How Does B&M’s 53% Share Price Decline Affect Its 2025 Valuation Outlook?

Reviewed by Bailey Pemberton

If you’re watching B&M European Value Retail’s stock and wondering whether it’s a smart buy, you’re definitely not alone right now. The company’s share price has taken some serious hits this year, down 53.0% year-to-date and an eye-opening 54.6% lower than it was twelve months ago. Even the past week saw a sharp move, with the stock dropping 24.7%. That kind of movement grabs attention, but it also raises a big question: Are we looking at a value trap or a hidden bargain?

The drop in the share price comes against a backdrop of shifting investor sentiment, with recent news about changes in consumer spending patterns and uncertain retail sector trends fueling perceptions of higher risk around discount retailers. Analysts are debating whether these pressures are temporary or a more permanent shift in the sector’s fortunes. While some headlines highlight challenges, others note that B&M’s fundamentals have kept the company well positioned compared to many rivals.

For investors assessing value, the company’s official valuation score lands at 5 out of 6. That’s a strong mark, meaning B&M passes almost every key undervaluation test used, from price to earnings to cash flow multiples. Still, numbers never tell the whole story, especially when recent news is making its mark and sentiment is changing fast.

So what does that valuation score really mean, and how is it calculated? In the next section, we’ll break down these methods and see how B&M stacks up in more detail. We’ll also hint at an even sharper lens for understanding a stock’s true value, which will be shared at the end of the article.

Why B&M European Value Retail is lagging behind its peers

Approach 1: B&M European Value Retail Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s fair value by projecting its expected future cash flows and then discounting them back to today’s value. This approach gives investors a way to judge whether the stock price offers good value based on the business’s real cash-generating potential.

For B&M European Value Retail, the DCF uses the 2 Stage Free Cash Flow to Equity approach. The company generated £551.1 Million in Free Cash Flow over the last twelve months, and analysts project steady growth over the next few years. By 2030, forecasts suggest annual Free Cash Flow could reach £340.5 Million, with projections for the next 10 years drawing on both analyst estimates for the initial years and longer-term extrapolations beyond 2028.

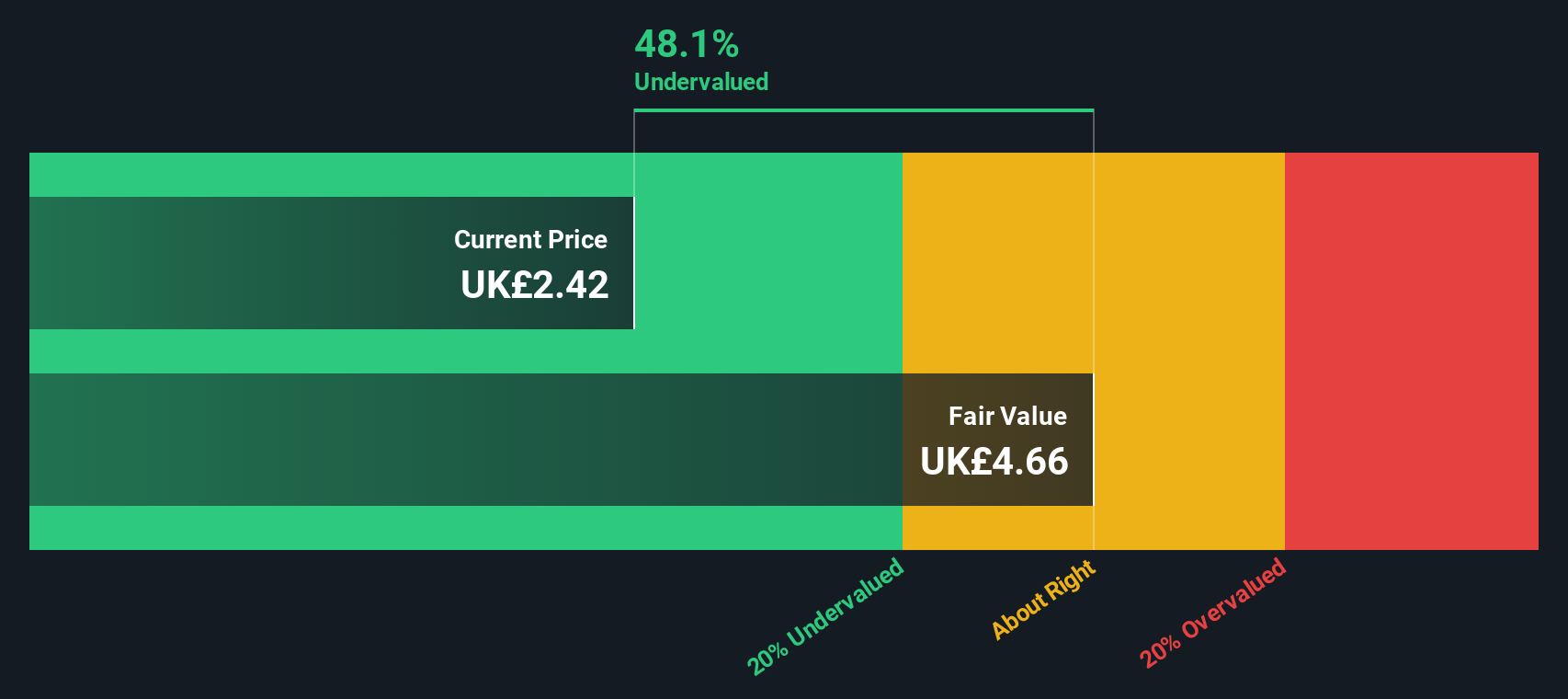

The resulting intrinsic value for B&M shares is estimated at £3.59 based on this DCF. With the share price recently well below that level, the model indicates the stock is trading at a 53.3% discount to its fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests B&M European Value Retail is undervalued by 53.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: B&M European Value Retail Price vs Earnings

The Price-to-Earnings (PE) ratio is a key valuation metric for profitable companies like B&M European Value Retail because it directly compares a company’s share price to its earnings per share. This makes it easy for investors to gauge value against profits generated. For businesses that consistently turn a profit, the PE ratio gives quick insight into how much the market is willing to pay for each pound of earnings today.

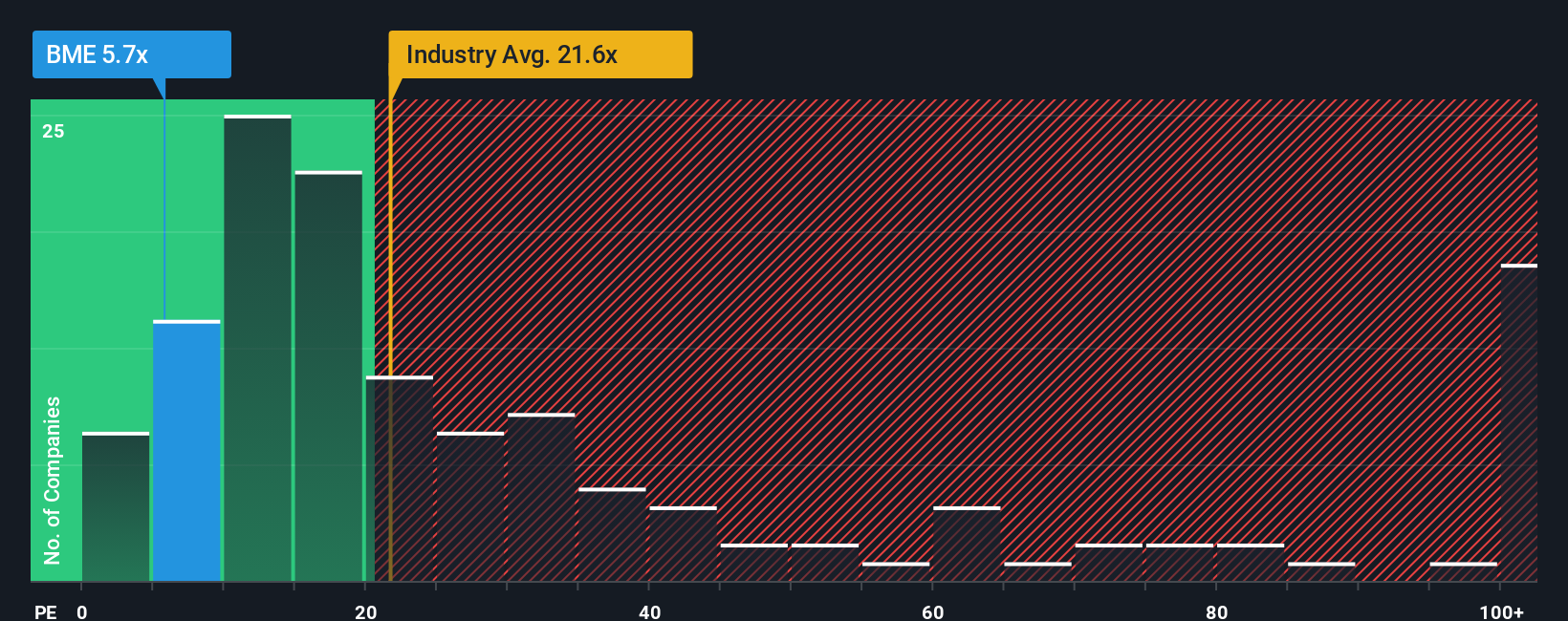

What counts as a “fair” PE ratio depends on growth prospects and perceived risk. Companies with strong earnings growth typically deserve a higher PE, while those facing uncertainty or sector headwinds tend to trade on lower multiples. B&M’s current PE ratio is 5.3x, which is far below both its industry average of 21.7x and its main peers at 13.4x. At first glance, these numbers suggest a meaningful discount.

However, rather than comparing only with sector averages, Simply Wall St’s “Fair Ratio” takes a more nuanced approach. This proprietary metric incorporates B&M’s specific earnings growth outlook, profit margins, risk profile, industry trends, and market cap. It provides a more accurate reflection of what the company’s PE “should” be, based on fundamentals rather than just broad comparisons. For B&M, the Fair Ratio lands at 13.5x. With the actual PE at 5.3x, the stock trades well below what this tailored analysis would suggest is fair value.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your B&M European Value Retail Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives, a smarter and more dynamic framework to connect a company’s story to the numbers behind its fair value.

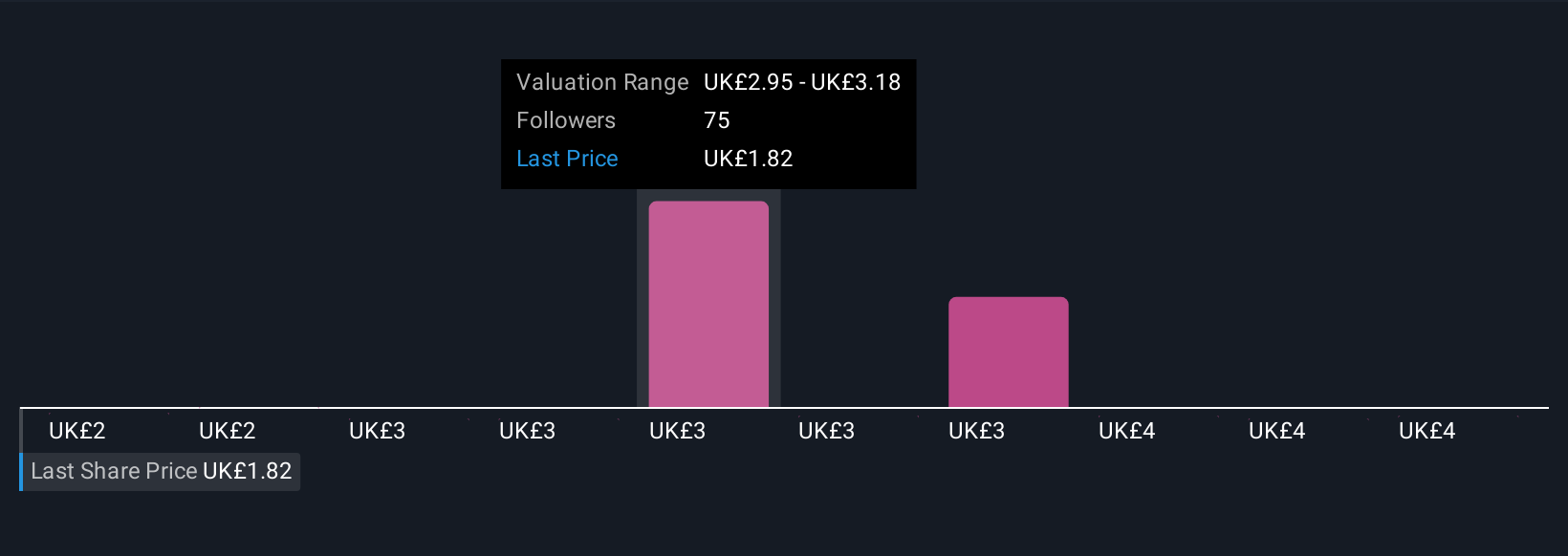

A Narrative is your personalized perspective about a company, linking what you believe about its future (such as growth drivers, challenges and trends) directly to financial forecasts and an estimate of fair value. Rather than relying only on static ratios or consensus estimates, Narratives let you anchor your investment decisions to your own assumptions about revenue, earnings and margins, tailored to real-world events.

Narratives are easy to create and update right on Simply Wall St’s Community page, a tool used by millions of investors, where you can test and share your view on a stock’s outlook. This approach empowers you to decide when to buy or sell by directly comparing your Narrative's Fair Value with today’s price. Plus, as fresh news or results arrive, Narratives can be updated in real-time, ensuring your perspective is always relevant and grounded in the latest facts.

For B&M European Value Retail, one investor might see “Everyday Low Prices and Expansion will boost revenue and drive the stock towards the bull case of £6.00,” while another might highlight risks like “Rising costs and slower growth support a much lower target of £2.07.”

Do you think there's more to the story for B&M European Value Retail? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if B&M European Value Retail might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BME

B&M European Value Retail

B&M European Value Retail S.A. retails general merchandise products and groceries.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)