- United Kingdom

- /

- Residential REITs

- /

- OFEX:WAFR

Cirata And 2 Other Prominent Penny Stocks On The UK Exchange

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing a downturn due to weak trade data from China, highlighting global economic interdependencies. In such uncertain times, identifying stocks that combine affordability with growth potential becomes crucial for investors. Penny stocks, though often seen as a term from past eras, continue to offer intriguing opportunities by representing smaller or newer companies that might pair strong financials with promising prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £149.49M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £481.5M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £330.8M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.97 | £451.13M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.28 | £859.14M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.23 | £159.09M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.67 | £89.06M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.315 | £329.7M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| QinetiQ Group (LSE:QQ.) | £3.696 | £2.06B | ★★★★★☆ |

Click here to see the full list of 443 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Cirata (AIM:CRTA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cirata plc, along with its subsidiaries, develops and provides collaboration software across North America, Europe, China, and internationally with a market cap of £25.19 million.

Operations: The company generates revenue primarily from the development and sale of software licenses, along with related maintenance and support services, totaling $7.14 million.

Market Cap: £25.19M

Cirata plc, with a market cap of £25.19 million, has shown resilience in the competitive penny stock landscape by securing significant contracts like the LDM deal with a top US bank and renewing partnerships with IBM and Marvell Semiconductor. Despite being unprofitable, its short-term assets ($13.5M) comfortably cover both short ($5.1M) and long-term liabilities ($717K), while maintaining a debt-free status. The company reported $7.14 million in revenue primarily from software licenses and related services, although growth remains flat year-on-year. Cirata's management team is relatively new but has secured strategic engagements that could drive future growth potential.

- Navigate through the intricacies of Cirata with our comprehensive balance sheet health report here.

- Gain insights into Cirata's outlook and expected performance with our report on the company's earnings estimates.

WH Ireland Group (AIM:WHI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: WH Ireland Group plc offers wealth management services mainly in the United Kingdom and has a market cap of £6.40 million.

Operations: The company's revenue is derived from two primary segments: Capital Markets, generating £8.36 million, and Wealth Management (including Harpsden), contributing £10.90 million.

