- United Kingdom

- /

- Consumer Durables

- /

- AIM:TUNE

UK Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid disappointing trade data from China, highlighting global economic interdependencies. For investors exploring beyond established blue-chip stocks, penny stocks—though an older term—remain a relevant investment area due to their potential for growth and affordability. By focusing on companies with solid financials and growth prospects, investors can uncover promising opportunities within this segment of the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.75 | £542.46M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.24 | £180.96M | ✅ 4 ⚠️ 2 View Analysis > |

| Focusrite (AIM:TUNE) | £2.30 | £134.83M | ✅ 5 ⚠️ 1 View Analysis > |

| Ingenta (AIM:ING) | £0.94 | £14.19M | ✅ 2 ⚠️ 3 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.075 | £14.79M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.35 | £29.82M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.56 | $325.54M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.50 | £253.48M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.13 | £180.35M | ✅ 4 ⚠️ 2 View Analysis > |

| Braemar (LSE:BMS) | £2.30 | £70.08M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 297 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

dotdigital Group (AIM:DOTD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: dotdigital Group Plc provides intuitive software as a service (SaaS) and managed services for digital marketing professionals globally, with a market cap of £227.07 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: £227.07M

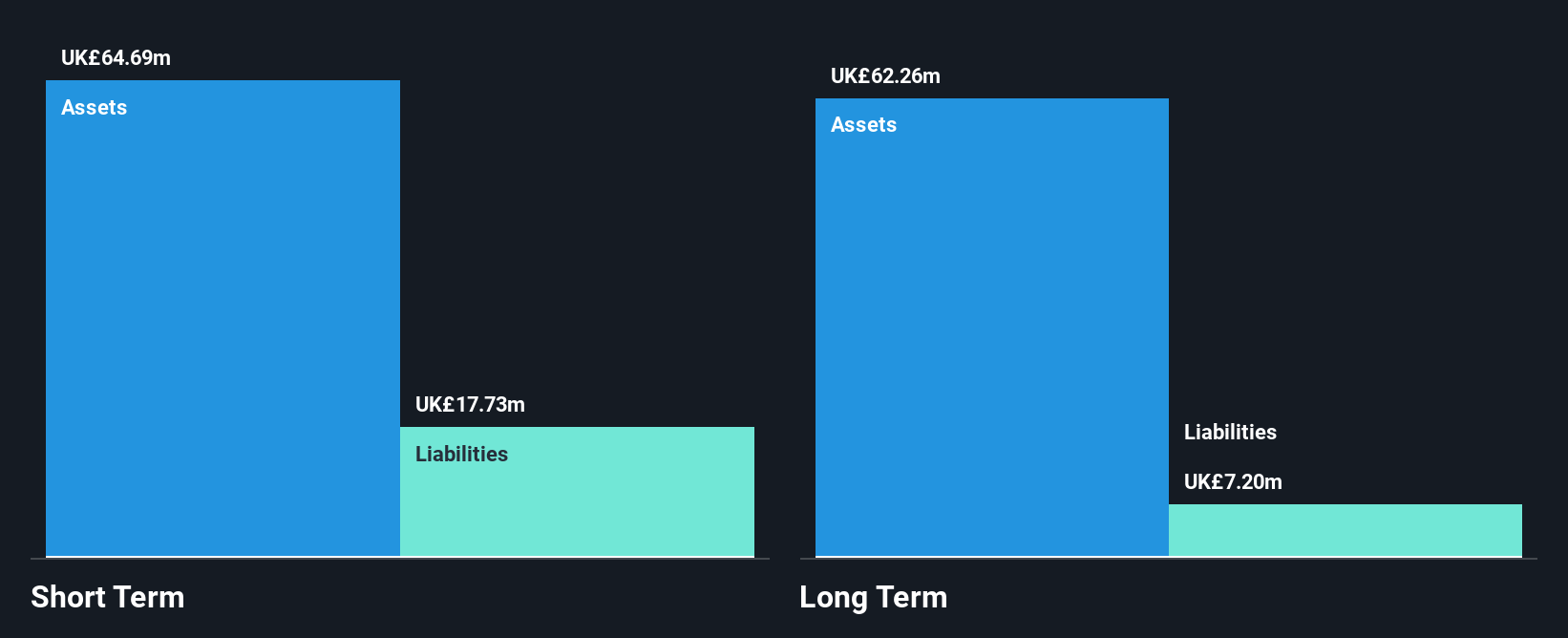

dotdigital Group Plc, with a market cap of £227.07 million, demonstrates financial stability through its short-term assets (£54.6M) exceeding both long-term (£16.3M) and short-term liabilities (£21.2M). The company is debt-free, enhancing its financial flexibility. Recent earnings show modest growth with sales increasing to £83.92 million for the year ended June 30, 2025, and net income rising slightly to £11.21 million from the previous year. Despite low Return on Equity (10.9%), analysts anticipate a significant price increase of 72.7%. Its management and board exhibit strong experience with average tenures of over five years.

- Unlock comprehensive insights into our analysis of dotdigital Group stock in this financial health report.

- Learn about dotdigital Group's future growth trajectory here.

Kitwave Group (AIM:KITW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kitwave Group plc operates as a food and drink wholesaler in the United Kingdom, with a market cap of £185.06 million.

Operations: The company generates revenue through its Ambient (£222.49 million), Foodservice (£298.67 million), and Frozen & Chilled (£246.87 million) segments in the UK market.

Market Cap: £185.06M

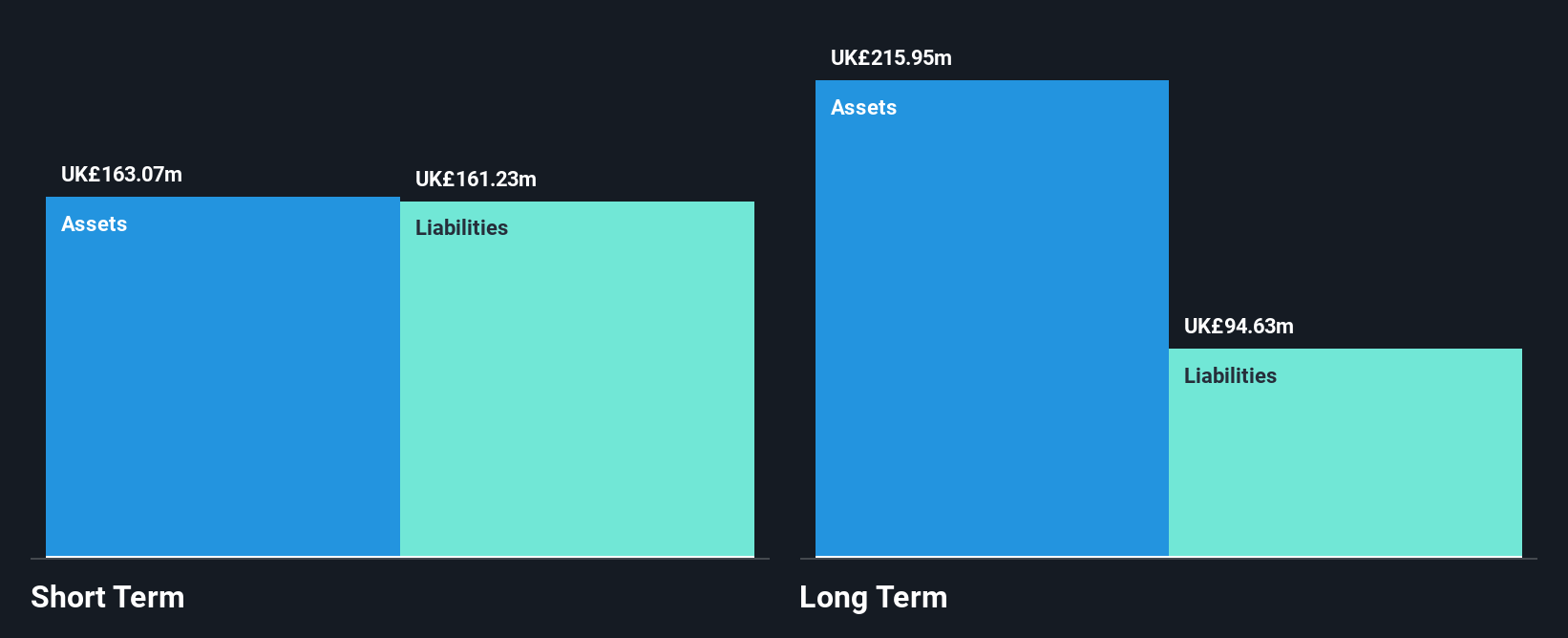

Kitwave Group plc, with a market cap of £185.06 million, shows financial resilience as its short-term assets (£163.1M) surpass both short-term (£161.2M) and long-term liabilities (£94.6M). While the company's debt is well-covered by operating cash flow (54.5%), it carries a high net debt to equity ratio (54.1%). Despite negative earnings growth last year (-10.6%), Kitwave's forecasted earnings growth stands at 19.56% annually, indicating potential recovery prospects. Trading at 42.5% below estimated fair value suggests it may offer good relative value compared to peers, though its dividend track record remains unstable amidst low returns on equity (12.8%).

- Get an in-depth perspective on Kitwave Group's performance by reading our balance sheet health report here.

- Understand Kitwave Group's earnings outlook by examining our growth report.

Focusrite (AIM:TUNE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Focusrite plc develops, manufactures, and markets professional audio and electronic music products across North America, Europe, the Middle East, Africa, and internationally with a market cap of £134.83 million.

Operations: No specific revenue segments are reported for Focusrite.

Market Cap: £134.83M

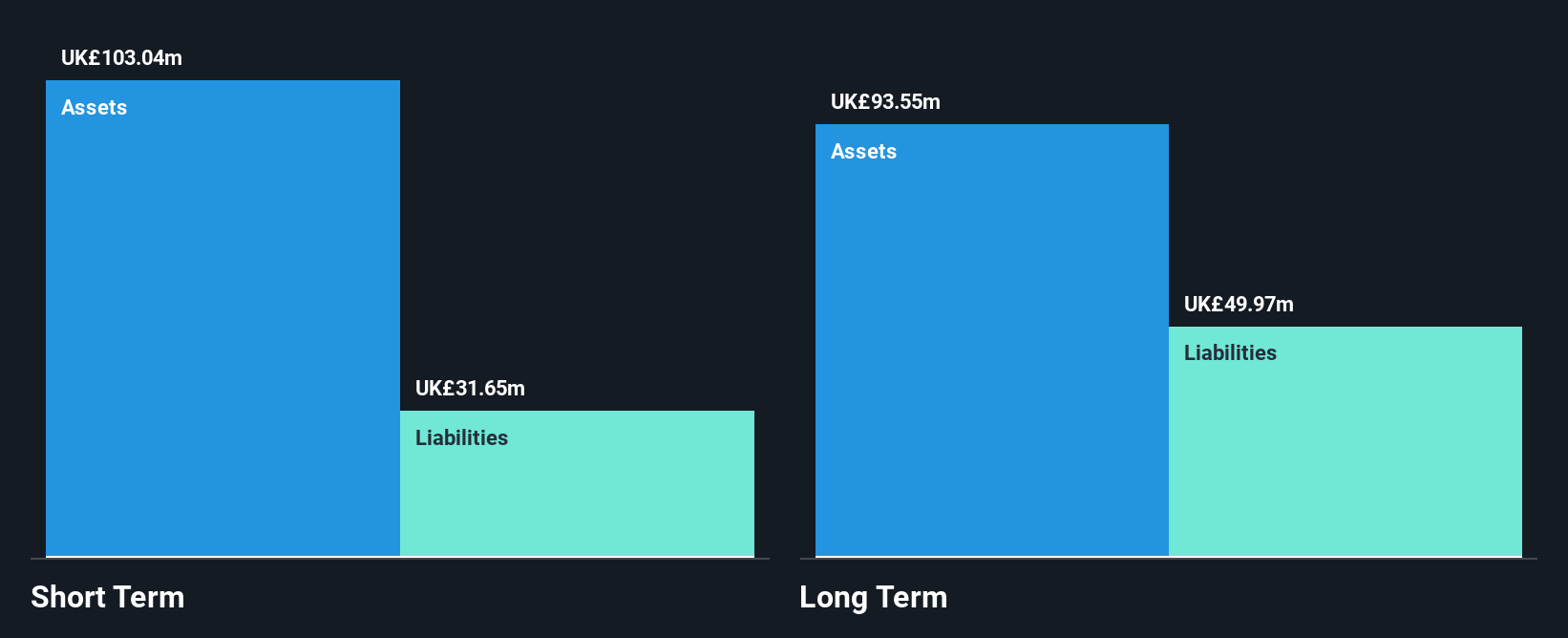

Focusrite plc, with a market cap of £134.83 million, demonstrates financial stability as its short-term assets (£104.2M) exceed both short-term (£33.5M) and long-term liabilities (£46.0M). The company's net profit margin has improved to 3.2% from last year's 1.6%, and earnings grew significantly by 105.8%, outpacing the industry average decline of -3.9%. Despite a low return on equity (4.6%), Focusrite maintains satisfactory debt levels with a net debt to equity ratio of 9.2% and covers interest payments well with EBIT (3.3x coverage). Trading below estimated fair value indicates potential investment appeal amidst stable yet high volatility.

- Click to explore a detailed breakdown of our findings in Focusrite's financial health report.

- Gain insights into Focusrite's outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Jump into our full catalog of 297 UK Penny Stocks here.

- Interested In Other Possibilities? These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TUNE

Focusrite

Engages in the development, manufacturing, and marketing of professional audio and electronic music products in North America, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives