- United Kingdom

- /

- Specialty Stores

- /

- LSE:CARD

If You Had Bought Card Factory's (LON:CARD) Shares Five Years Ago You Would Be Down 88%

Card Factory plc (LON:CARD) shareholders should be happy to see the share price up 15% in the last quarter. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. Like a ship taking on water, the share price has sunk 88% in that time. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The real question is whether the business can leave its past behind and improve itself over the years ahead.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

See our latest analysis for Card Factory

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

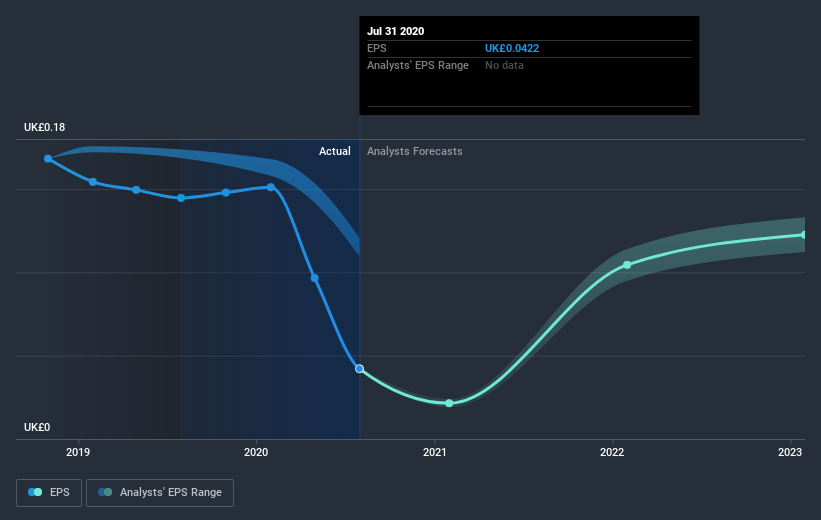

Looking back five years, both Card Factory's share price and EPS declined; the latter at a rate of 25% per year. Readers should note that the share price has fallen faster than the EPS, at a rate of 35% per year, over the period. This implies that the market was previously too optimistic about the stock. The low P/E ratio of 9.42 further reflects this reticence.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Card Factory's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Card Factory's TSR, which was a 84% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

We regret to report that Card Factory shareholders are down 72% for the year. Unfortunately, that's worse than the broader market decline of 5.5%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 13% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Card Factory better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with Card Factory .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you’re looking to trade Card Factory, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:CARD

Card Factory

Operates as a specialist retailer of cards, gifts, and celebration essentials in the United Kingdom, South Africa, Republic of Ireland, the United States, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives