- United Kingdom

- /

- Media

- /

- LSE:FOUR

3 UK Dividend Stocks Yielding Up To 9.8%

Reviewed by Simply Wall St

The United Kingdom market has climbed 1.1% in the last 7 days and is up 6.9% over the past 12 months, with earnings expected to grow by 14% per annum over the next few years. In this favorable environment, identifying dividend stocks that offer strong yields can be a prudent strategy for income-focused investors.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.73% | ★★★★★★ |

| Shoe Zone (AIM:SHOE) | 9.80% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.33% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.11% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.88% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.48% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.69% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.33% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.98% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.36% | ★★★★★☆ |

Click here to see the full list of 61 stocks from our Top UK Dividend Stocks screener.

We'll examine a selection from our screener results.

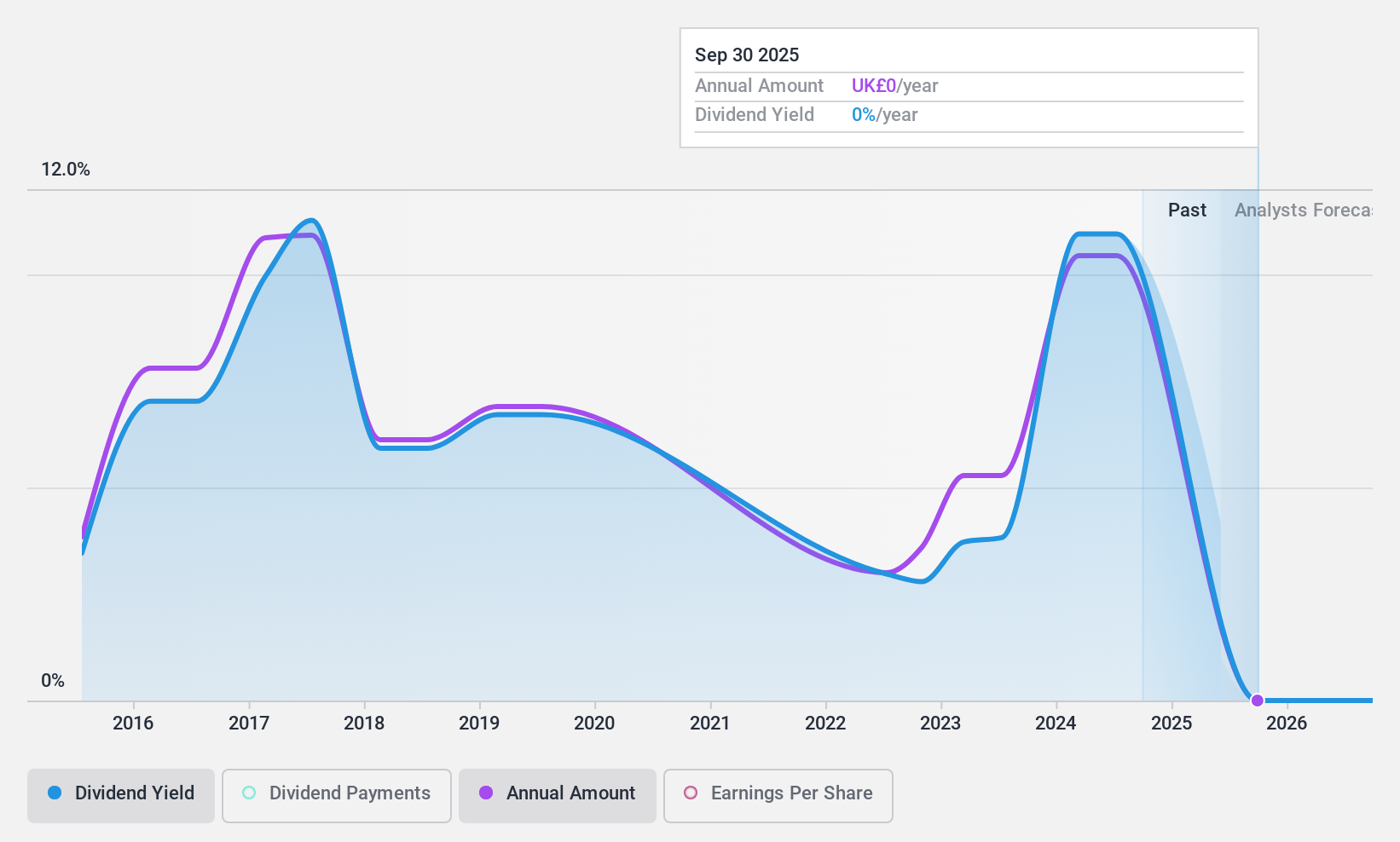

Shoe Zone (AIM:SHOE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shoe Zone plc operates as a footwear retailer in the United Kingdom, with a market cap of £82.05 million.

Operations: Shoe Zone plc generates £166.74 million in revenue from its footwear retail operations in the United Kingdom.

Dividend Yield: 9.8%

Shoe Zone's dividend payments are well covered by both earnings (35.8% payout ratio) and cash flows (30% cash payout ratio). Despite a volatile dividend track record over the past 10 years, recent growth in earnings by 50.2% and a high yield of 9.8%, placing it in the top 25% of UK dividend payers, make it attractive. However, future earnings are forecast to decline by an average of 37.2% per year for the next three years, raising concerns about sustainability.

- Dive into the specifics of Shoe Zone here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Shoe Zone shares in the market.

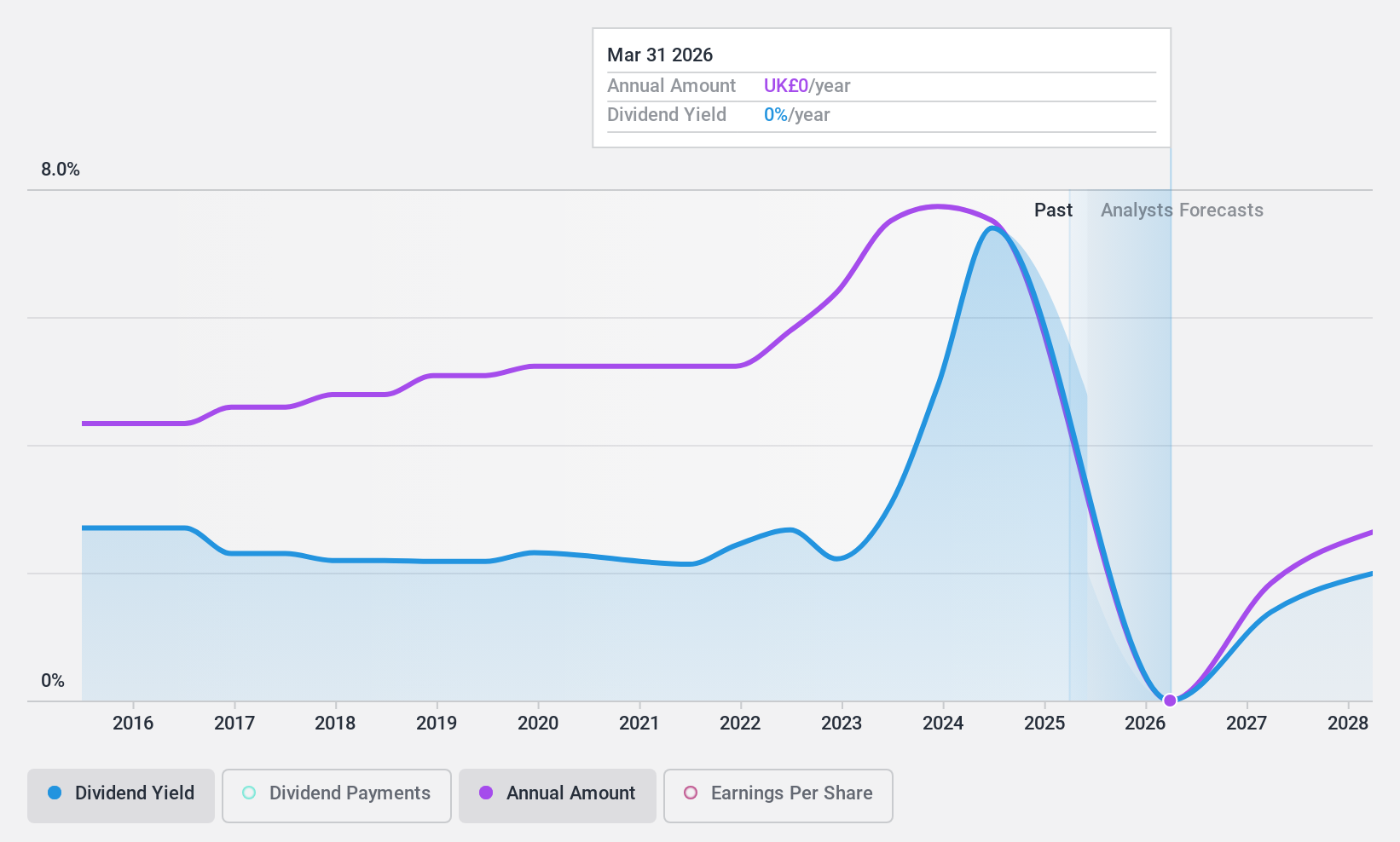

Burberry Group (LSE:BRBY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Burberry Group plc, with a market cap of £2.23 billion, manufactures, retails, and wholesales luxury goods under the Burberry brand through its subsidiaries.

Operations: Burberry Group plc generates its revenue primarily through Retail/Wholesale (£2.91 billion) and Licensing (£63 million).

Dividend Yield: 9.7%

Burberry Group's dividend yield of 9.74% ranks in the top 25% of UK dividend payers. However, its dividends have been volatile over the past decade, with significant annual drops exceeding 20%. Despite this, the current payout ratios—82.5% for earnings and 73% for cash flows—indicate coverage by both metrics. Recent financials show a decline in retail revenue to £458 million from £589 million last year and forecasted operating losses for H1 FY2025.

- Click to explore a detailed breakdown of our findings in Burberry Group's dividend report.

- Upon reviewing our latest valuation report, Burberry Group's share price might be too pessimistic.

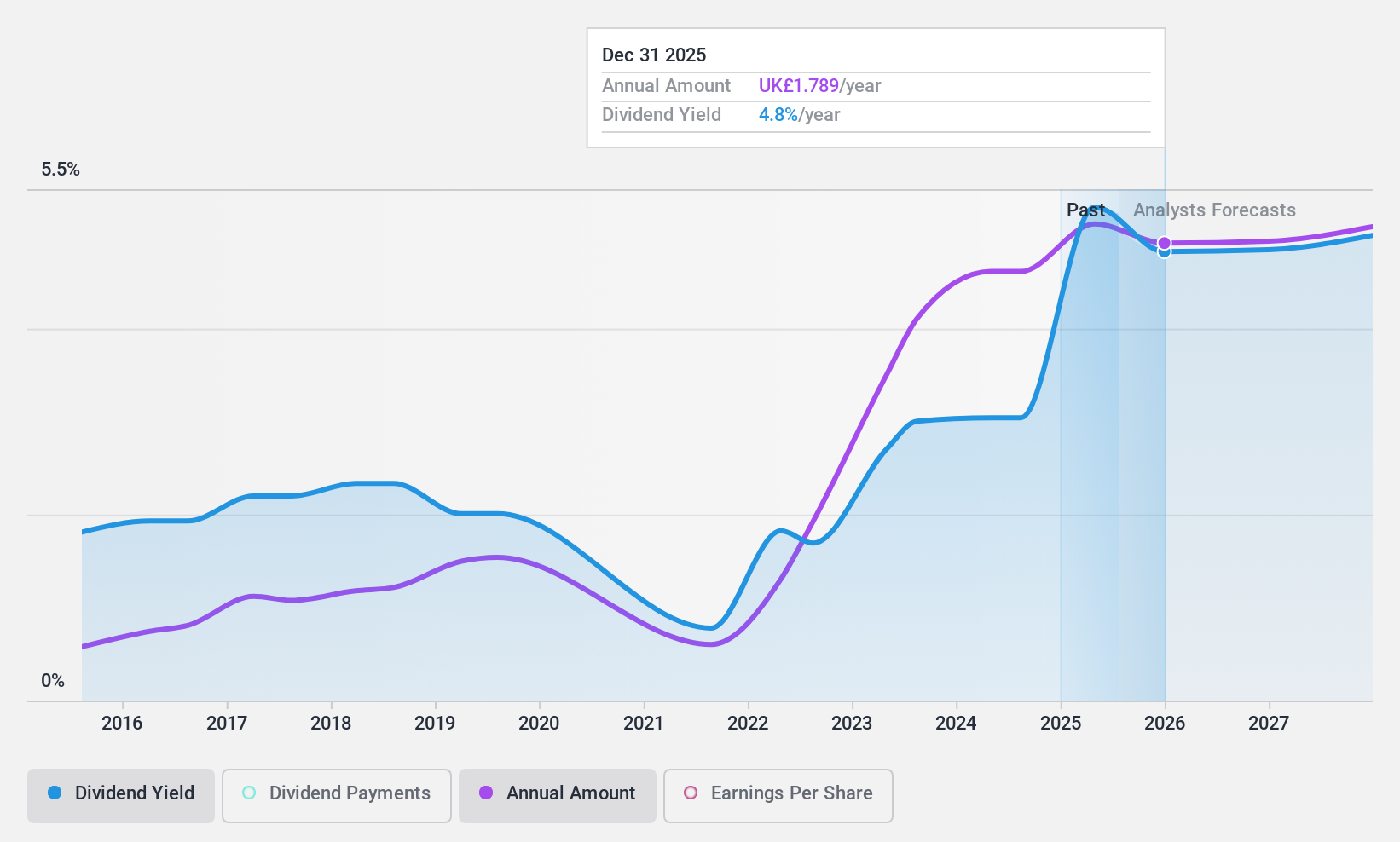

4imprint Group (LSE:FOUR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: 4imprint Group plc, with a market cap of £1.47 billion, operates as a direct marketer of promotional products in North America, the United Kingdom, and Ireland.

Operations: The company's revenue segments include $1.33 billion from North America and $25 million from the United Kingdom and Ireland.

Dividend Yield: 3.1%

4imprint Group has shown consistent growth, with recent half-year sales rising to US$667.5 million and net income increasing to US$54.7 million. The company declared an interim dividend of 62.7 pence, up from 50.8 pence last year, reflecting a 23% increase. Dividends have been stable and growing over the past decade, with a current yield of 3.11%. Payout ratios are sustainable at 58.1% for earnings and 56.4% for cash flows.

- Take a closer look at 4imprint Group's potential here in our dividend report.

- Our expertly prepared valuation report 4imprint Group implies its share price may be lower than expected.

Seize The Opportunity

- Investigate our full lineup of 61 Top UK Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:FOUR

4imprint Group

Operates as a direct marketer of promotional products in North America, the United Kingdom, and Ireland.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives