- United Kingdom

- /

- Software

- /

- AIM:ADVT

3 UK Penny Stocks With Market Caps Under £600M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interdependencies. In such fluctuating conditions, identifying stocks with strong financials becomes crucial for investors seeking stability and potential growth. Penny stocks, though an older term, still represent opportunities in smaller or newer companies that may offer value and growth potential despite their lower price points.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.155 | £476.67M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.925 | £155.52M | ✅ 4 ⚠️ 2 View Analysis > |

| On the Beach Group (LSE:OTB) | £2.29 | £331.83M | ✅ 5 ⚠️ 1 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.75 | £133.18M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.845 | £12.76M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.6875 | $399.66M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.454 | £176.1M | ✅ 3 ⚠️ 2 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.445 | £38.36M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.14 | £183.46M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 306 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

AdvancedAdvT (AIM:ADVT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AdvancedAdvT Limited provides software solutions across Europe, the United Kingdom, North America, and internationally with a market cap of £239.97 million.

Operations: The company generated £48.84 million in revenue from the United Kingdom segment.

Market Cap: £239.97M

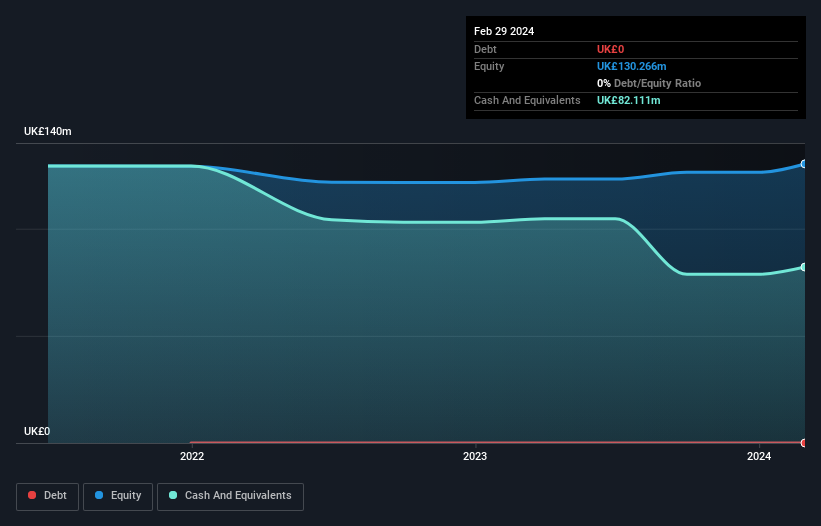

AdvancedAdvT Limited, with a market cap of £239.97 million, has shown revenue growth in its UK segment and reported sales of £25.44 million for the first half of 2025. Despite this, net income decreased to £2.93 million from £7.85 million the previous year, partly due to a large one-off loss impacting earnings quality. The company remains debt-free with strong asset coverage over liabilities but faces challenges like low return on equity and negative recent earnings growth compared to industry averages. AdvancedAdvT is actively seeking acquisitions as part of its strategy to enhance long-term value through consolidation opportunities in fragmented industries.

- Click here and access our complete financial health analysis report to understand the dynamics of AdvancedAdvT.

- Evaluate AdvancedAdvT's prospects by accessing our earnings growth report.

James Halstead (AIM:JHD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: James Halstead plc is a flooring products manufacturer and supplier serving both commercial and domestic markets globally, with a market cap of £575.17 million.

Operations: The company generates £261.97 million in revenue from its operations focused on the manufacture and distribution of flooring products.

Market Cap: £575.17M

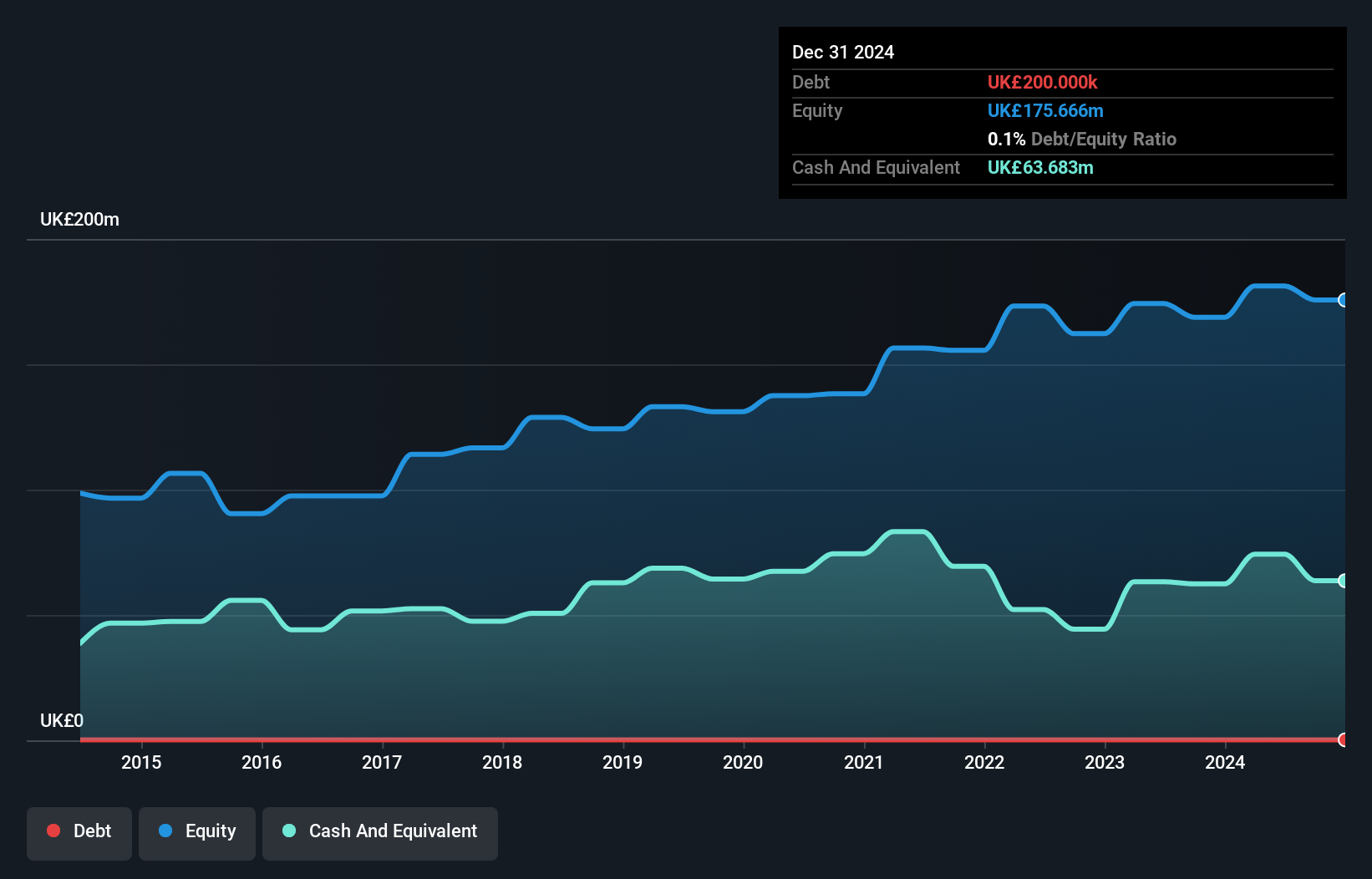

James Halstead plc, with a market cap of £575.17 million, reported stable financial performance despite a slight dip in sales to £261.97 million and net income to £40.61 million for the year ended June 30, 2025. The company maintains robust financial health with more cash than total debt and short-term assets exceeding liabilities significantly. Its high return on equity at 22.3% reflects strong profitability, although recent earnings growth was negative compared to industry averages. The board's experience supports governance stability while the company's dividend history marks 49 years of consecutive increases, though current dividends are not well covered by earnings or free cash flows.

- Get an in-depth perspective on James Halstead's performance by reading our balance sheet health report here.

- Examine James Halstead's earnings growth report to understand how analysts expect it to perform.

Van Elle Holdings (AIM:VANL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Van Elle Holdings plc operates as a geotechnical and ground engineering contractor in the United Kingdom, with a market cap of £40.47 million.

Operations: Van Elle Holdings generates revenue through three main segments: General Piling (£46.03 million), Specialist Piling & Rail (£46.10 million), and Ground Engineering Services (£38.14 million).

Market Cap: £40.47M

Van Elle Holdings, with a market cap of £40.47 million, shows a mixed financial profile as a penny stock. The company has become profitable over the past five years and maintains more cash than total debt, with operating cash flow well covering its debt obligations. However, recent earnings growth was negative at -40.5%, impacting profit margins which decreased to 2.4% from 3.8% last year. Despite this, analysts forecast earnings growth of 25.5% annually and agree on potential stock price appreciation by 42.6%. The management team is experienced but dividend sustainability remains unstable due to an inconsistent track record.

- Jump into the full analysis health report here for a deeper understanding of Van Elle Holdings.

- Gain insights into Van Elle Holdings' outlook and expected performance with our report on the company's earnings estimates.

Seize The Opportunity

- Click this link to deep-dive into the 306 companies within our UK Penny Stocks screener.

- Interested In Other Possibilities? Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ADVT

AdvancedAdvT

Engages in the provision of software solutions in Europe, the United Kingdom, North America, and internationally.

Flawless balance sheet with very low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion