- United Kingdom

- /

- Software

- /

- AIM:CNS

Corero Network Security plc's (LON:CNS) Stock On An Uptrend: Could Fundamentals Be Driving The Momentum?

Corero Network Security (LON:CNS) has had a great run on the share market with its stock up by a significant 16% over the last three months. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. In this article, we decided to focus on Corero Network Security's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for Corero Network Security

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Corero Network Security is:

4.6% = US$797k ÷ US$17m (Based on the trailing twelve months to June 2024).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each £1 of shareholders' capital it has, the company made £0.05 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Corero Network Security's Earnings Growth And 4.6% ROE

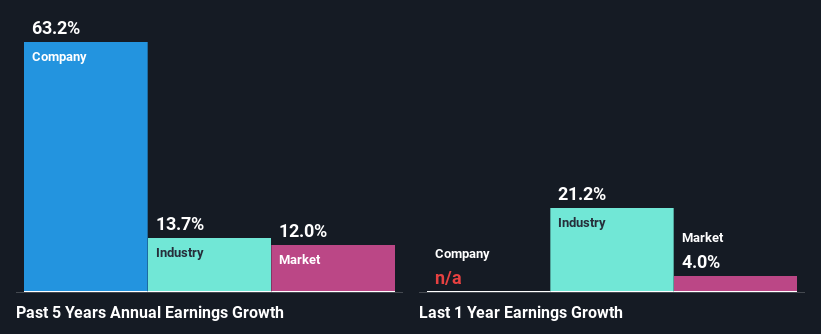

When you first look at it, Corero Network Security's ROE doesn't look that attractive. Next, when compared to the average industry ROE of 10.0%, the company's ROE leaves us feeling even less enthusiastic. In spite of this, Corero Network Security was able to grow its net income considerably, at a rate of 63% in the last five years. Therefore, there could be other reasons behind this growth. Such as - high earnings retention or an efficient management in place.

As a next step, we compared Corero Network Security's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 14%.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. What is CNS worth today? The intrinsic value infographic in our free research report helps visualize whether CNS is currently mispriced by the market.

Is Corero Network Security Making Efficient Use Of Its Profits?

Given that Corero Network Security doesn't pay any regular dividends to its shareholders, we infer that the company has been reinvesting all of its profits to grow its business.

Summary

In total, it does look like Corero Network Security has some positive aspects to its business. With a high rate of reinvestment, albeit at a low ROE, the company has managed to see a considerable growth in its earnings. With that said, the latest industry analyst forecasts reveal that the company's earnings growth is expected to slow down. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

If you're looking to trade Corero Network Security, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CNS

Corero Network Security

Provides distributed denial of service (DDoS) protection solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives