- United Kingdom

- /

- Residential REITs

- /

- LSE:PRSR

Are Dividend Investors Getting More Than They Bargained For With The PRS REIT plc's (LON:PRSR) Dividend?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Today we'll take a closer look at The PRS REIT plc (LON:PRSR) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

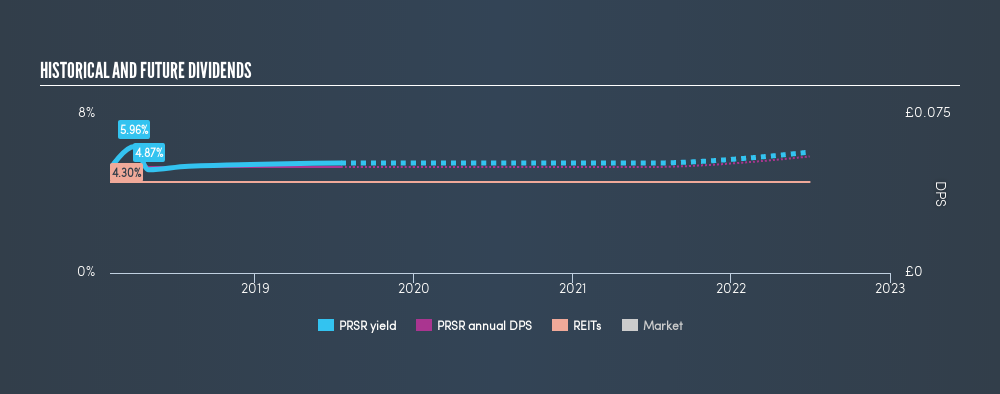

Some readers mightn't know much about PRS REIT's 5.2% dividend, as it has only been paying distributions for a year or so. Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Explore this interactive chart for our latest analysis on PRS REIT!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. PRS REIT paid out -578% of its profit as dividends, over the trailing twelve month period. When a company is loss-making, we next need to check to see if its cash flows can support the dividend.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Last year, PRS REIT paid a dividend while reporting negative free cash flow. While there may be an explanation, we think this behaviour is generally not sustainable.

It is worth considering that PRS REIT is a Real Estate Investment Trust (REIT). REITs have different rules governing their payments, and are often required to pay out a high portion of their earnings to investors.

With a strong net cash balance, PRS REIT investors may not have much to worry about in the near term from a dividend perspective.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. This company has been paying a dividend for less than 2 years, which we think is too soon to consider it a reliable dividend stock. Its most recent annual dividend was UK£0.05 per share.

We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

Dividend Growth Potential

The other half of the dividend investing equation is evaluating whether earnings per share (EPS) are growing. Growing EPS can help maintain or increase the purchasing power of the dividend over the long run. Earnings per share have been growing at a good rate, and the company is paying less than half its earnings as dividends. We generally think this is an attractive combination, as it permits further reinvestment in the business.

We'd also point out that PRS REIT issued a meaningful number of new shares in the past year. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. We're a bit uncomfortable with PRS REIT paying out a high percentage of both its cashflow and earnings. We were also glad to see it growing earnings, although its dividend history is not as long as we'd like. In summary, PRS REIT has a number of shortcomings that we'd find it hard to get past. Things could change, but we think there are a number of better ideas out there.

You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in PRS REIT stock.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:PRSR

PRS REIT

A closed-ended real estate investment trust established to invest in the Private Rented Sector ("PRS") and to provide shareholders with an attractive level of income together with the potential for capital and income growth.

Undervalued second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.