- United Kingdom

- /

- Software

- /

- AIM:GBG

High Growth Tech Stocks In The United Kingdom Featuring Beeks Financial Cloud Group

Reviewed by Simply Wall St

The United Kingdom's stock market has been experiencing some turbulence, with the FTSE 100 closing lower due to weak trade data from China, highlighting the challenges faced by companies tied to global economic conditions. In this environment, identifying high-growth tech stocks can be particularly appealing as they often demonstrate resilience and potential for significant returns despite broader market uncertainties.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.14% | 46.78% | ★★★★★☆ |

| Facilities by ADF | 48.47% | 189.97% | ★★★★★☆ |

| Redcentric | 5.32% | 67.90% | ★★★★★☆ |

| Pinewood Technologies Group | 20.59% | 23.16% | ★★★★★☆ |

| Altitude Group | 24.51% | 30.10% | ★★★★★☆ |

| YouGov | 7.55% | 56.01% | ★★★★★☆ |

| Windar Photonics | 36.65% | 46.33% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

| Cordel Group | 33.50% | 148.58% | ★★★★★☆ |

Click here to see the full list of 41 stocks from our UK High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Beeks Financial Cloud Group (AIM:BKS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beeks Financial Cloud Group plc offers managed cloud computing, connectivity, and analytics services tailored for the capital markets and financial services sectors globally, with a market capitalization of £201.16 million.

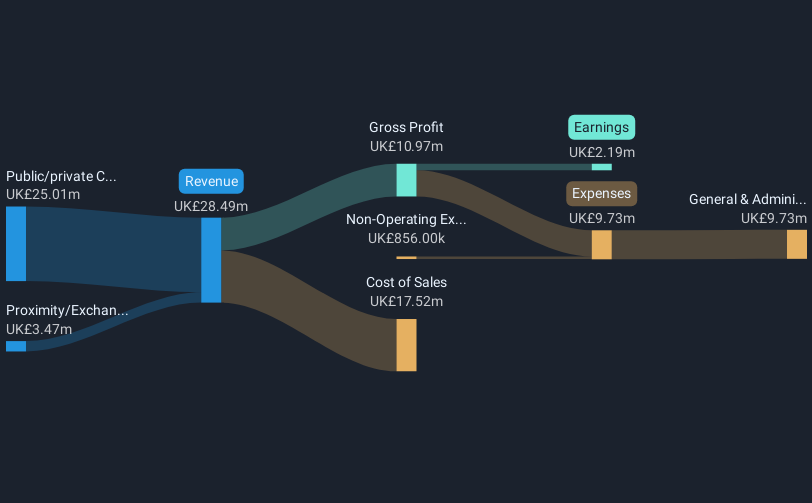

Operations: The company generates revenue primarily from its Public/Private Cloud services, contributing £25.01 million, and Proximity/Exchange Cloud services, adding £3.47 million.

