- United Kingdom

- /

- Diversified Financial

- /

- AIM:TIME

Discover 3 UK Penny Stocks With Market Caps Over £40M

Reviewed by Simply Wall St

The UK market has been experiencing some turbulence, with the FTSE 100 index recently closing lower following weak trade data from China, highlighting ongoing global economic challenges. In such a climate, investors often seek opportunities in less conventional areas like penny stocks—companies that may be smaller or newer but can provide unique value propositions. Despite their historical reputation as speculative investments, certain penny stocks with strong financials and growth potential continue to attract attention for their ability to offer both stability and opportunity in uncertain times.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.84 | £552.59M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.16 | £174.5M | ✅ 4 ⚠️ 2 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.40 | £116.23M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.915 | £13.81M | ✅ 2 ⚠️ 3 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.17 | £16.1M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.25 | £28.55M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.55 | $319.73M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.50 | £253.36M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.42 | £68.59M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.13 | £180.35M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 292 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Gear4music (Holdings) (AIM:G4M)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Gear4music (Holdings) plc is a retailer of musical instruments, musician equipment, and audio-visual equipment operating in the United Kingdom, Europe, and internationally with a market cap of £67.55 million.

Operations: The company generates revenue of £146.72 million from the sale of musical instruments and equipment.

Market Cap: £67.55M

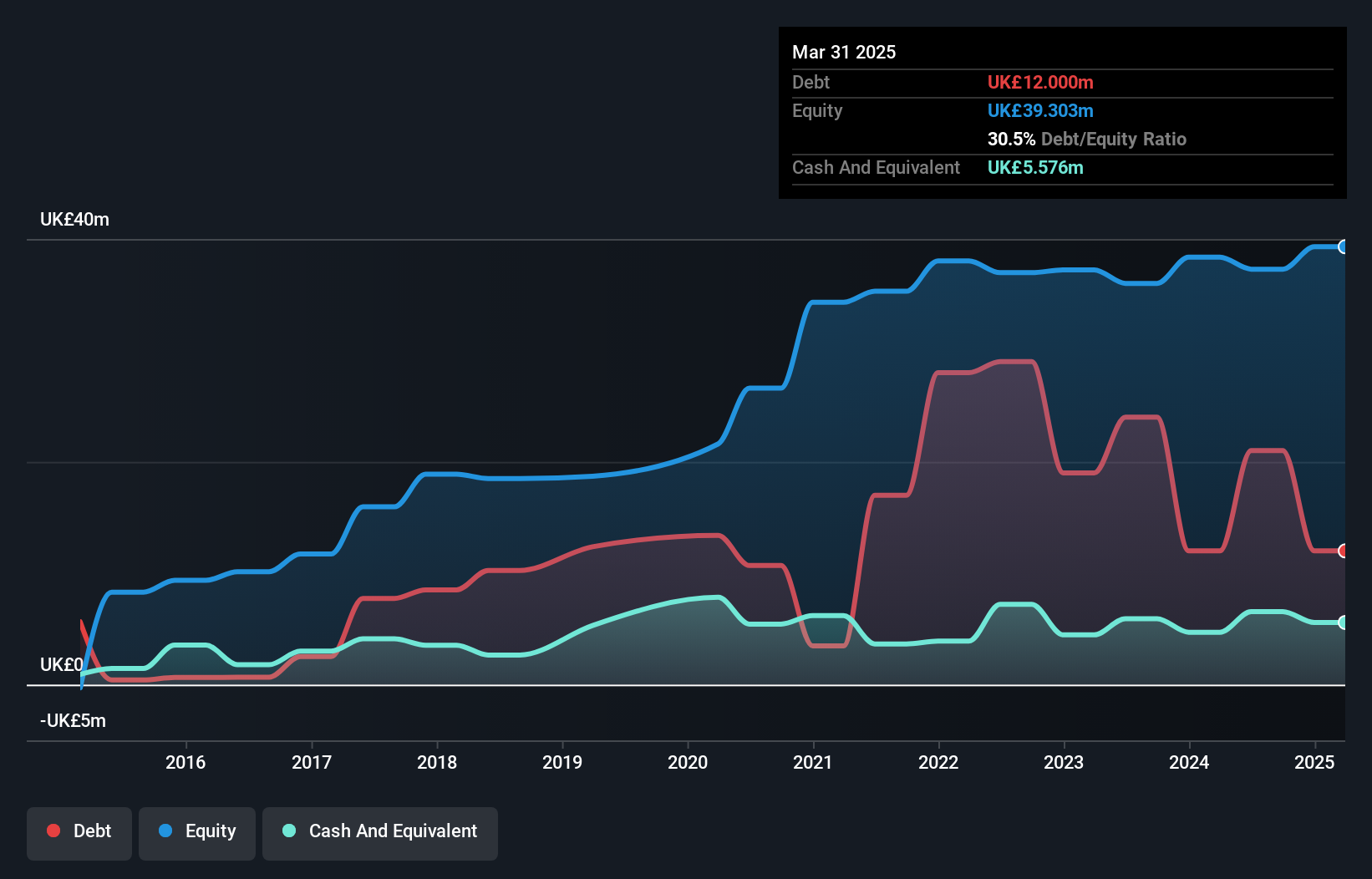

Gear4music (Holdings) plc has demonstrated stable weekly volatility over the past year and improved net profit margins, albeit slightly. The board of directors is experienced with an average tenure of 8.8 years, contributing to a steady governance structure. The company has strengthened its financial position by reducing its debt-to-equity ratio from 62% to 30.5% over five years, with short-term assets exceeding liabilities. Recent revenue growth is notable, with a reported £80.7 million for six months ending September 2025 compared to £61.7 million last year, reflecting strong performance despite low return on equity and interest coverage challenges.

- Get an in-depth perspective on Gear4music (Holdings)'s performance by reading our balance sheet health report here.

- Gain insights into Gear4music (Holdings)'s future direction by reviewing our growth report.

Time Finance (AIM:TIME)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Time Finance plc, along with its subsidiaries, offers financial products and services to consumers and businesses in the United Kingdom, with a market cap of £49.51 million.

Operations: The company generates revenue through its Asset Finance segment, which accounts for £20.94 million, and its Invoice Finance segment, contributing £15.77 million.

Market Cap: £49.51M

Time Finance plc has demonstrated robust financial health, with short-term assets of £200.3 million surpassing both its long-term liabilities (£73.5 million) and short-term liabilities (£85.1 million). The company reported a revenue increase to £37.12 million for the year ending May 31, 2025, alongside improved net income of £5.86 million and higher profit margins at 15.8%. Despite a relatively new management team, Time Finance benefits from an experienced board and shows strong earnings growth compared to the industry average. Its debt is well-covered by operating cash flow, enhancing its financial stability in the penny stock market segment.

- Take a closer look at Time Finance's potential here in our financial health report.

- Evaluate Time Finance's prospects by accessing our earnings growth report.

Castings (LSE:CGS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Castings P.L.C. is involved in iron casting and machining operations across the UK, Europe, the Americas, and internationally, with a market cap of £110.82 million.

Operations: The company's revenue is generated from two main segments: Foundry Operations, contributing £197.94 million, and Machining Operations, adding £32.13 million.

