David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Currys plc (LON:CURY) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Currys

How Much Debt Does Currys Carry?

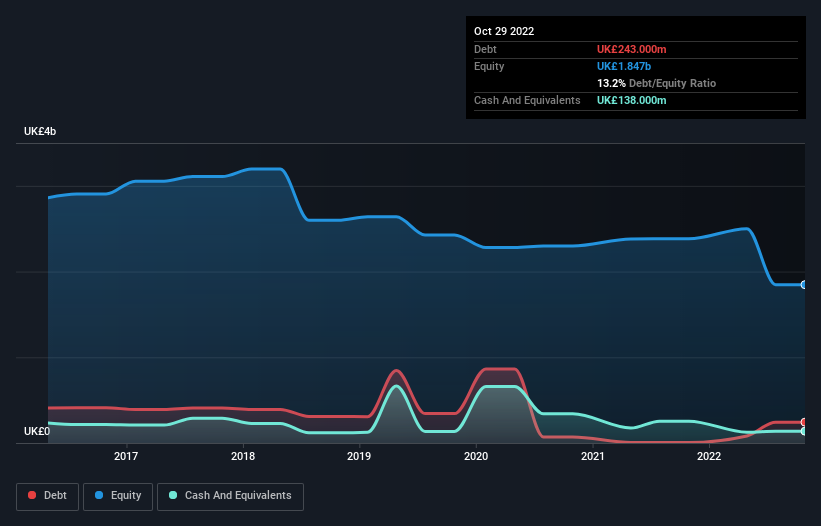

You can click the graphic below for the historical numbers, but it shows that as of October 2022 Currys had UK£243.0m of debt, an increase on UK£5.00m, over one year. However, it does have UK£138.0m in cash offsetting this, leading to net debt of about UK£105.0m.

How Strong Is Currys' Balance Sheet?

According to the last reported balance sheet, Currys had liabilities of UK£3.16b due within 12 months, and liabilities of UK£1.83b due beyond 12 months. On the other hand, it had cash of UK£138.0m and UK£786.0m worth of receivables due within a year. So it has liabilities totalling UK£4.07b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the UK£850.5m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Currys would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Currys has a very low debt to EBITDA ratio of 0.50 so it is strange to see weak interest coverage, with last year's EBIT being only 1.4 times the interest expense. So one way or the other, it's clear the debt levels are not trivial. One way Currys could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 12%, as it did over the last year. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Currys's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Happily for any shareholders, Currys actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Neither Currys's ability to handle its total liabilities nor its interest cover gave us confidence in its ability to take on more debt. But the good news is it seems to be able to convert EBIT to free cash flow with ease. Taking the abovementioned factors together we do think Currys's debt poses some risks to the business. While that debt can boost returns, we think the company has enough leverage now. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example Currys has 2 warning signs (and 1 which is potentially serious) we think you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:CURY

Currys

Operates as a omnichannel retailer of technology products and services in the United Kingdom, Ireland, Norway, Sweden, Finland, Denmark, Iceland, Greenland, and the Faroe Islands.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026