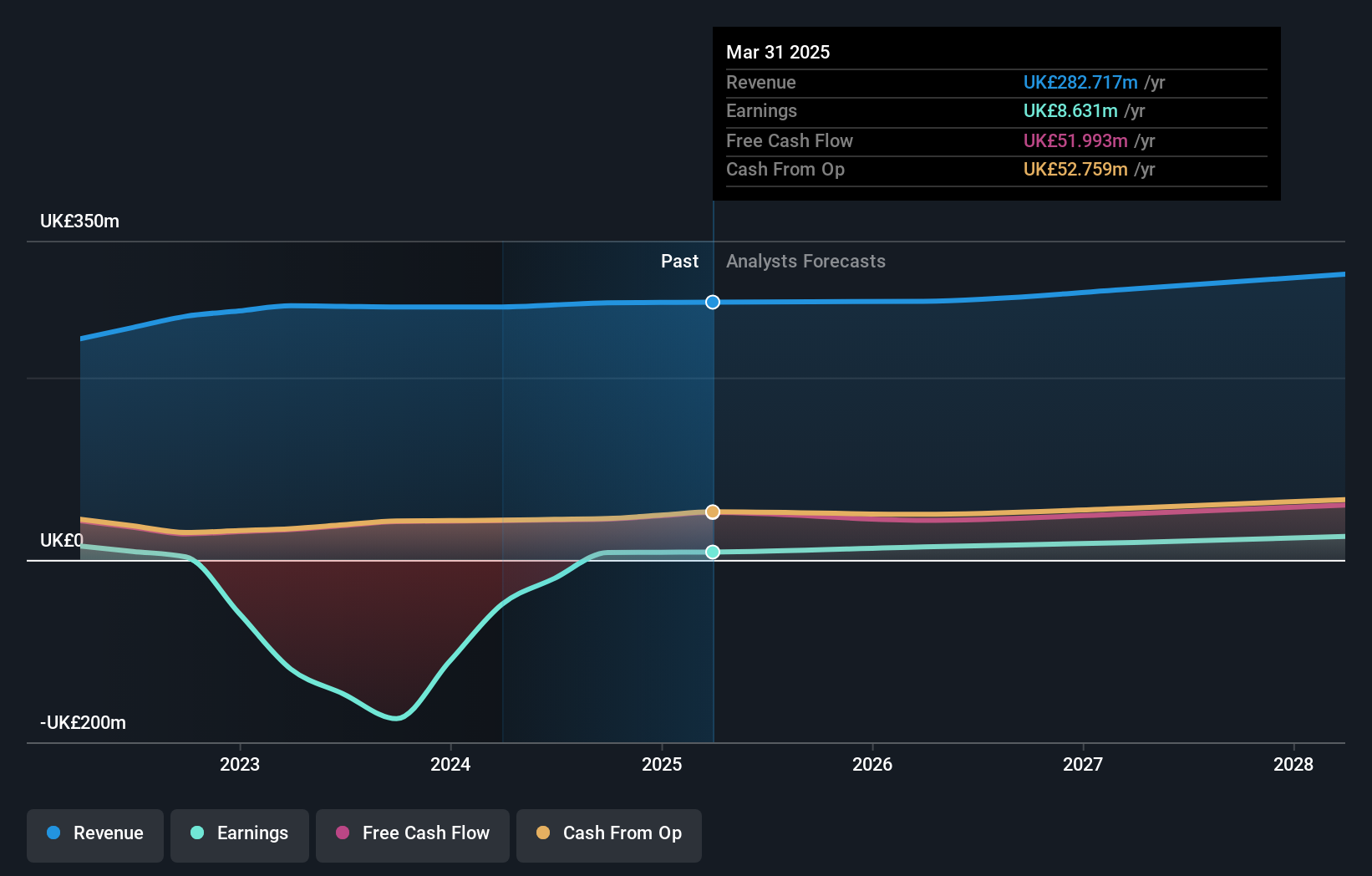

Beeks Financial Cloud Group, a UK-based tech firm, is demonstrating robust growth with its revenue expected to increase by 22.1% annually, outpacing the UK market's average of 3.6%. This financial uplift is complemented by an anticipated earnings surge of 36.9% per year, significantly higher than the market forecast of 14.4%. Recently, Beeks secured a pivotal deal with Grupo Bolsa Mexicana de Valores to deploy advanced infrastructure in Mexico City, enhancing its foothold in Latin America and underscoring its capability to deliver high-scale and secure technological solutions. This strategic expansion not only broadens Beeks' market presence but also aligns with its commitment to innovation and quality service delivery in the financial sector.

- Click to explore a detailed breakdown of our findings in Beeks Financial Cloud Group's health report.

Gain insights into Beeks Financial Cloud Group's past trends and performance with our Past report.

GB Group (AIM:GBG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GB Group plc, with a market cap of £875.36 million, offers identity data intelligence products and services across the United Kingdom, the United States, Australia, and other international markets.

Operations: The company generates revenue through three main segments: Identity (£159.78 million), Location (£83.94 million), and Fraud (£38.14 million). The Identity segment is the largest contributor to its revenue stream.

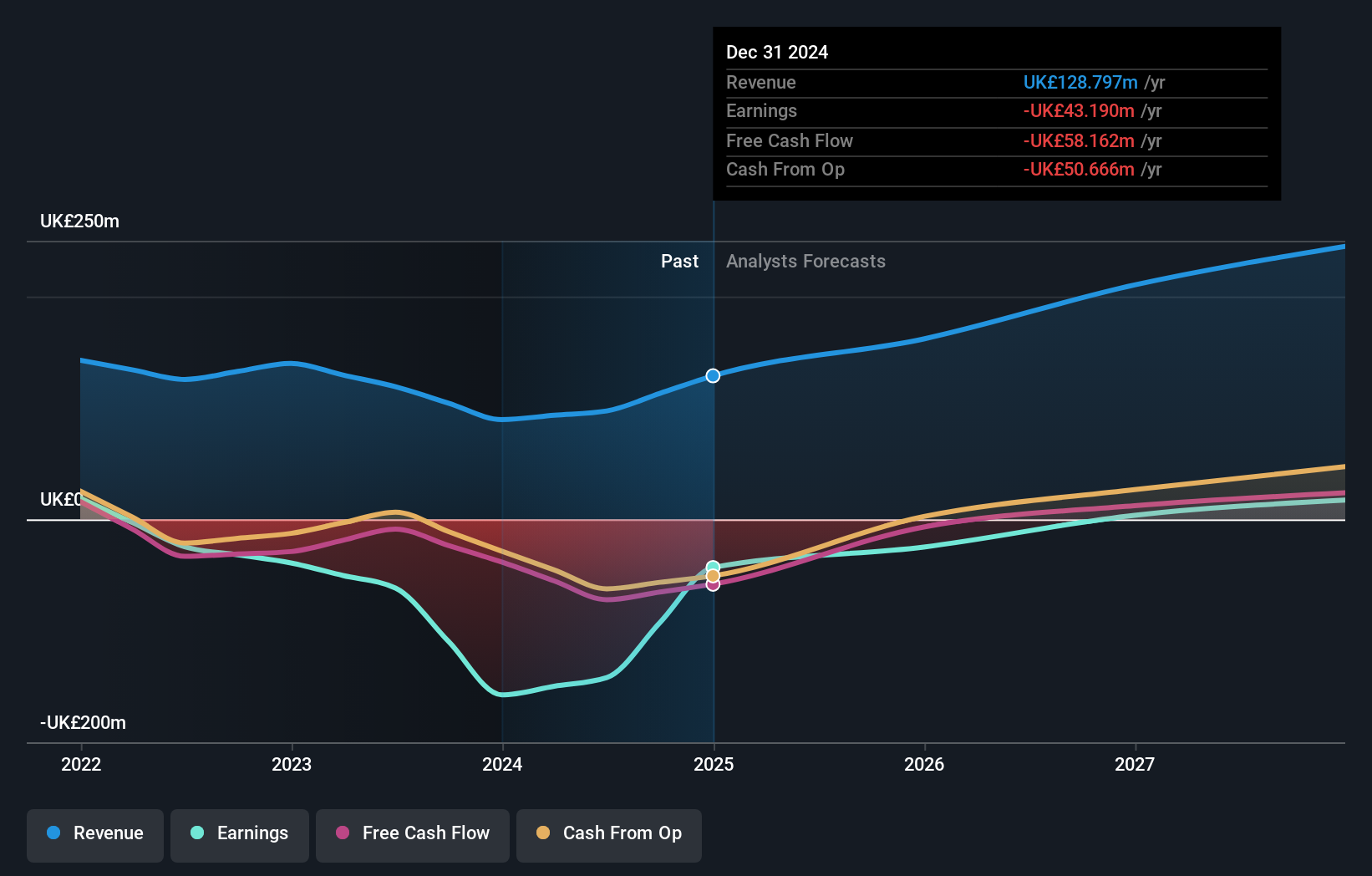

GB Group, a UK-based tech firm, recently turned profitable and is poised for substantial growth with earnings expected to increase by 38.9% annually. This growth is significantly above the UK market average of 14.4%. Despite a slower revenue growth rate at 6.8% per year compared to high-growth benchmarks, it still surpasses the UK market's average of 3.6%. The company’s financials were notably influenced by a one-off gain of £52.5M last fiscal year, which could skew pure operational performance metrics temporarily but underscores potential for sizable financial maneuvers or reinvestments in strategic areas like R&D or market expansion initiatives.

- Unlock comprehensive insights into our analysis of GB Group stock in this health report.

Understand GB Group's track record by examining our Past report.

Oxford Biomedica (LSE:OXB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Oxford Biomedica plc is a contract development and manufacturing organization dedicated to providing therapies globally, with a market cap of £397.41 million.

Operations: Oxford Biomedica focuses on delivering therapies through its platform segment, generating revenue of £97.24 million.

Oxford Biomedica stands out in the high-growth tech landscape of the UK, notably with its recent announcement on February 20, 2025, about its role in Boehringer Ingelheim's LENTICLAIR™? 1 trial for cystic fibrosis. This collaboration underscores OXB's cutting-edge capabilities in gene therapy, a sector driven by high R&D investments and innovation. Financially, OXB is set to shift from unprofitability to profitability within three years, with expected revenue growth at an impressive rate of 18.3% annually—significantly surpassing the UK market average of 3.6%. This anticipated growth is complemented by a projected annual earnings increase of 96.43%, highlighting both the company's potential and its strategic focus on addressing critical medical needs through advanced biotechnologies.

- Navigate through the intricacies of Oxford Biomedica with our comprehensive health report here.

Explore historical data to track Oxford Biomedica's performance over time in our Past section.

Where To Now?

- Unlock more gems! Our UK High Growth Tech and AI Stocks screener has unearthed 38 more companies for you to explore.Click here to unveil our expertly curated list of 41 UK High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:GBG

GB Group

Provides identity data intelligence products and services in the United Kingdom, the United States, Australia, and internationally.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives