- United Kingdom

- /

- Residential REITs

- /

- LSE:SOHO

European Small Caps With Insider Action: 3 Undervalued Picks to Watch

Reviewed by Simply Wall St

As European markets experience a positive shift, with the STOXX Europe 600 Index rising by 2.77% amid easing trade tensions and stable economic indicators, small-cap stocks are drawing attention from investors looking for growth opportunities. In this environment, identifying promising small-cap stocks involves focusing on companies that demonstrate resilience and potential for expansion despite broader market challenges.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 10.8x | 0.5x | 41.94% | ★★★★★★ |

| Tristel | 28.0x | 3.9x | 25.84% | ★★★★★★ |

| J D Wetherspoon | 12.2x | 0.4x | 31.27% | ★★★★★☆ |

| Eastnine | 17.2x | 8.3x | 42.27% | ★★★★★☆ |

| Savills | 23.5x | 0.5x | 43.67% | ★★★★☆☆ |

| Norcros | 24.5x | 0.6x | 27.32% | ★★★☆☆☆ |

| FRP Advisory Group | 12.8x | 2.3x | 13.49% | ★★★☆☆☆ |

| Italmobiliare | 11.1x | 1.5x | -264.08% | ★★★☆☆☆ |

| Speedy Hire | NA | 0.2x | -9.12% | ★★★☆☆☆ |

| Arendals Fossekompani | NA | 1.6x | 42.74% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

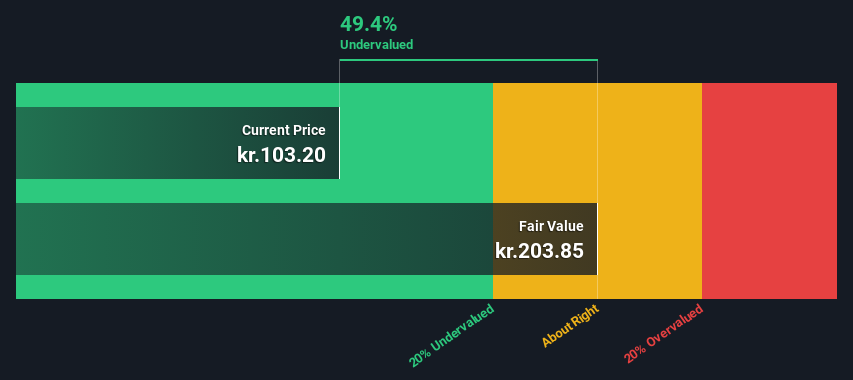

DFDS (CPSE:DFDS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: DFDS operates a comprehensive ferry and logistics network, with a market capitalization of approximately DKK 27.32 billion.

Operations: The company generates revenue primarily from its Ferry and Logistics divisions, with the Ferry Division contributing DKK 17.86 billion and the Logistics Division adding DKK 13.35 billion. Over recent periods, there has been a notable trend in gross profit margin, peaking at 26.08% in Q4 2019 before declining to 19.71% by Q4 2024.

PE: 9.5x

DFDS, a European transport and logistics company, has seen its net profit margin decrease from 5.6% to 1.8% over the past year, while sales increased to DKK 29.75 billion from DKK 27.30 billion. Despite lower earnings per share (DKK 9.68) and no dividend for the last financial year, insider confidence is highlighted by executive purchases in early February 2025. The company's restructuring efforts aim to enhance asset utilization and volume growth amid challenging market conditions, with projected revenue growth of around 5% for the year ahead.

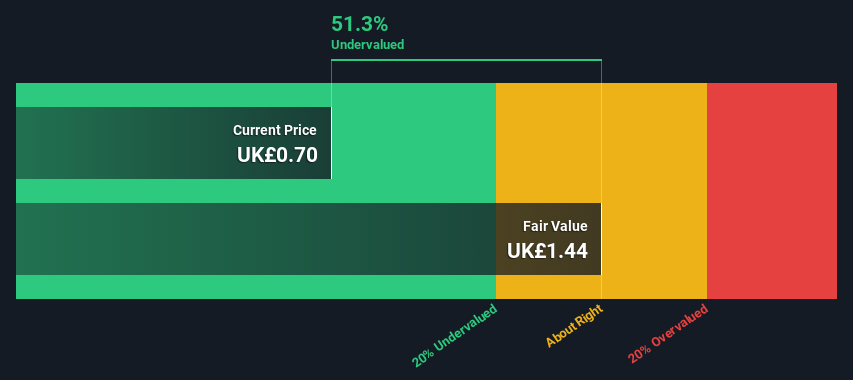

Social Housing REIT (LSE:SOHO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Social Housing REIT focuses on investing in residential properties for social housing purposes, with a market cap of £0.25 billion.

Operations: The company's revenue primarily stems from its residential REIT segment, with a recent reported figure of £39.18 million. The gross profit margin has shown fluctuations, reaching 88.59% in March 2024 before declining to 80.06% by December 2024. Operating expenses and non-operating expenses have significantly impacted net income, leading to a negative net income margin of -92.88% as of the latest data point in December 2024.

PE: -7.9x

Social Housing REIT, a smaller player in the European market, faces challenges with its financial position as debt is not adequately covered by operating cash flow and relies solely on external borrowing. The company reported a net loss of £36.39 million for 2024, contrasting with a previous year's profit of £34.99 million, highlighting recent struggles. Despite these hurdles, insider confidence is evident as key figures have increased their share purchases over the past year, suggesting belief in future potential amidst current difficulties.

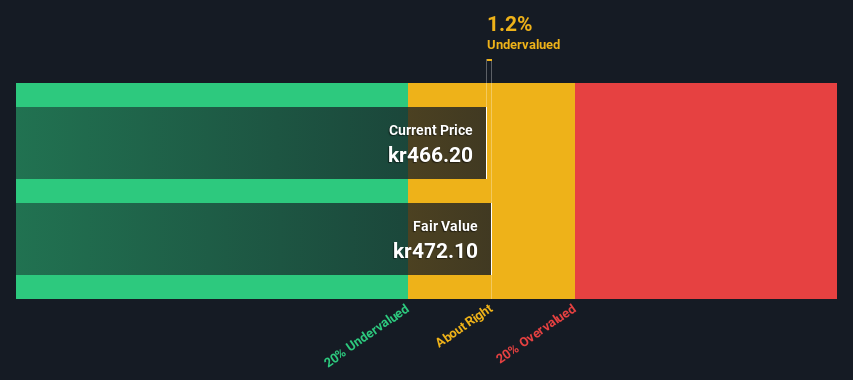

Vitec Software Group (OM:VIT B)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Vitec Software Group is a company specializing in the development and delivery of industry-specific software solutions, with a market cap of approximately SEK 18.77 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, with recent quarterly revenue reaching SEK 3.50 billion. The cost of goods sold (COGS) for the same period was SEK 1.85 billion, contributing to a gross profit margin of 47.21%. Operating expenses, including general and administrative costs, impact the net income margin which stands at 11.65%.

PE: 43.2x

Vitec Software Group, a European tech company, shows potential in the small cap sector with its steady financial performance. Despite high debt levels and reliance on external borrowing, the firm's earnings are projected to grow 17.78% annually. Recent first-quarter results revealed revenue of SEK 902 million, up from SEK 716 million last year. Insider confidence is evident with share purchases completed by December 2024. The company has increased dividends for the 23rd consecutive year, now at SEK 3.60 per share annually.

Key Takeaways

- Dive into all 67 of the Undervalued European Small Caps With Insider Buying we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Social Housing REIT, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SOHO

Social Housing REIT

Social Housing REIT plc (the "Company") is a Real Estate Investment Trust ("REIT") incorporated in England and Wales under the Companies Act 2006 as a public company limited by shares on 12 June 2017.

Good value average dividend payer.

Market Insights

Community Narratives