European Undervalued Small Caps With Insider Action To Explore In July 2025

Reviewed by Simply Wall St

As European markets navigate a landscape marked by trade tensions and fluctuating economic indicators, the pan-European STOXX Europe 600 Index has recently shown resilience with a modest gain, despite the looming threat of higher U.S. tariffs on European goods. Amidst this backdrop, small-cap stocks present intriguing opportunities for investors seeking to capitalize on potential growth and insider actions that may indicate confidence in these companies' future prospects.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Kitwave Group | 13.0x | 0.3x | 45.28% | ★★★★★☆ |

| Stelrad Group | 13.5x | 0.8x | 35.77% | ★★★★★☆ |

| Yubico | 32.8x | 4.7x | 11.53% | ★★★★☆☆ |

| Renold | 10.6x | 0.7x | 3.34% | ★★★★☆☆ |

| Seeing Machines | NA | 2.9x | 44.11% | ★★★★☆☆ |

| A.G. BARR | 19.2x | 1.8x | 47.03% | ★★★☆☆☆ |

| Oxford Instruments | 44.7x | 2.3x | 6.80% | ★★★☆☆☆ |

| Fintel | 44.0x | 3.3x | 41.94% | ★★★☆☆☆ |

| CVS Group | 44.4x | 1.3x | 39.53% | ★★★☆☆☆ |

| Karnov Group | 220.8x | 4.7x | 32.87% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

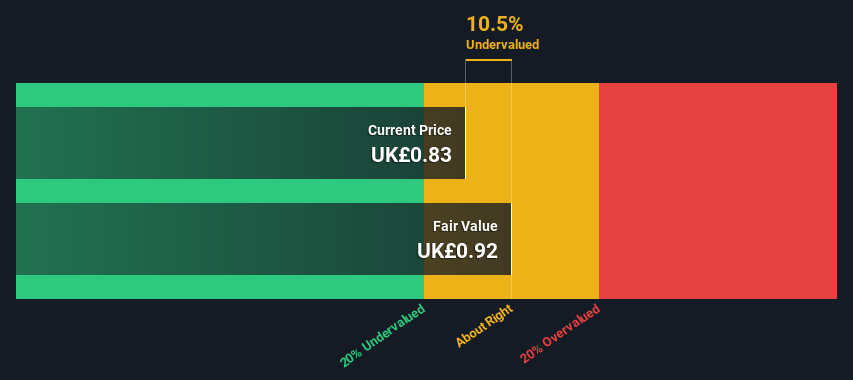

dotdigital Group (AIM:DOTD)

Simply Wall St Value Rating: ★★★★★★

Overview: Dotdigital Group specializes in providing data-driven omni-channel marketing automation solutions, with a market capitalization of approximately £0.26 billion.

Operations: The company generates revenue primarily from its data-driven omni-channel marketing automation services, with the latest reported revenue at £82.59 million. Over recent periods, the gross profit margin has shown a decreasing trend, reaching 78.92% in December 2024 and further declining to 78.92% by July 2025. Operating expenses have been increasing steadily, impacting net income margins which have also seen a downward trajectory from previous highs.

PE: 20.6x

Dotdigital Group, a smaller European player in the tech sector, showcases potential for growth despite recent challenges. With an anticipated 11% annual earnings growth and insider confidence demonstrated through recent share purchases, the company appears poised for future expansion. The appointment of Tom Mullan as CFO, bringing extensive software industry experience, strengthens their leadership team. While external borrowing presents some risk, revenue guidance aligns with market expectations for 2025 after accounting for contract non-renewals impacting £0.7 million.

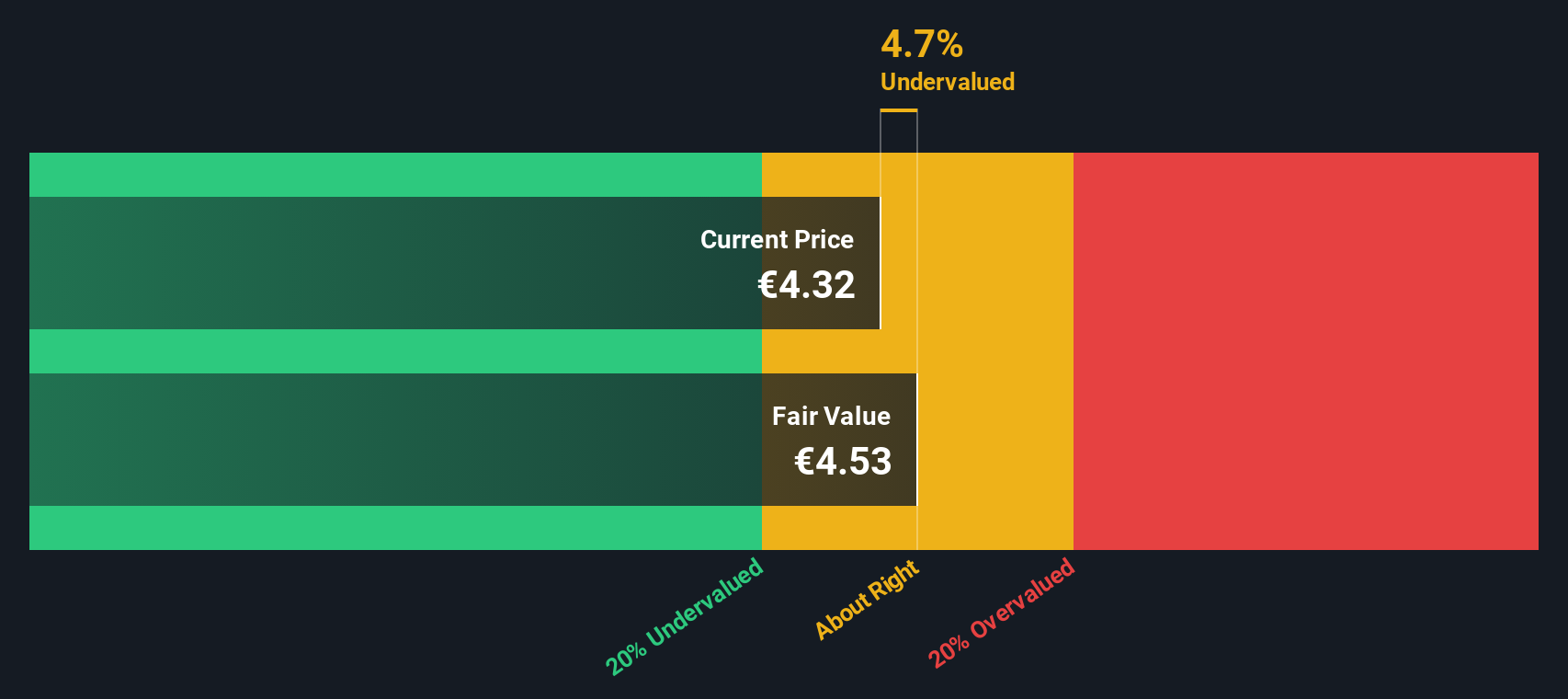

Ariston Holding (BIT:ARIS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ariston Holding specializes in the production and sale of thermal comfort products, burners, and components, with a market capitalization of €3.5 billion.

Operations: Thermal Comfort is the primary revenue driver, contributing significantly more than Burners and Components. The gross profit margin shows fluctuations, reaching 40.52% in late 2023 before declining to around 39.82% by mid-2025. Operating expenses have consistently increased over time, with General & Administrative Expenses being a major component of these costs.

PE: 615.8x

Ariston Holding, a European small company, has experienced insider confidence with recent share purchases made in Q1 2025. Despite high volatility in the past three months and reliance on external borrowing, the company is poised for growth with earnings expected to increase by 40.37% annually. However, profit margins have dipped from 6.1% last year to just 0.09%. Recent presentations at an Italian investment conference highlight Ariston's commitment to transparency and strategic communication with investors.

- Click here to discover the nuances of Ariston Holding with our detailed analytical valuation report.

Review our historical performance report to gain insights into Ariston Holding's's past performance.

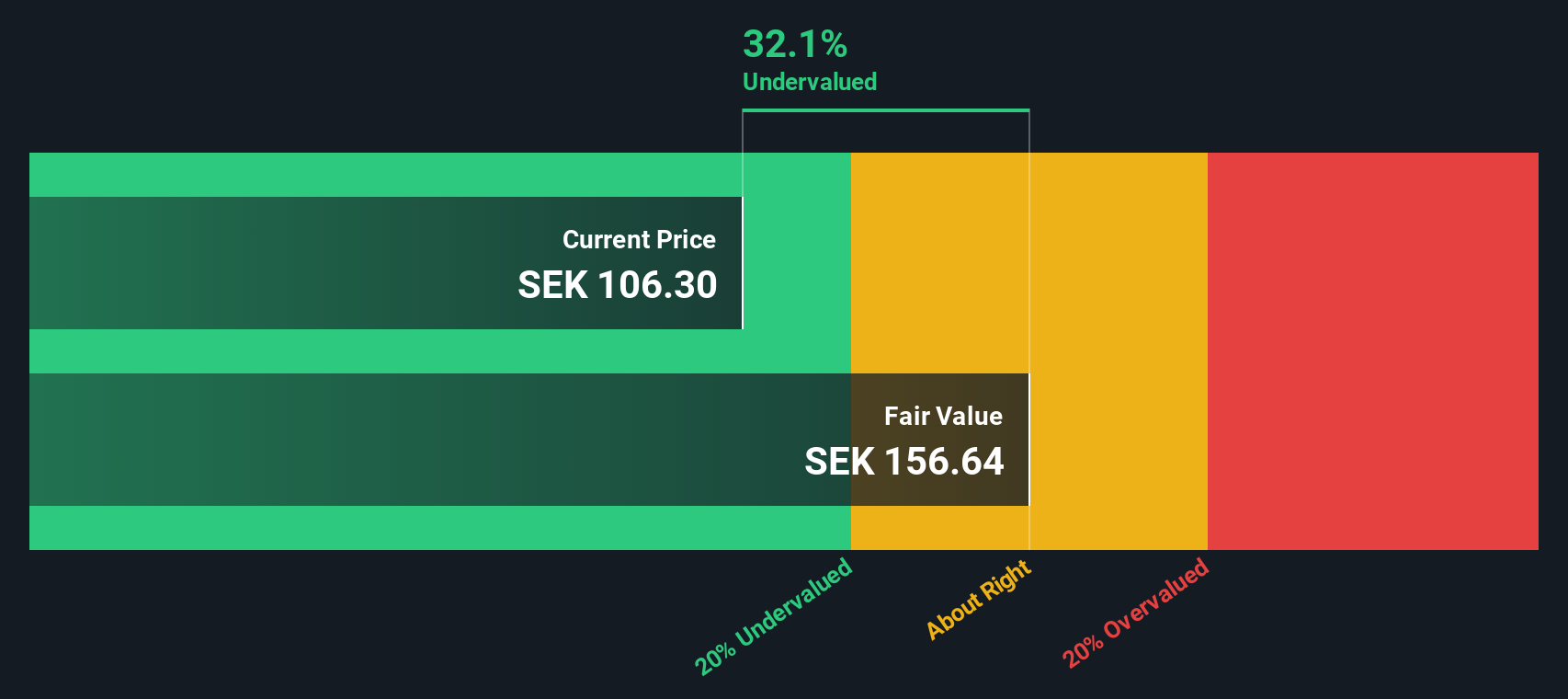

BioGaia (OM:BIOG B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: BioGaia is a Swedish biotechnology company specializing in the development and sale of probiotic products, with a market capitalization of approximately SEK 8.63 billion.

Operations: BioGaia generates revenue primarily from its Pediatrics and Adult Health segments, with Pediatrics being the larger contributor. The company has experienced fluctuations in its net income margin, which was 34.36% as of September 30, 2023. Operating expenses are significant, with a notable portion allocated to Sales & Marketing and R&D activities.

PE: 34.8x

BioGaia, a European small-cap company, recently announced an extra dividend of SEK 4.95 per share alongside a regular dividend increase to SEK 1.95 per share at its AGM on May 7, 2025. Despite a slight dip in Q1 sales to SEK 366 million and net income falling to SEK 80 million from the previous year, insider confidence is evident with recent purchases by insiders. Earnings are projected to grow annually by over 17%, indicating potential for future value appreciation despite current funding risks due to reliance on external borrowing.

Turning Ideas Into Actions

- Take a closer look at our Undervalued European Small Caps With Insider Buying list of 59 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ARIS

Ariston Holding

Through its subsidiaries, produces and distributes hot water and space heating solutions in the Netherlands, Germany, Italy, Switzerland, and internationally.

Excellent balance sheet moderate.

Similar Companies

Market Insights

Community Narratives