- United Kingdom

- /

- Software

- /

- AIM:GBG

Exploring High Growth Tech Stocks In The UK October 2024

Reviewed by Simply Wall St

The United Kingdom's market has been experiencing some turbulence, with the FTSE 100 closing lower due to weak trade data from China, highlighting concerns over global economic recovery and its impact on sectors closely tied to Chinese demand. In this environment, identifying high-growth tech stocks in the UK requires careful consideration of companies that can demonstrate resilience and adaptability amidst fluctuating global economic conditions.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| Oxford Biomedica | 21.00% | 98.44% | ★★★★★☆ |

| Thruvision Group | 20.76% | 63.31% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

Click here to see the full list of 50 stocks from our UK High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

GB Group (AIM:GBG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GB Group plc, along with its subsidiaries, offers identity data intelligence products and services across the United Kingdom, the United States, Australia, and other international markets with a market capitalization of £809.29 million.

Operations: The company generates revenue through three primary segments: Identity (£156.06 million), Location (£81.07 million), and Fraud (£40.20 million).

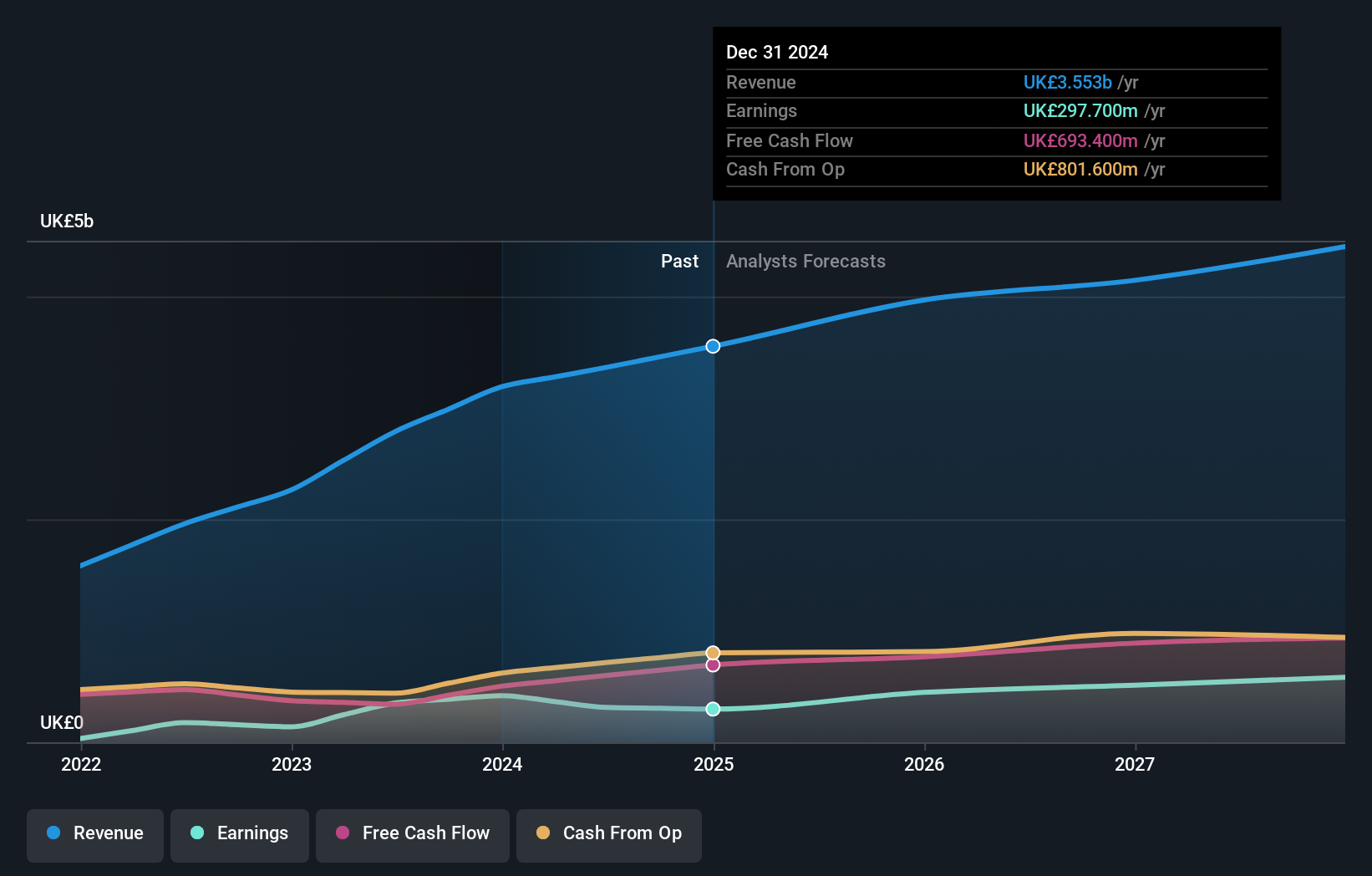

GB Group, amidst a challenging landscape, showcases promising growth with its revenue expected to increase by 6.1% annually, outpacing the UK market's average of 3.5%. This growth is underpinned by substantial investment in R&D, which is pivotal as the company transitions towards profitability, anticipated within the next three years. Earnings are also projected to surge by an impressive 90.6% per year. Despite current unprofitability and a low forecasted return on equity at 3.4%, these investments and revenue accelerations position GB Group for potential future success in the high-growth tech sector of the UK.

- Take a closer look at GB Group's potential here in our health report.

Explore historical data to track GB Group's performance over time in our Past section.

Informa (LSE:INF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Informa plc is an international company engaged in events, digital services, and academic research across the UK, Continental Europe, the US, China, and other global markets with a market cap of £10.94 billion.

Operations: The company generates revenue primarily through its four segments: Informa Markets (£1.67 billion), Informa Connect (£630.20 million), Informa Tech (£426.70 million), and Taylor & Francis (£636.70 million).

