- United Kingdom

- /

- Office REITs

- /

- LSE:WKP

UK's Top Undervalued Small Caps With Insider Action In January 2025

Reviewed by Simply Wall St

Amidst a challenging backdrop for the United Kingdom's market, with the FTSE 100 and FTSE 250 indices reflecting pressures from weak trade data out of China, small-cap stocks are drawing attention as potential pockets of opportunity. In such an environment, discerning investors often seek companies with strong fundamentals and insider activity as indicators of confidence in their resilience and growth potential.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| NCC Group | NA | 1.3x | 28.04% | ★★★★★★ |

| 4imprint Group | 15.6x | 1.3x | 39.53% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 33.44% | ★★★★★☆ |

| XPS Pensions Group | 11.2x | 3.2x | 6.54% | ★★★★☆☆ |

| Robert Walters | 36.3x | 0.2x | 27.72% | ★★★★☆☆ |

| Sabre Insurance Group | 11.3x | 1.5x | 12.78% | ★★★★☆☆ |

| iomart Group | 24.2x | 0.6x | 33.77% | ★★★★☆☆ |

| Telecom Plus | 17.9x | 0.7x | 30.62% | ★★★☆☆☆ |

| Warpaint London | 24.2x | 4.2x | 0.73% | ★★★☆☆☆ |

| THG | NA | 0.3x | -514.81% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

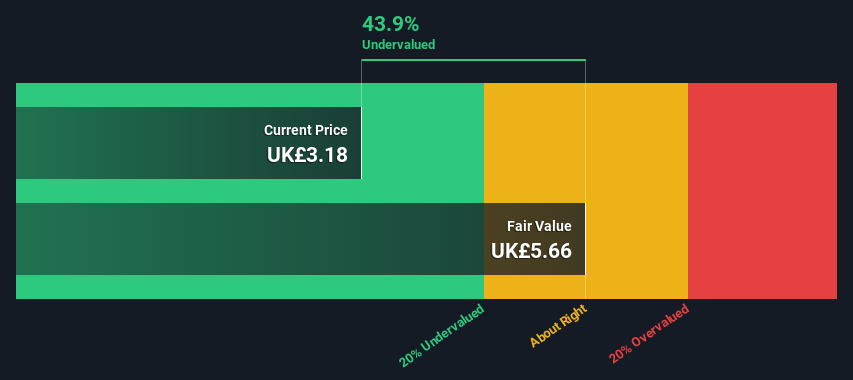

Coats Group (LSE:COA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Coats Group is a global industrial thread manufacturer with operations in apparel, footwear, and performance materials, boasting a market cap of approximately £1.07 billion.

Operations: The company's revenue primarily comes from its Apparel, Footwear, and Performance Materials segments. Over the observed periods, the net income margin shows fluctuations, with a notable increase to 6.90% by mid-2024. The cost of goods sold (COGS) significantly impacts gross profit margins, which reached 36.28% in mid-2024. Operating expenses are consistently driven by sales and marketing as well as general and administrative costs.

PE: 18.5x

Coats, a UK company with small market capitalization, has shown promising sales growth of 11% from July to October 2024, driven by Footwear and Apparel segments. Despite high debt levels and reliance on external borrowing, the company is forecasted to grow earnings by 15.79% annually. Recent insider confidence was demonstrated through share purchases in the past year. An executive transition will occur as Hannah Nichols steps in as CFO post-May 2025 AGM, potentially steering future financial strategies positively for Coats.

- Delve into the full analysis valuation report here for a deeper understanding of Coats Group.

Evaluate Coats Group's historical performance by accessing our past performance report.

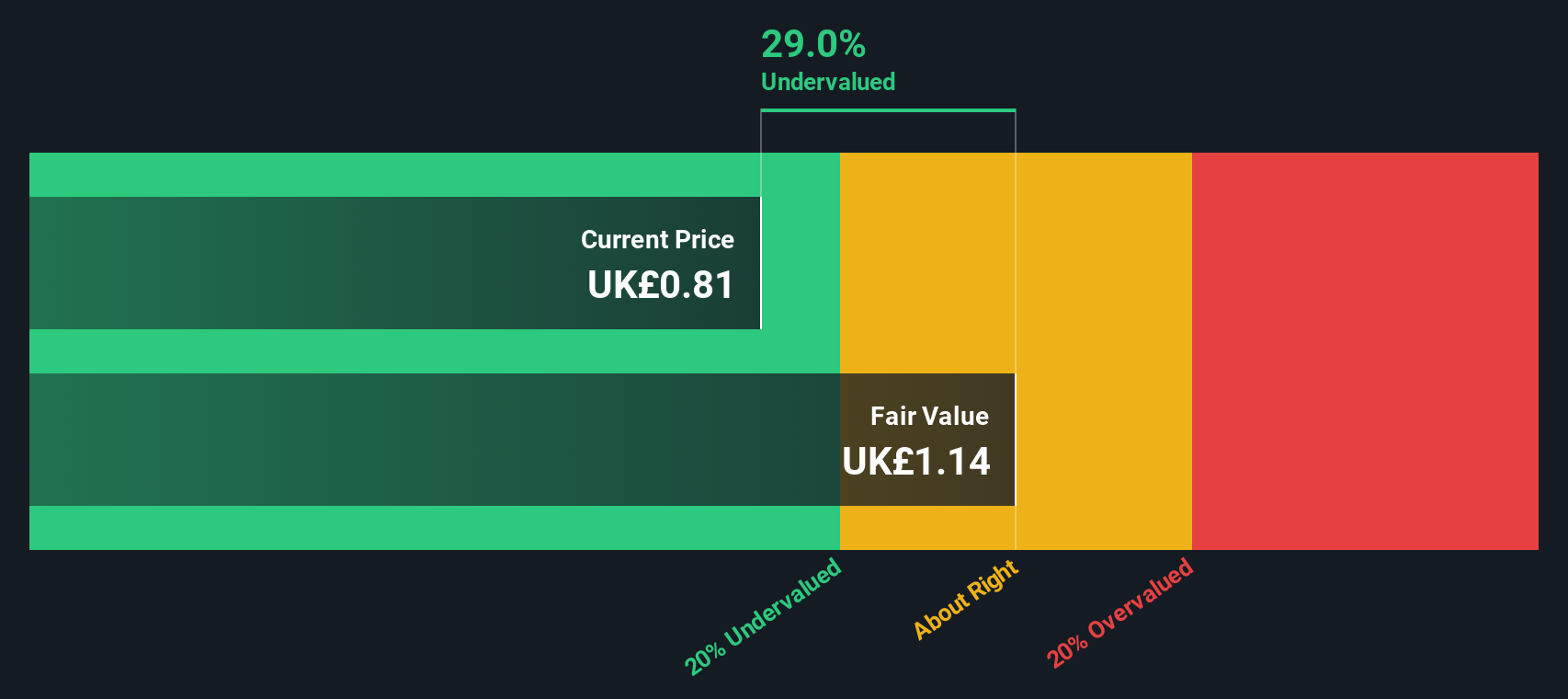

Workspace Group (LSE:WKP)

Simply Wall St Value Rating: ★★★★★★

Overview: Workspace Group is a company focused on providing business accommodation for rent, with a market capitalization of approximately £1.18 billion.

Operations: The primary revenue stream is derived from providing business accommodation for rent, with the latest reported revenue at £186 million. The gross profit margin has recently been recorded at 67.58%. Operating expenses and non-operating expenses have significantly impacted net income, which was last noted as a loss of £34.4 million.

PE: -26.7x

Workspace Group, a key player in the UK market, has shown signs of being undervalued. They reported a net income of £10.2 million for the half-year ending September 2024, bouncing back from a significant loss last year. This turnaround is complemented by insider confidence through share purchases over recent months. Workspace's commitment to sustainability is evident with Leroy House, their first fully net-zero building, reflecting an innovative approach that appeals to London's SMEs and supports future growth prospects.

- Click here and access our complete valuation analysis report to understand the dynamics of Workspace Group.

Explore historical data to track Workspace Group's performance over time in our Past section.

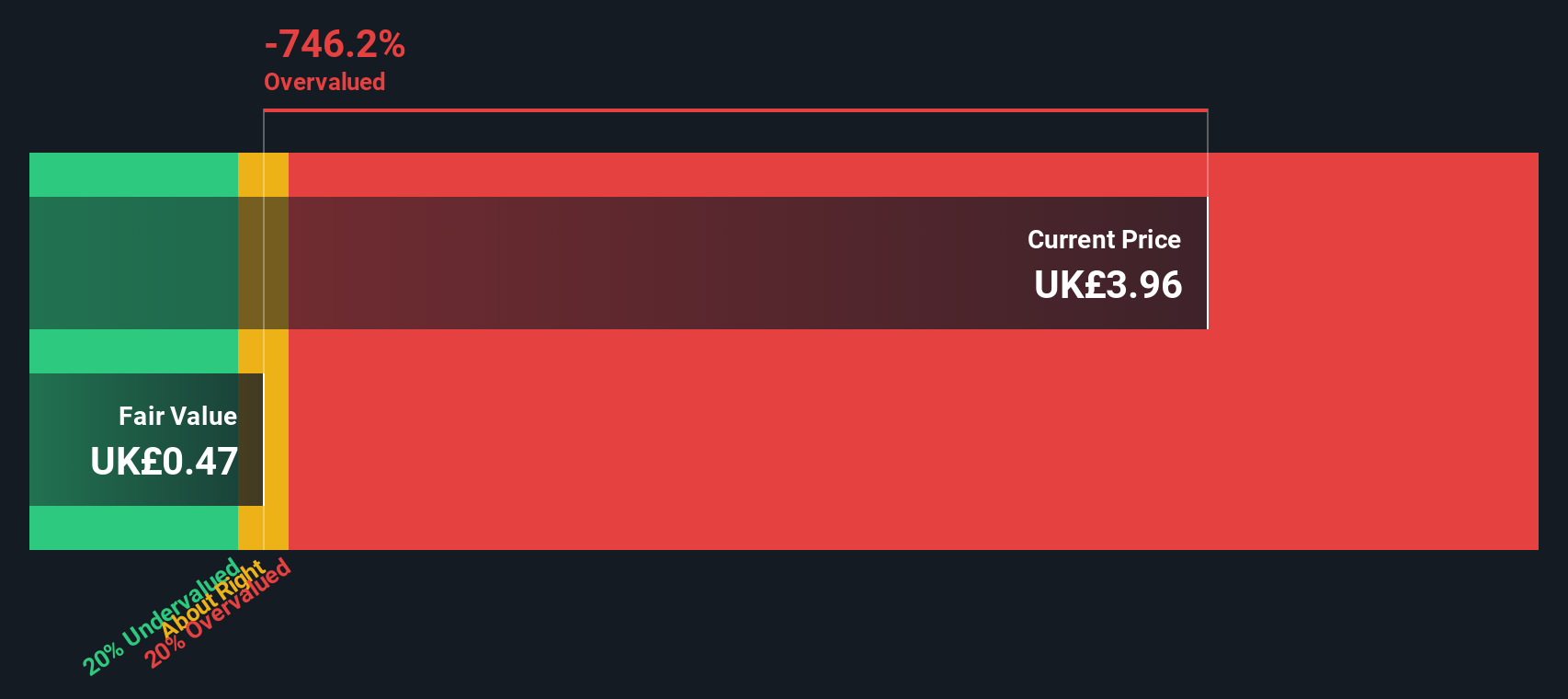

Zigup (LSE:ZIG)

Simply Wall St Value Rating: ★★★★★★

Overview: Zigup operates in the rental and claims services sectors, with a market capitalization of £2.45 billion.

Operations: Zigup generates revenue primarily from UK&I Rental (£575.33 million), Spain Rental (£360.69 million), and Claims & Services (£953.98 million). The company's gross profit margin showed a notable fluctuation, peaking at 29.54% in October 2022 before declining to 21.99% by January 2025, indicating variability in cost management and pricing strategies over time.

PE: 7.4x

Zigup, a UK-based company, has seen its profit margins decline to 5.1% from 7.7% last year, with net income dropping to £43.42 million for the half-year ending October 2024 compared to £74.56 million previously. Despite this, sales increased slightly to £338.21 million from £322.89 million a year ago. The company's financial position is challenged by reliance on external borrowing without customer deposits as funding sources; however, insider confidence remains high with recent share purchases indicating potential optimism about future growth prospects amidst ongoing dividend increases and revenue forecasts of 5% annual growth.

- Click here to discover the nuances of Zigup with our detailed analytical valuation report.

Review our historical performance report to gain insights into Zigup's's past performance.

Where To Now?

- Unlock more gems! Our Undervalued UK Small Caps With Insider Buying screener has unearthed 37 more companies for you to explore.Click here to unveil our expertly curated list of 40 Undervalued UK Small Caps With Insider Buying.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Workspace Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:WKP

Workspace Group

Workspace is London’s leading owner and operator of flexible workspace, currently managing 4.3 million sq.

Established dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives