- United Kingdom

- /

- Specialty Stores

- /

- LSE:TPT

Getting In Cheap On Topps Tiles Plc (LON:TPT) Might Be Difficult

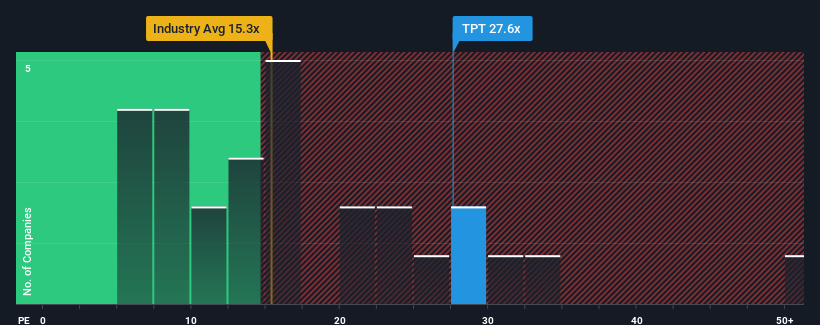

When close to half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") below 15x, you may consider Topps Tiles Plc (LON:TPT) as a stock to avoid entirely with its 27.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times haven't been advantageous for Topps Tiles as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Topps Tiles

How Is Topps Tiles' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Topps Tiles' is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 65%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 49% each year during the coming three years according to the four analysts following the company. That's shaping up to be materially higher than the 14% per year growth forecast for the broader market.

In light of this, it's understandable that Topps Tiles' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Topps Tiles' P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Topps Tiles' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Topps Tiles that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Topps Tiles might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:TPT

Topps Tiles

Engages in the retail and wholesale distribution of ceramic and porcelain tiles, natural stone, and related products for residential and commercial markets in the United Kingdom.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives