- United Kingdom

- /

- Software

- /

- LSE:APTD

Discovering 3 Undiscovered Gems in the United Kingdom Market

Reviewed by Simply Wall St

Amidst the challenges faced by the United Kingdom market, highlighted by recent declines in the FTSE 100 and FTSE 250 due to weak trade data from China, investors are increasingly seeking opportunities that may not be immediately apparent. In this environment, identifying stocks with strong fundamentals and resilience to broader economic pressures can uncover potential gems within the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Aptitude Software Group (LSE:APTD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aptitude Software Group plc, along with its subsidiaries, offers financial management software solutions in the UK and globally, with a market capitalization of £195.37 million.

Operations: Aptitude Software Group generates revenue primarily from its financial management software, reporting £72.41 million in revenue. The company's market capitalization stands at £195.37 million.

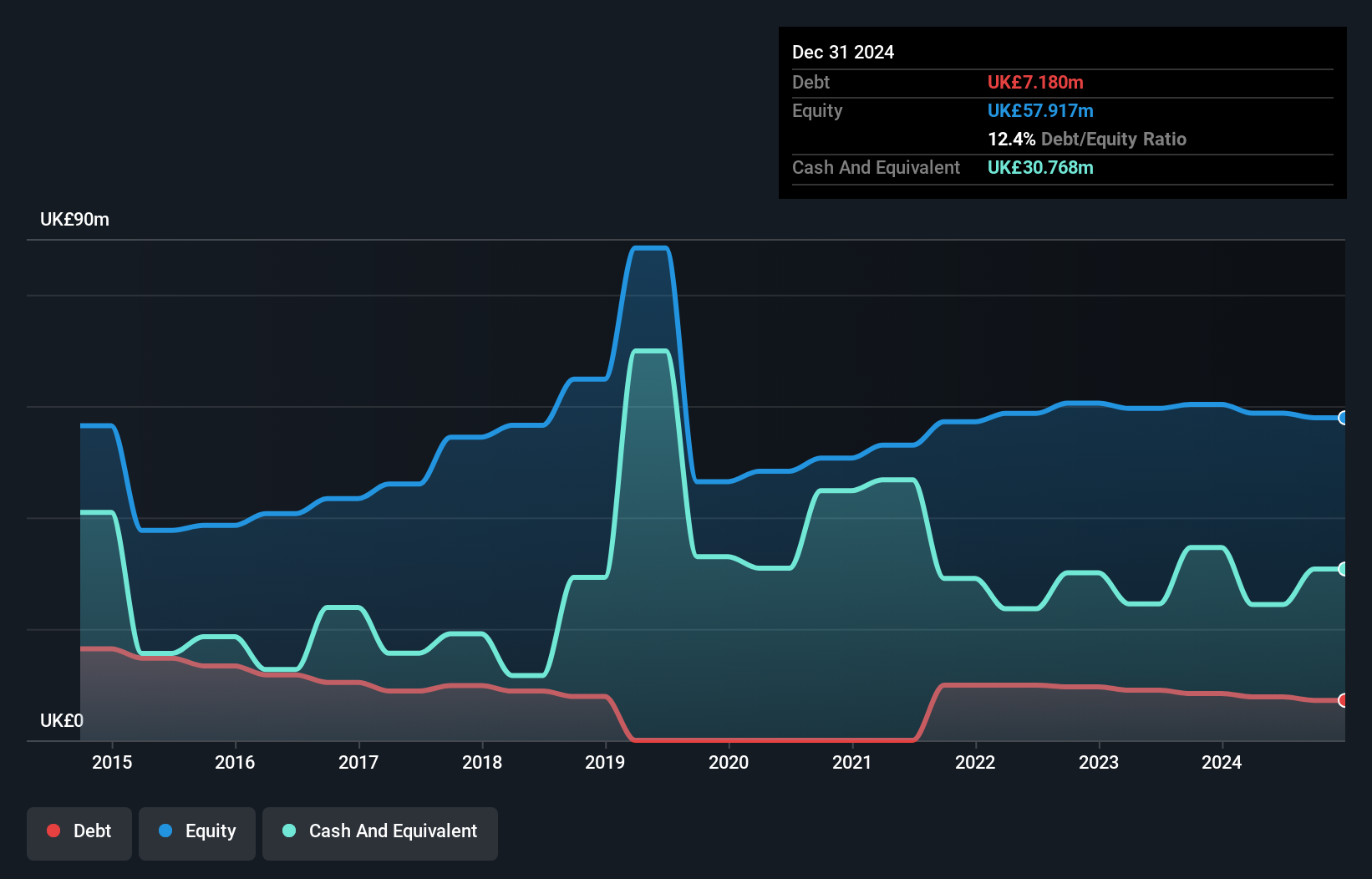

Aptitude Software Group, a UK-based software company, has shown impressive growth with earnings surging 104.9% over the past year, significantly outpacing the software industry's 21.2% growth rate. Despite a slight dip in sales to £35.26 million from £37.54 million last year, net income rose to £2.03 million from £1.3 million, indicating robust financial health and high-quality earnings. The company's debt-to-equity ratio increased to 13%, but its cash position remains strong enough to cover total debt comfortably while trading at 46% below estimated fair value suggests potential for further appreciation in its stock price.

- Click to explore a detailed breakdown of our findings in Aptitude Software Group's health report.

Evaluate Aptitude Software Group's historical performance by accessing our past performance report.

Octopus Renewables Infrastructure Trust (LSE:ORIT)

Simply Wall St Value Rating: ★★★★★★

Overview: Octopus Renewables Infrastructure Trust plc is a closed-end investment company focusing on renewable energy infrastructure assets in Europe and Australia, with a market cap of £435.45 million.

Operations: The trust generates revenue of £25.30 million from its investments in renewable energy infrastructure assets.

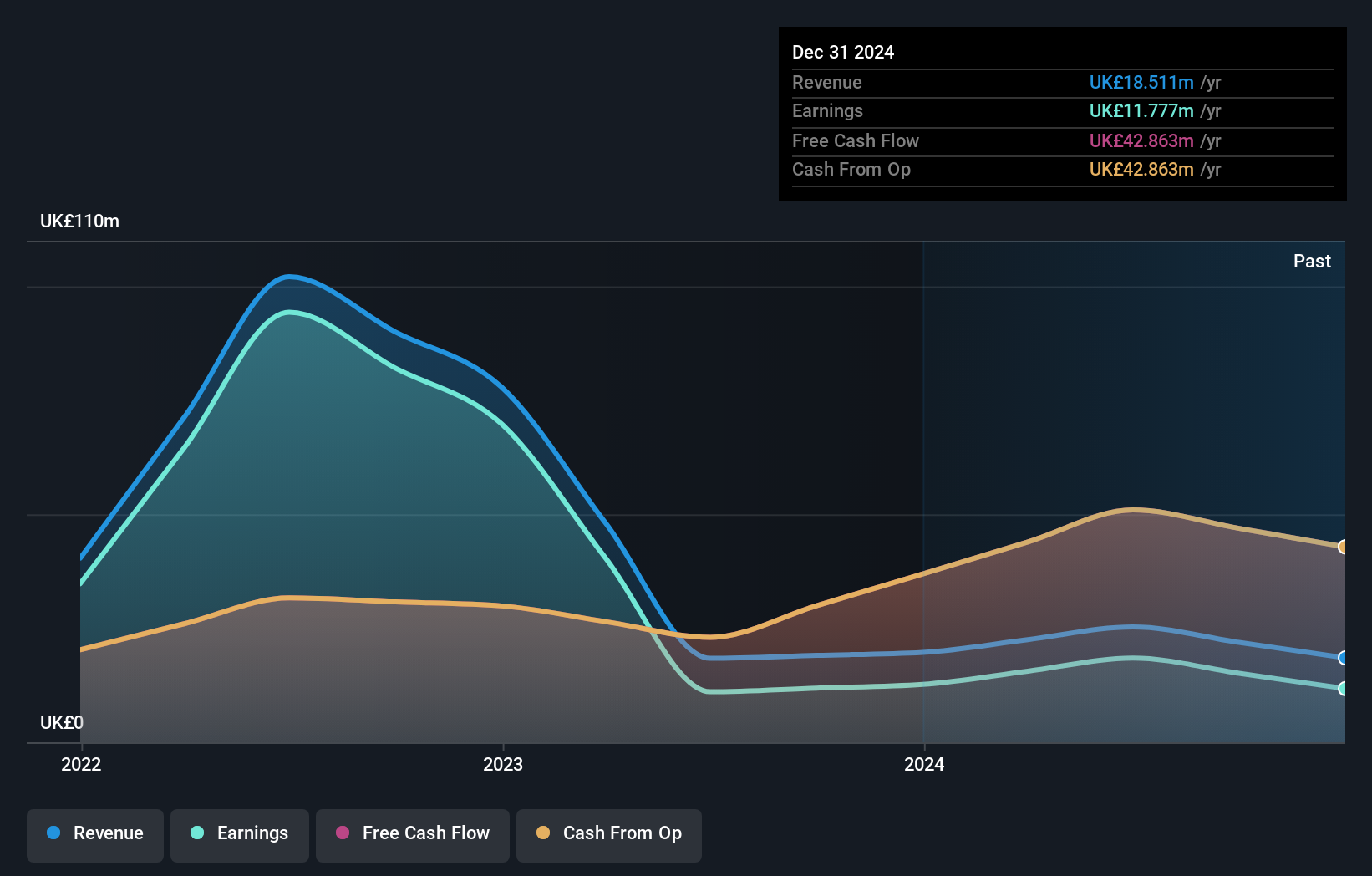

Octopus Renewables Infrastructure Trust, a nimble player in the renewable sector, reported impressive earnings growth of 66.6% over the past year, significantly outpacing the Capital Markets industry average of 11.9%. With no debt on its books for five years and a positive free cash flow reaching £50.95 million by October 2024, financial stability seems assured. Recent buybacks saw 3 million shares repurchased for £2.2 million from June to September 2024, highlighting shareholder value focus. Earnings for H1 2024 were robust at £11.3 million compared to last year's £5.53 million, indicating strong operational performance amidst industry challenges.

- Get an in-depth perspective on Octopus Renewables Infrastructure Trust's performance by reading our health report here.

Understand Octopus Renewables Infrastructure Trust's track record by examining our Past report.

Stelrad Group (LSE:SRAD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Stelrad Group PLC is a company that specializes in the manufacturing and distribution of radiators across the United Kingdom, Ireland, Europe, Turkey, and other international markets, with a market capitalization of £196.12 million.

Operations: Stelrad Group derives its revenue primarily from the manufacture and distribution of radiators, generating £294.27 million in this segment.

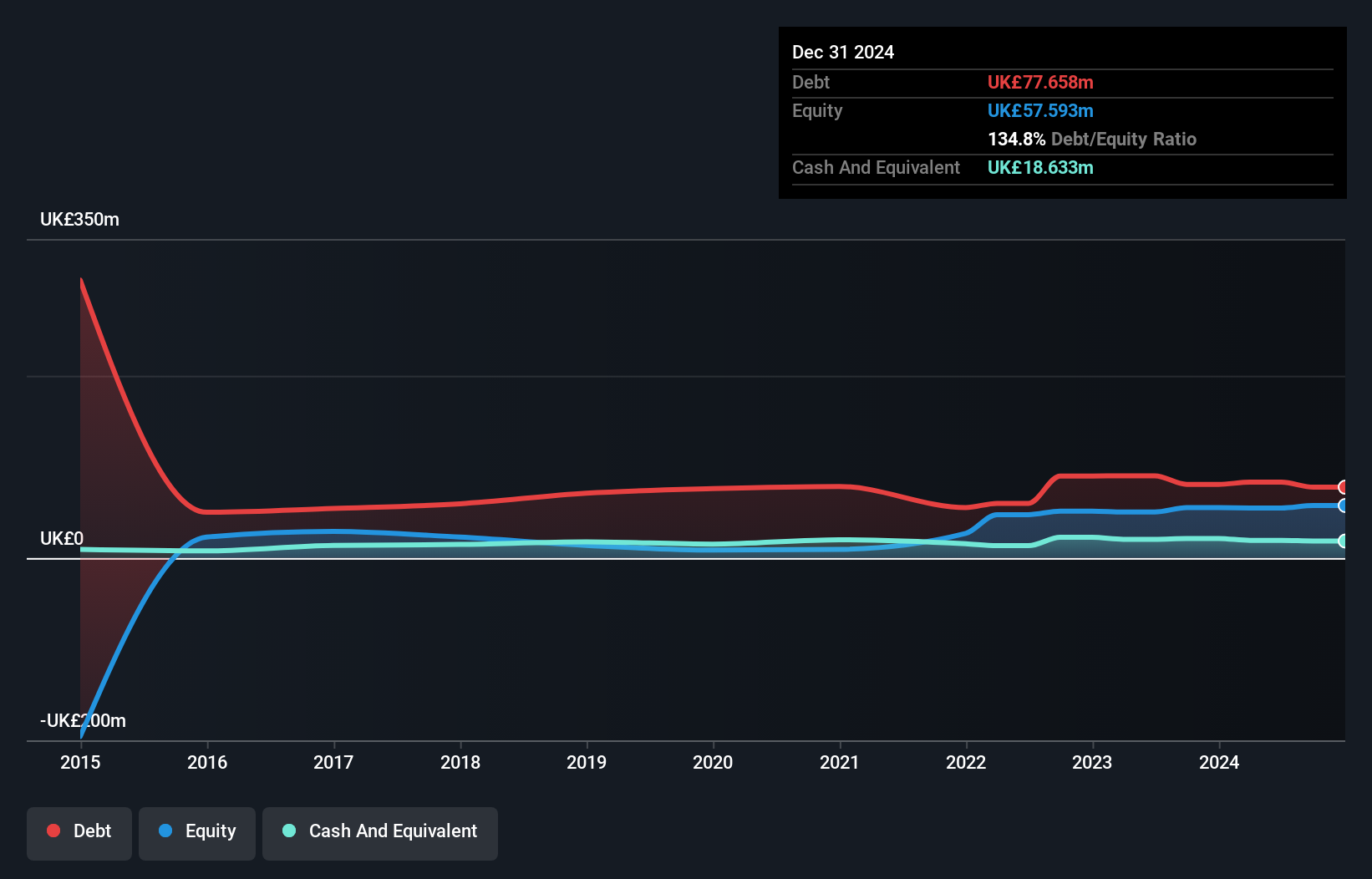

Stelrad Group, a notable player in the UK market, has demonstrated solid financial management with its interest payments well covered by EBIT at 4.5 times. Despite a high net debt to equity ratio of 116.1%, the company has reduced this from 647.5% over five years, indicating effective debt management. Earnings grew by an impressive 32.9% last year, outpacing the Consumer Durables industry which saw -22.5%. Recent board changes include Leigh Wilcox as CFO, enhancing leadership stability since he joined in 2012. Additionally, Stelrad declared an interim dividend increase to £0.0298 per share for October payouts.

- Delve into the full analysis health report here for a deeper understanding of Stelrad Group.

Gain insights into Stelrad Group's past trends and performance with our Past report.

Taking Advantage

- Delve into our full catalog of 81 UK Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:APTD

Aptitude Software Group

Provides financial management software in the United Kingdom and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives