Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, CloudCoCo Group plc (LON:CLCO) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for CloudCoCo Group

How Much Debt Does CloudCoCo Group Carry?

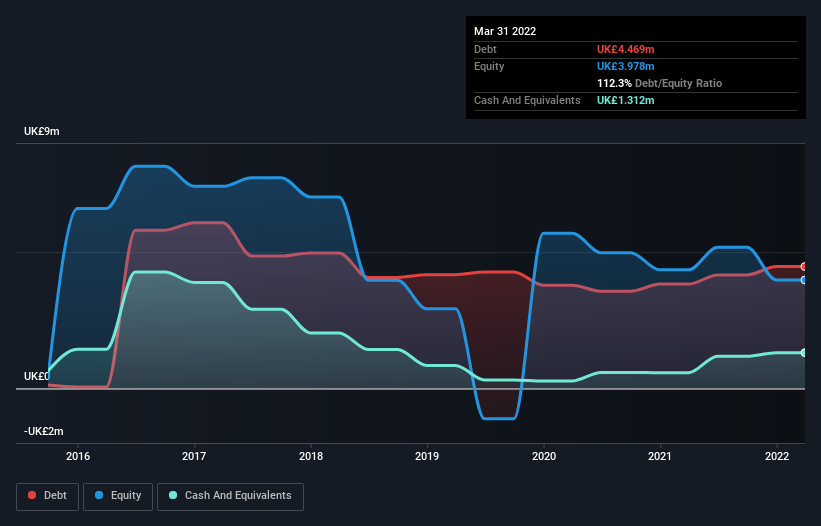

As you can see below, at the end of March 2022, CloudCoCo Group had UK£4.47m of debt, up from UK£3.83m a year ago. Click the image for more detail. However, because it has a cash reserve of UK£1.31m, its net debt is less, at about UK£3.16m.

A Look At CloudCoCo Group's Liabilities

The latest balance sheet data shows that CloudCoCo Group had liabilities of UK£9.34m due within a year, and liabilities of UK£6.30m falling due after that. Offsetting this, it had UK£1.31m in cash and UK£3.74m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by UK£10.6m.

This deficit casts a shadow over the UK£6.71m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, CloudCoCo Group would likely require a major re-capitalisation if it had to pay its creditors today. When analysing debt levels, the balance sheet is the obvious place to start. But it is CloudCoCo Group's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year CloudCoCo Group wasn't profitable at an EBIT level, but managed to grow its revenue by 103%, to UK£16m. So its pretty obvious shareholders are hoping for more growth!

Caveat Emptor

While we can certainly appreciate CloudCoCo Group's revenue growth, its earnings before interest and tax (EBIT) loss is not ideal. Its EBIT loss was a whopping UK£2.4m. When we look at that alongside the significant liabilities, we're not particularly confident about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it had negative free cash flow of UK£953k over the last twelve months. That means it's on the risky side of things. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 4 warning signs with CloudCoCo Group (at least 3 which are potentially serious) , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CLCO

CloudCoCo Group

Provides IT and communications solutions in the United Kingdom.

Solid track record with adequate balance sheet.

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Investing in the future with RGYAS as fair value hits 228.23

The global leader in cash handling

Wolters Kluwer - A Fundamental and Historical Valuation

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.