- United Kingdom

- /

- Semiconductors

- /

- AIM:IQE

Investors Appear Satisfied With IQE plc's (LON:IQE) Prospects As Shares Rocket 27%

Despite an already strong run, IQE plc (LON:IQE) shares have been powering on, with a gain of 27% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 66% in the last year.

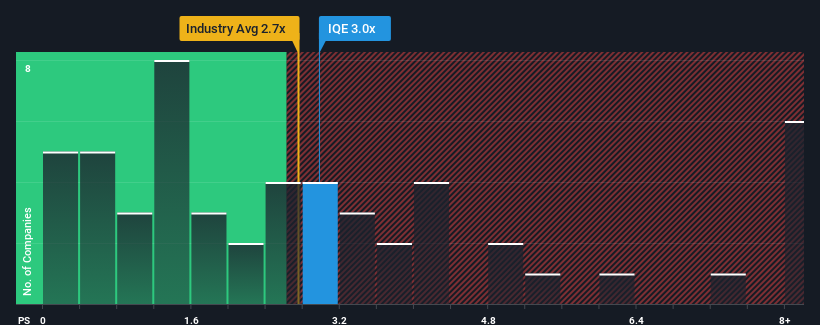

Even after such a large jump in price, it's still not a stretch to say that IQE's price-to-sales (or "P/S") ratio of 3x right now seems quite "middle-of-the-road" compared to the Semiconductor industry in the United Kingdom, where the median P/S ratio is around 2.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for IQE

What Does IQE's P/S Mean For Shareholders?

IQE could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on IQE.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, IQE would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 31% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 35% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 17% each year as estimated by the three analysts watching the company. That's shaping up to be similar to the 15% per year growth forecast for the broader industry.

With this information, we can see why IQE is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From IQE's P/S?

IQE appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at IQE's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with IQE (at least 2 which make us uncomfortable), and understanding these should be part of your investment process.

If you're unsure about the strength of IQE's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:IQE

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives