- United Kingdom

- /

- Real Estate

- /

- LSE:RAV

Would Shareholders Who Purchased Raven Property Group's (LON:RAV) Stock Year Be Happy With The Share price Today?

The simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do both better or worse than that. Investors in Raven Property Group Limited (LON:RAV) have tasted that bitter downside in the last year, as the share price dropped 44%. That contrasts poorly with the market decline of 8.7%. We note that it has not been easy for shareholders over three years, either; the share price is down 42% in that time. Furthermore, it's down 11% in about a quarter. That's not much fun for holders.

See our latest analysis for Raven Property Group

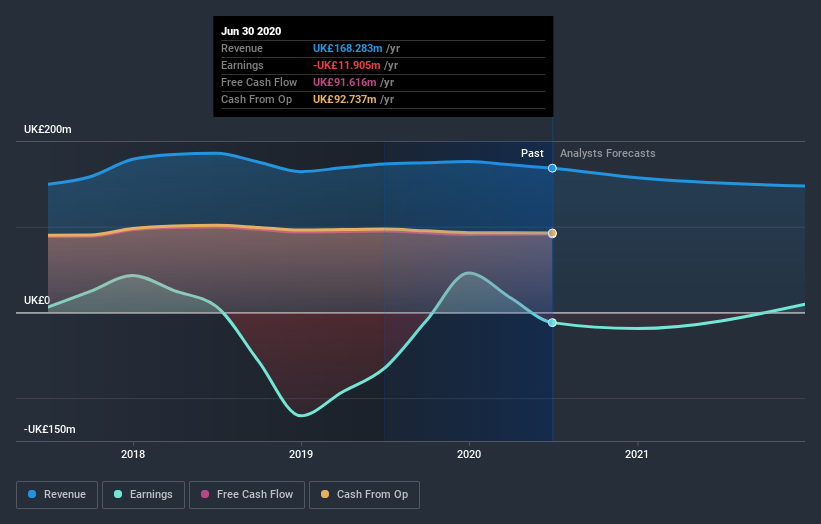

Raven Property Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Raven Property Group's revenue didn't grow at all in the last year. In fact, it fell 2.8%. That looks pretty grim, at a glance. Shareholders have seen the share price drop 44% in that time. What would you expect when revenue is falling, and it doesn't make a profit? It's hard to escape the conclusion that buyers must envision either growth down the track, cost cutting, or both.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Raven Property Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We regret to report that Raven Property Group shareholders are down 44% for the year. Unfortunately, that's worse than the broader market decline of 8.7%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Raven Property Group , and understanding them should be part of your investment process.

We will like Raven Property Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you decide to trade Raven Property Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About LSE:RAV

Raven Property Group

Raven was founded in 2005 to invest in class A warehouse complexes in Russia and lease to Russian and International tenants.

Undervalued with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success