Market Cap: £110.82M

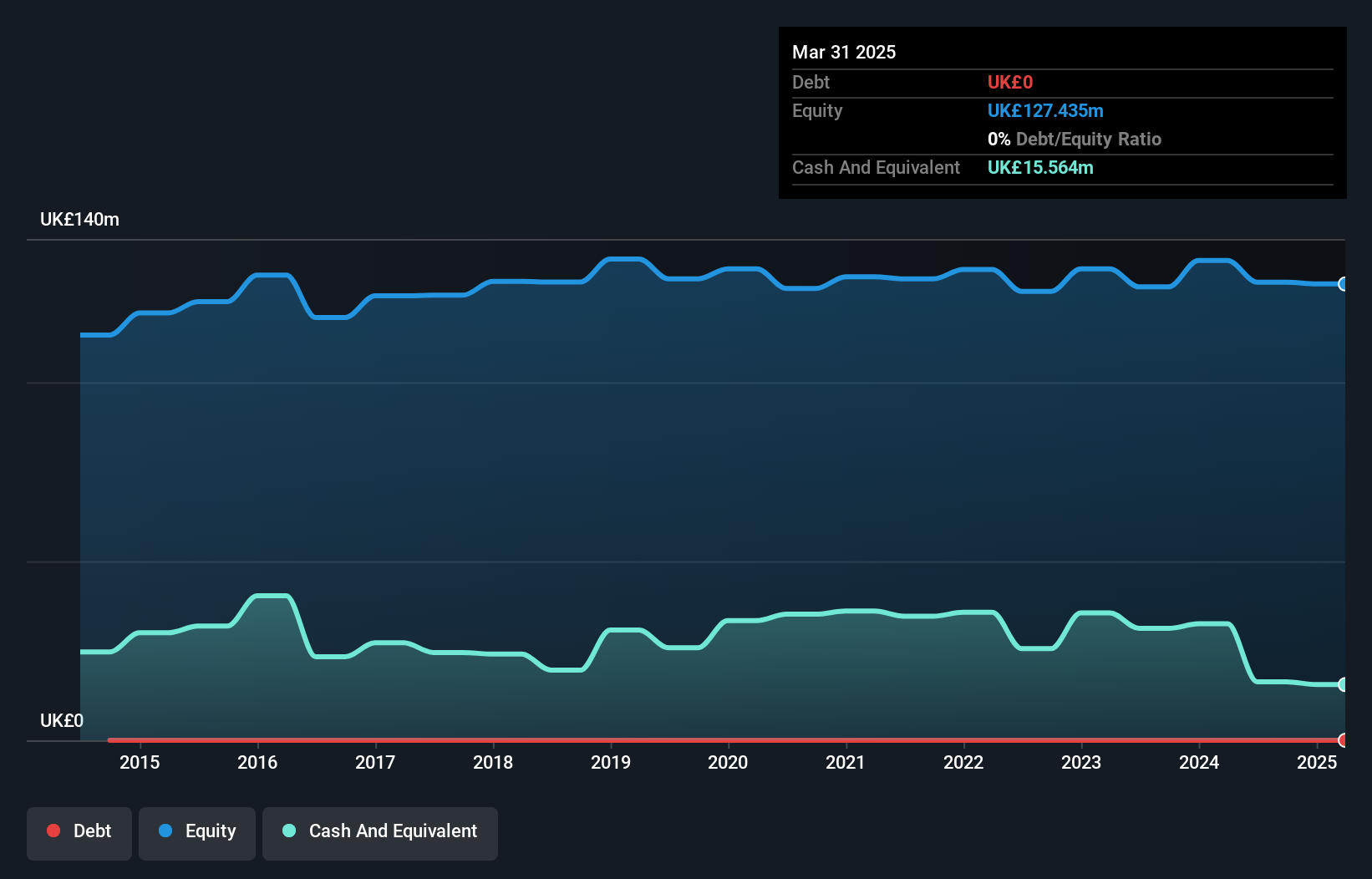

Castings P.L.C. presents a mixed picture in the penny stock segment, with stable weekly volatility and a debt-free balance sheet enhancing its financial stability. The company reported sales of £87.56 million for the half year ended September 30, 2025, with net income rising to £3.73 million from the previous year. However, profit margins have decreased to 2.4% from 7.5%, and earnings growth has been negative over the past year at -75%. Despite these challenges, Castings maintains strong short-term asset coverage over liabilities and continues to pay dividends consistently at an interim rate of 4.21 pence per share.

- Click to explore a detailed breakdown of our findings in Castings' financial health report.

- Explore Castings' analyst forecasts in our growth report.

Make It Happen

- Take a closer look at our UK Penny Stocks list of 292 companies by clicking here.

- Curious About Other Options? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Time Finance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TIME

Time Finance

Provides financial products and services to consumers and businesses in the United Kingdom.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives