- United Kingdom

- /

- Consumer Durables

- /

- AIM:CHH

UK Dividend Stocks To Watch In July 2025

Reviewed by Simply Wall St

As the FTSE 100 index faces pressure from weak trade data out of China, concerns about global economic recovery continue to influence market sentiment in the United Kingdom. In this environment, dividend stocks can offer a measure of stability and income potential for investors seeking to navigate uncertain times.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 7.52% | ★★★★★★ |

| Treatt (LSE:TET) | 3.25% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 4.96% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 6.49% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.75% | ★★★★★☆ |

| Man Group (LSE:EMG) | 7.27% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.41% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.63% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.61% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.77% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top UK Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Churchill China (AIM:CHH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Churchill China plc manufactures and sells ceramic and related products across the UK, Europe, the US, and internationally, with a market cap of £74.24 million.

Operations: Churchill China plc generates revenue primarily from its Ceramics segment, amounting to £71.10 million, and its Materials segment, contributing £13.06 million.

Dividend Yield: 5.6%

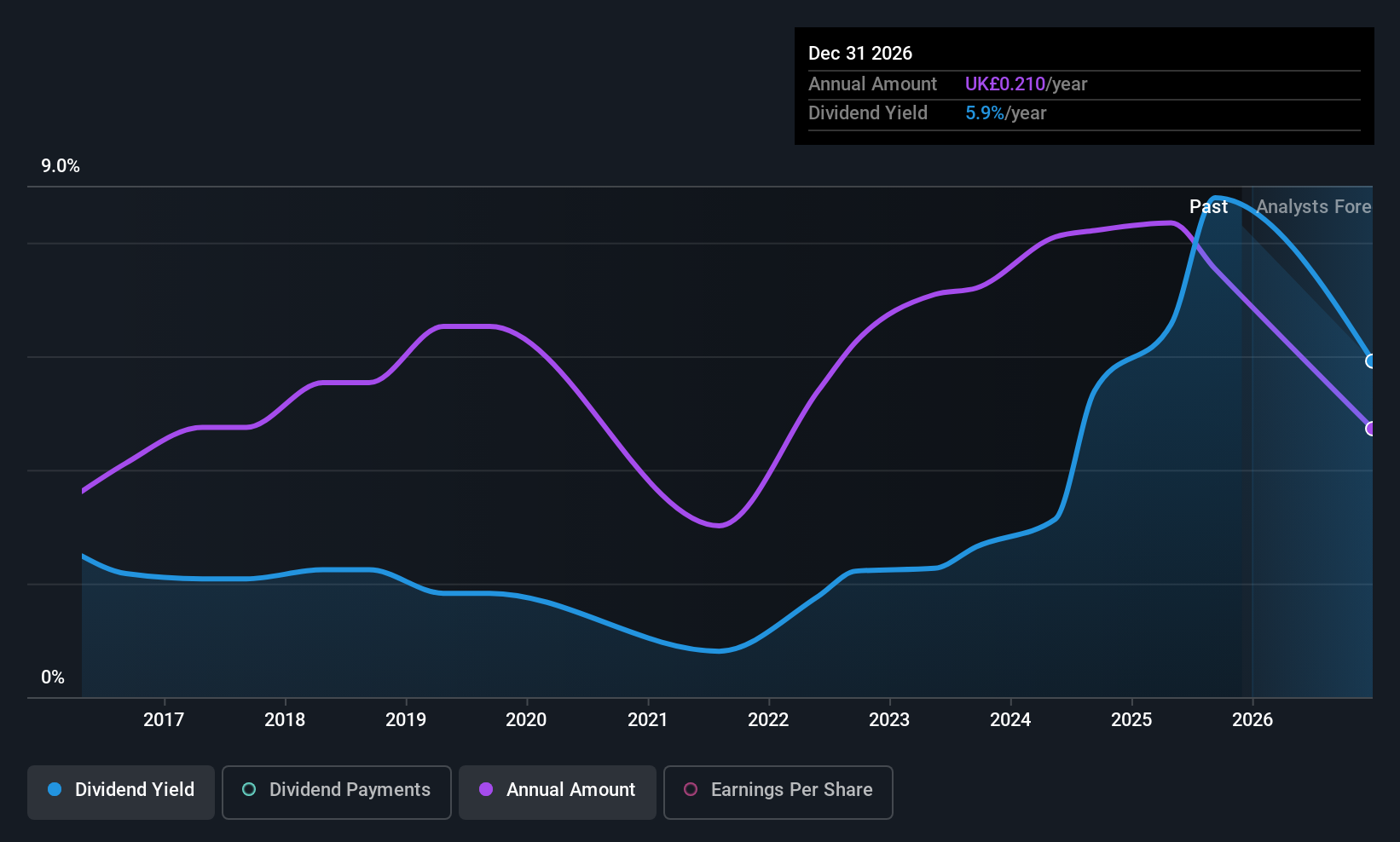

Churchill China recently proposed a final dividend of 26.5 pence per share, despite a decline in profitability with sales and net income decreasing from the previous year. The dividend yield of 5.63% places it among the top UK payers, yet its high cash payout ratio suggests dividends are not well covered by cash flows, raising sustainability concerns. While dividends have increased over the past decade, their volatility and lack of reliable growth highlight potential risks for investors seeking stable income streams.

- Navigate through the intricacies of Churchill China with our comprehensive dividend report here.

- According our valuation report, there's an indication that Churchill China's share price might be on the cheaper side.

Drax Group (LSE:DRX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Drax Group plc, along with its subsidiaries, focuses on renewable power generation in the United Kingdom and has a market capitalization of £2.41 billion.

Operations: Drax Group's revenue is primarily derived from its Biomass Generation (£4.92 billion), Energy Solutions (£3.79 billion), Pellet Production (£942.10 million), and Flexible Generation (£222.80 million) segments in the United Kingdom.

Dividend Yield: 3.8%

Drax Group's recent approval of a 15.6 pence per share dividend shows commitment to shareholder returns, supported by a low payout ratio of 18.9%, indicating strong earnings and cash flow coverage. However, its dividend yield of 3.78% is below the top UK payers, and historical volatility raises concerns about reliability for income-focused investors. Despite trading at a significant discount to estimated fair value, insider selling and forecasted earnings decline may pose challenges for future stability.

- Dive into the specifics of Drax Group here with our thorough dividend report.

- Upon reviewing our latest valuation report, Drax Group's share price might be too pessimistic.

Unite Group (LSE:UTG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Unite Group PLC owns, manages, and develops purpose-built student accommodation facilities for the higher education sector in the United Kingdom, with a market cap of £4.17 billion.

Operations: Unite Group PLC generates revenue of £299.30 million from its operations segment, focusing on purpose-built student accommodation for higher education in the UK.

Dividend Yield: 4.4%

Unite Group's dividend payments have been volatile over the past decade, though they are currently covered by both earnings and cash flows, with payout ratios of 57.4% and 87.4% respectively. The dividend yield of 4.38% is lower than the UK market's top payers, raising questions about its attractiveness for income investors. Recent developments include a joint venture with Manchester Metropolitan University to develop new student accommodation, potentially impacting future financial stability and growth prospects positively.

- Click here to discover the nuances of Unite Group with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Unite Group shares in the market.

Make It Happen

- Embark on your investment journey to our 58 Top UK Dividend Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CHH

Churchill China

Manufactures and sells ceramic and related products in the United Kingdom, rest of Europe, the United States, and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.