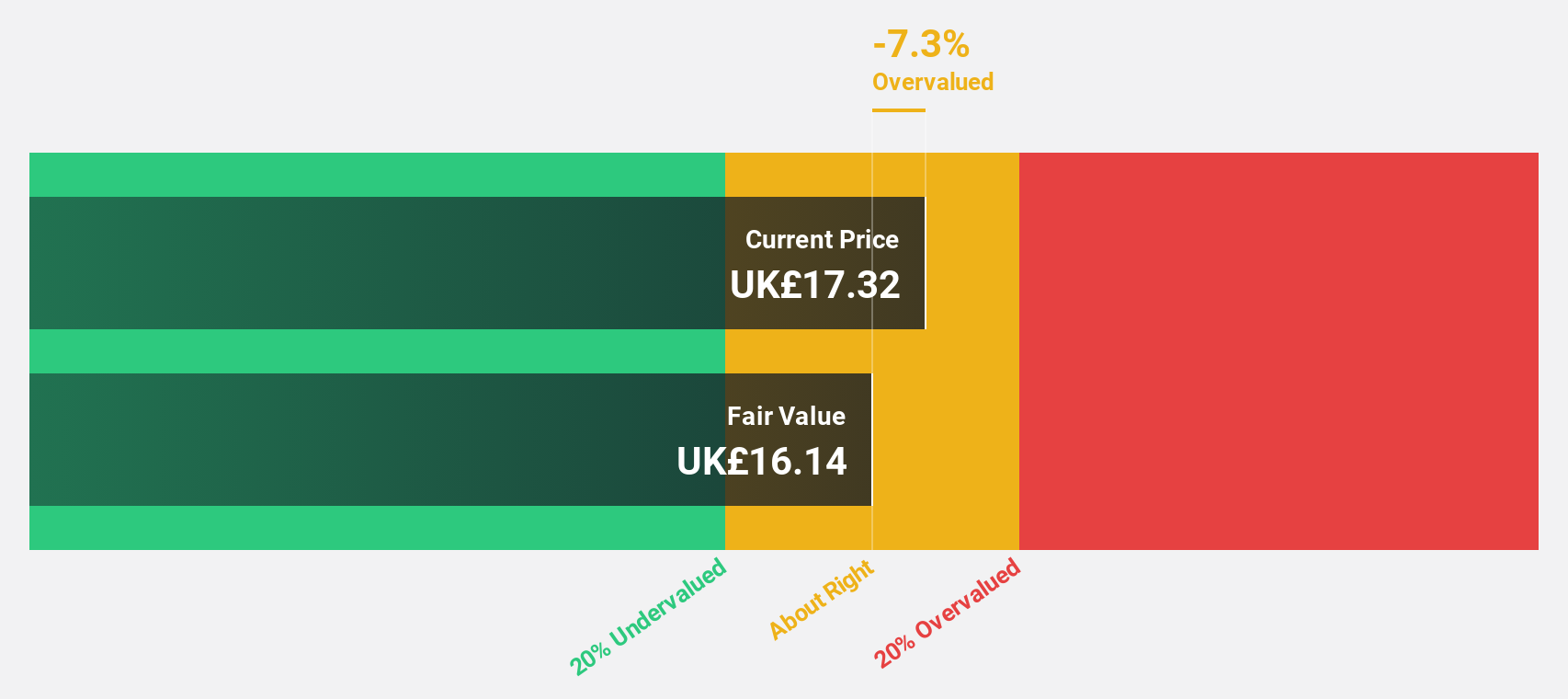

Estimated Discount To Fair Value: 40.3%

Avon Technologies is trading at £12.48, significantly below its estimated fair value of £20.9, indicating it is undervalued based on cash flows. Recent corporate guidance highlights strong momentum and improved earnings expectations for FY24, with revenue growth revised to around 11%. Despite interest payments not being well covered by earnings, Avon’s strategic focus and operational efficiency are driving faster progress. Earnings are forecast to grow substantially by 118.76% annually as the company moves towards profitability within three years.

- Our earnings growth report unveils the potential for significant increases in Avon Technologies' future results.

- Take a closer look at Avon Technologies' balance sheet health here in our report.

Where To Now?

- Investigate our full lineup of 61 Undervalued UK Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:LBG

LBG Media

Operates an online media publisher the United Kingdom, Ireland, Australia, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.