Informa, despite a challenging backdrop, is making significant strides in the tech sector with its recent acquisition of Ascential plc, enhancing its Informa Festivals business. This move, coupled with a robust partnership strategy exemplified by over a decade-long relationship with Monaco, underscores its commitment to expanding its luxury and lifestyle event portfolio. Financially, Informa's R&D investment remains pivotal; last year's expenditure accounted for 7.6% of revenue aiming to bolster future offerings. Impressively, earnings are projected to grow by 22.5% annually over the next three years despite some past volatility marked by a substantial one-off loss of £213.5 million as of June 2024.

Sage Group (LSE:SGE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Sage Group plc, along with its subsidiaries, offers technology solutions and services tailored for small and medium-sized businesses across the United States, the United Kingdom, France, and other international markets, with a market cap of £10.15 billion.

Operations: Sage Group generates revenue primarily from its technology solutions and services for small and medium-sized businesses, with significant contributions from North America (£1.01 billion) and Europe (£595 million). The company focuses on delivering tailored solutions across various international markets.

Sage Group is harnessing robust growth in the tech sector, particularly through strategic partnerships and enhanced offerings like its Sage Business Cloud. Recently, they reported a 9% increase in quarterly revenue to £585 million, underscoring strong demand for cloud-based solutions. Their commitment to innovation is evident with R&D expenses reaching 15.1% of revenue, significantly higher than the industry norm, ensuring their products remain competitive and responsive to market needs. Additionally, their collaboration with VoPay introduces advanced payment technologies into their platforms, streamlining financial operations for SMBs and embedding efficiency into business processes. This move not only enhances Sage's product suite but also positions it well amidst evolving financial technology landscapes.

- Navigate through the intricacies of Sage Group with our comprehensive health report here.

Evaluate Sage Group's historical performance by accessing our past performance report.

Taking Advantage

- Unlock our comprehensive list of 50 UK High Growth Tech and AI Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:GBG

GB Group

Provides identity data intelligence products and services in the United Kingdom, the United States, Australia, and internationally.

Undervalued with reasonable growth potential.