Market Cap: £6.4M

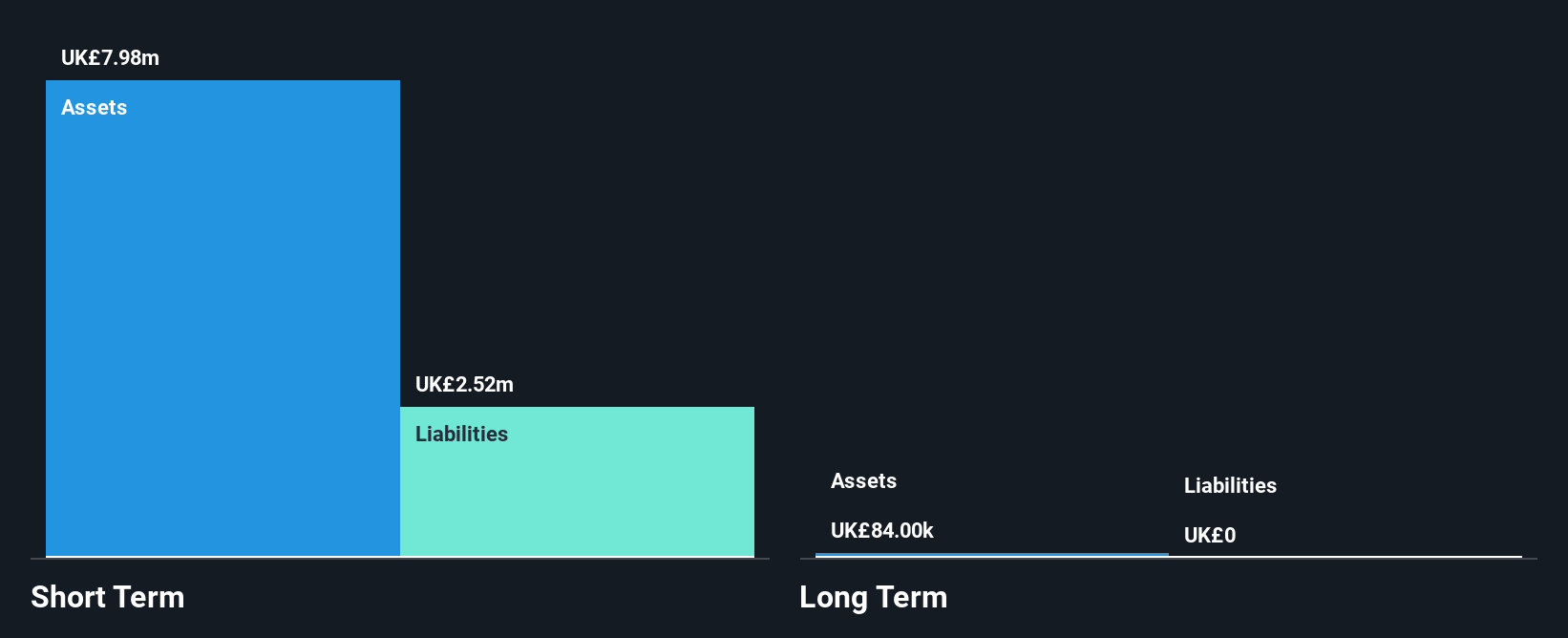

WH Ireland Group plc, with a market cap of £6.40 million, remains debt-free and has not diluted its shareholders over the past year. Despite being unprofitable, it has reduced its losses significantly from last year and maintains sufficient cash runway for over a year based on current free cash flow. The management team is seasoned with an average tenure of 5.5 years, contributing to stability in operations. Although WHI's short-term assets (£10.4M) surpass both short (£4.1M) and long-term liabilities (£144K), the company generates less than US$1 million in revenue, indicating it's pre-revenue status.

- Take a closer look at WH Ireland Group's potential here in our financial health report.

- Evaluate WH Ireland Group's historical performance by accessing our past performance report.

Walls & Futures Reit (OFEX:WAFR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Walls & Futures Reit Plc is a single-family residential REIT company with a market cap of £563,262.

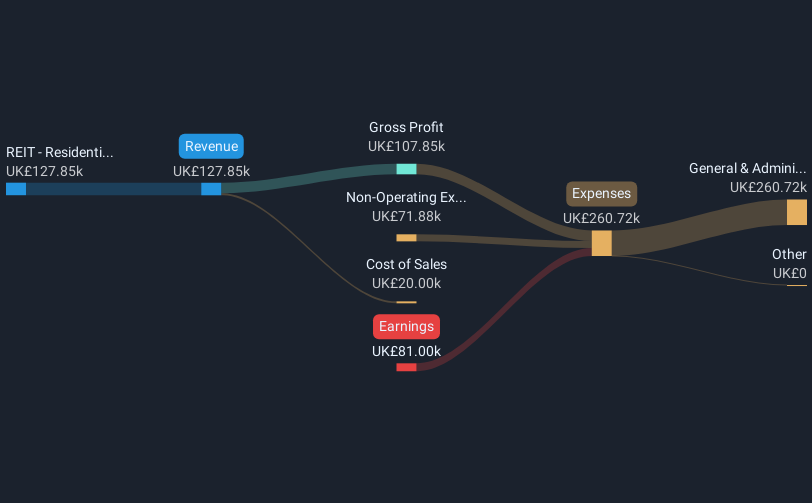

Operations: The company generates its revenue from the residential REIT segment, amounting to £0.13 million.

Market Cap: £563.26k

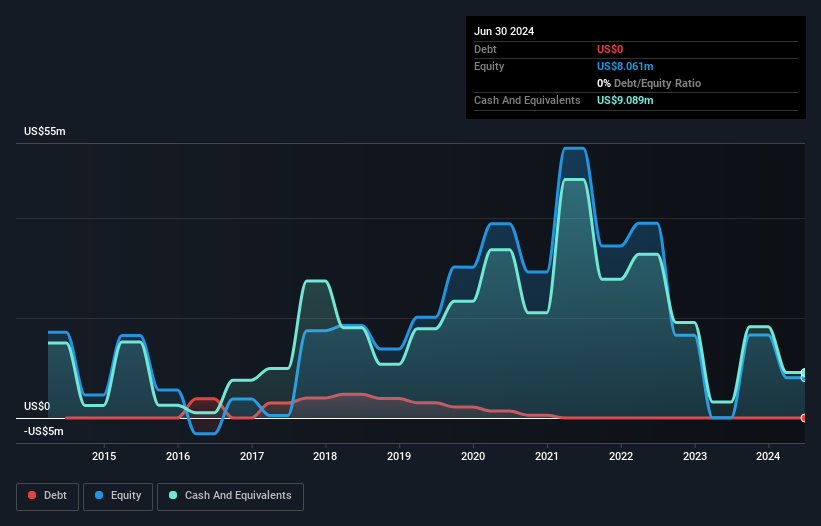

Walls & Futures Reit Plc, with a market cap of £563,262, is pre-revenue with earnings of £0.13 million and remains unprofitable. Despite its challenges, the company has more cash than debt and maintains a sufficient cash runway for over three years based on current free cash flow. Its short-term assets (£630.7K) exceed both short-term (£38.8K) and long-term liabilities (£3K), providing some financial stability. However, earnings have declined by 46.9% annually over the past five years, and its negative return on equity reflects ongoing profitability issues despite stable weekly volatility at 6%.

- Jump into the full analysis health report here for a deeper understanding of Walls & Futures Reit.

- Examine Walls & Futures Reit's past performance report to understand how it has performed in prior years.

Where To Now?

- Take a closer look at our UK Penny Stocks list of 443 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walls & Futures Reit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OFEX:WAFR

Walls & Futures Reit

Operates as a single-family residential REIT company.

Excellent balance sheet slight.

Market Insights

Community Narratives