- United Kingdom

- /

- Specialty Stores

- /

- AIM:CMO

CMO Group PLC's (LON:CMO) Stock Retreats 39% But Revenues Haven't Escaped The Attention Of Investors

CMO Group PLC (LON:CMO) shareholders that were waiting for something to happen have been dealt a blow with a 39% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 23% in that time.

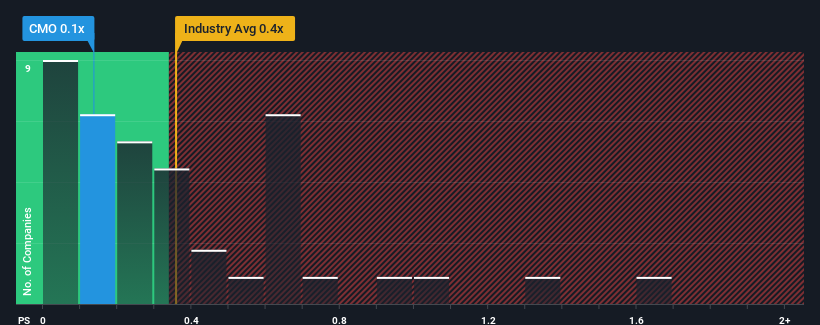

Although its price has dipped substantially, there still wouldn't be many who think CMO Group's price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S in the United Kingdom's Specialty Retail industry is similar at about 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for CMO Group

What Does CMO Group's Recent Performance Look Like?

CMO Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think CMO Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For CMO Group?

There's an inherent assumption that a company should be matching the industry for P/S ratios like CMO Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's top line. Even so, admirably revenue has lifted 37% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 2.3% as estimated by the only analyst watching the company. That's shaping up to be similar to the 3.5% growth forecast for the broader industry.

With this in mind, it makes sense that CMO Group's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From CMO Group's P/S?

With its share price dropping off a cliff, the P/S for CMO Group looks to be in line with the rest of the Specialty Retail industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that CMO Group maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with CMO Group (at least 1 which is potentially serious), and understanding these should be part of your investment process.

If you're unsure about the strength of CMO Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CMO

CMO Group

Engages in the online retailing of building materials and supplies in the United Kingdom.

Good value with adequate balance sheet.

Market Insights

Community Narratives