- United Kingdom

- /

- Semiconductors

- /

- AIM:CML

CML Microsystems And 2 Other UK Penny Stocks To Consider

Reviewed by Simply Wall St

The UK market has been experiencing some volatility, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting global economic interdependencies. In such fluctuating conditions, investors might find value in exploring penny stocks—smaller or newer companies that can offer unique opportunities despite their modest market presence. While the term "penny stocks" may seem outdated, these investments can still provide growth potential when backed by strong financials and a clear path forward.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.21M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.75 | £178.85M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.94 | £448.27M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.14 | £806.38M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £4.40 | £83.91M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.39 | £337.16M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.378 | £40.9M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.01 | £85.93M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.16 | £154.1M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.43 | £182.11M | ★★★★★☆ |

Click here to see the full list of 443 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

CML Microsystems (AIM:CML)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CML Microsystems plc, with a market cap of £41.37 million, designs, manufactures, and markets semiconductor products for the communications industries across the United Kingdom, the Americas, Far East, and internationally.

Operations: The company's revenue is primarily derived from its Semiconductor Components for The Communications Industry segment, which generated £24.85 million.

Market Cap: £41.37M

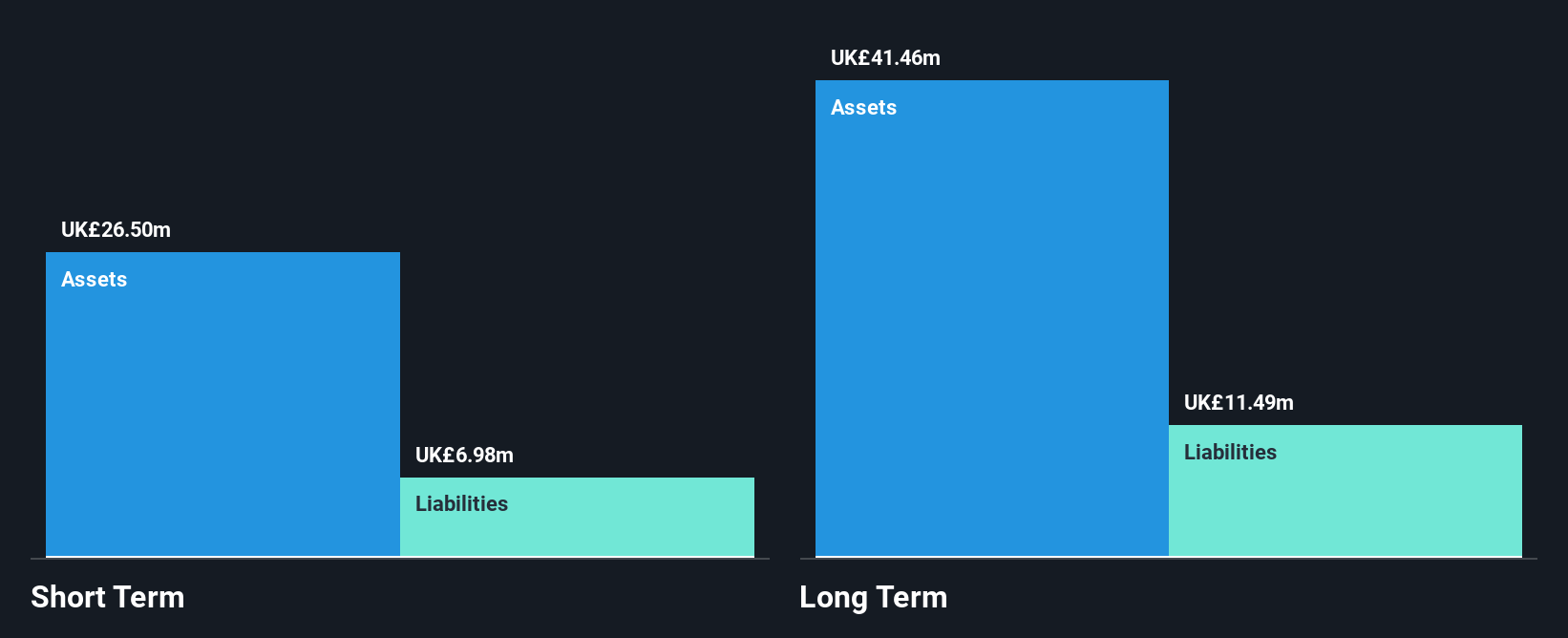

CML Microsystems, with a market cap of £41.37 million, has shown resilience despite recent challenges. The company reported half-year sales of £12.53 million, up from £10.58 million the previous year, but net income declined to £0.697 million from £1.47 million due to reduced profit margins and negative earnings growth over the past year (-70.8%). However, CML remains debt-free and its short-term assets comfortably cover both short- and long-term liabilities (£26.5M vs £7M and £11.5M respectively). A share buyback program is underway to repurchase up to 14.65% of its issued capital, potentially enhancing shareholder value amidst stable weekly volatility (5%).

- Click to explore a detailed breakdown of our findings in CML Microsystems' financial health report.

- Evaluate CML Microsystems' historical performance by accessing our past performance report.

MYCELX Technologies (AIM:MYX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MYCELX Technologies Corporation is a clean water technology company offering water treatment solutions to various sectors including oil and gas, power, marine, and heavy manufacturing across the Middle East, the United States, Australia, and other international markets with a market cap of £7.92 million.

Operations: The company's revenue is primarily derived from its Pollution and Treatment Control Products segment, totaling $8.84 million.

Market Cap: £7.92M

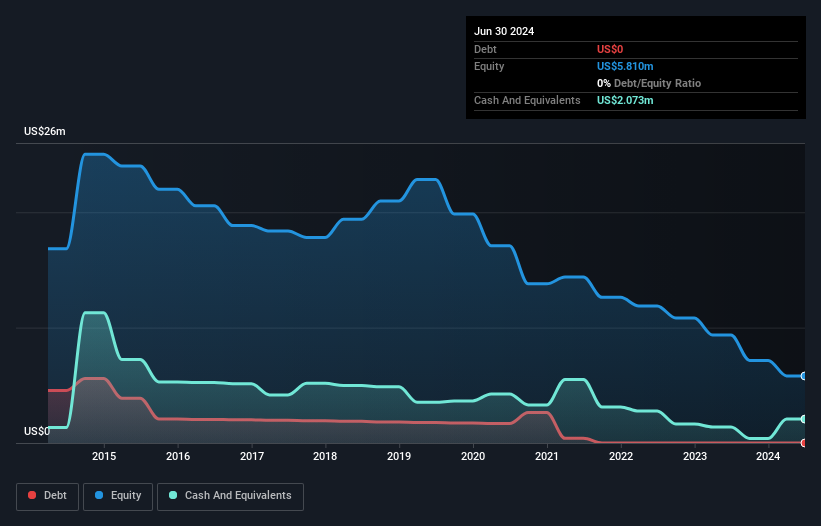

MYCELX Technologies, with a market cap of £7.92 million, operates in the clean water technology sector and is currently unprofitable. Despite this, MYCELX remains debt-free and has sufficient short-term assets ($5.6M) to cover both short- ($1.9M) and long-term liabilities ($997K). Revenue is forecast to grow 55.07% annually, though recent guidance suggests a decline to approximately $4.9 million for 2024 year-end revenue from previous levels of $8.84 million. The company has not seen meaningful shareholder dilution recently and maintains a seasoned management team with an average tenure of 26 years.

- Jump into the full analysis health report here for a deeper understanding of MYCELX Technologies.

- Gain insights into MYCELX Technologies' future direction by reviewing our growth report.

Symphony International Holdings (LSE:SIHL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Symphony International Holdings Limited is a private equity and venture capital firm that focuses on a variety of investment stages including early stage, management buy-outs, and growth capital, with a market cap of $190.97 million.

Operations: Symphony International Holdings Limited does not report specific revenue segments.

Market Cap: $190.97M

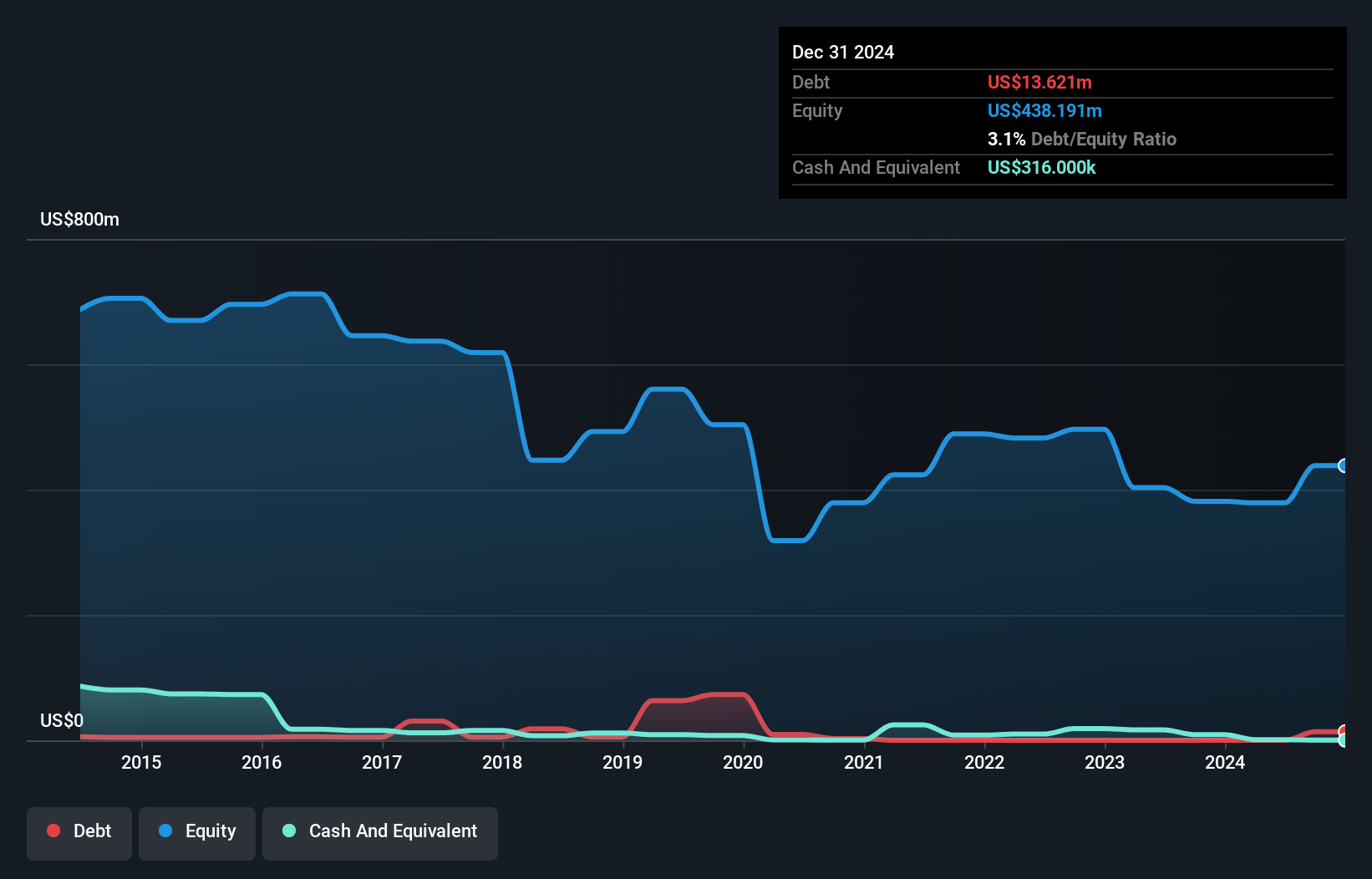

Symphony International Holdings Limited, with a market cap of $190.97 million, operates as a private equity and venture capital firm but remains pre-revenue and unprofitable. The company benefits from being debt-free, eliminating concerns over interest payments or long-term liabilities. Its short-term assets ($1.1M) comfortably cover its short-term liabilities ($362K). Despite the lack of profitability, there has been no significant shareholder dilution recently. However, the dividend yield of 6.72% is not supported by earnings or cash flows. The board is experienced with an average tenure of 17.6 years, although management tenure data is insufficient for assessment.

- Click here and access our complete financial health analysis report to understand the dynamics of Symphony International Holdings.

- Examine Symphony International Holdings' past performance report to understand how it has performed in prior years.

Key Takeaways

- Take a closer look at our UK Penny Stocks list of 443 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CML

CML Microsystems

Through its subsidiaries, designs, manufactures, and semiconductor products for industrial, professional and commercial applications in the Americas, Europe, Far East, and internationally.

Flawless balance sheet unattractive dividend payer.

Market Insights

Community Narratives