- United Kingdom

- /

- Hospitality

- /

- LSE:JDW

Undervalued Small Caps With Insider Action On UK Radar In November 2024

Reviewed by Simply Wall St

The United Kingdom's market landscape has been influenced by global economic challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting the interconnectedness of international economies. In such a climate, discerning investors often look for small-cap stocks that demonstrate resilience and potential value, especially those with notable insider activity which can signal confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Senior | 19.3x | 0.6x | 33.25% | ★★★★★★ |

| NWF Group | 8.1x | 0.1x | 38.87% | ★★★★★☆ |

| Genus | 159.7x | 1.9x | 18.80% | ★★★★★☆ |

| J D Wetherspoon | 15.5x | 0.4x | 18.58% | ★★★★★☆ |

| Headlam Group | NA | 0.2x | 24.66% | ★★★★★☆ |

| Marlowe | NA | 0.8x | 44.66% | ★★★★☆☆ |

| Optima Health | NA | 1.3x | 36.38% | ★★★★☆☆ |

| Sabre Insurance Group | 11.3x | 1.5x | 12.47% | ★★★☆☆☆ |

| Alpha Group International | 10.5x | 4.9x | -34.13% | ★★★☆☆☆ |

| THG | NA | 0.3x | -263.98% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

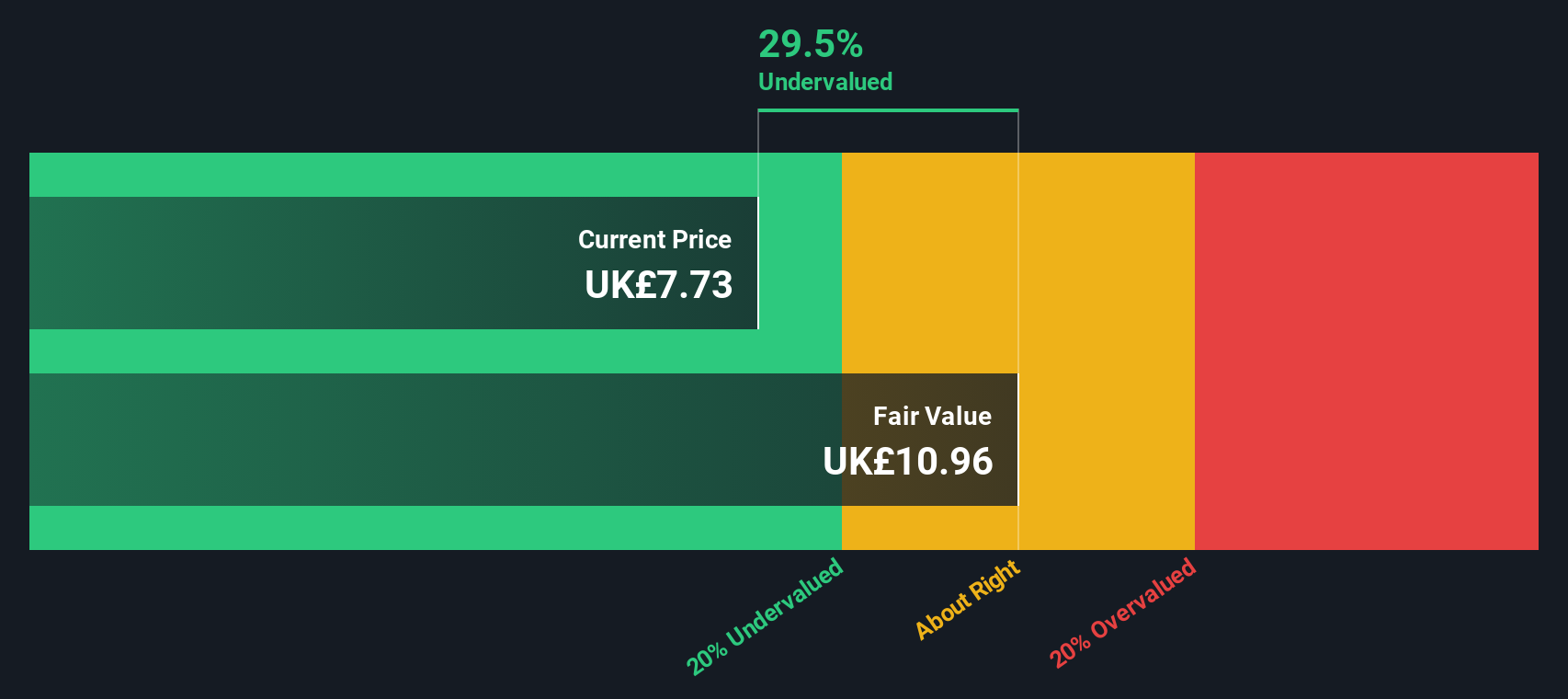

Hammerson (LSE:HMSO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hammerson is a real estate investment company focused on managing and developing flagship retail destinations in the UK, France, and Ireland, with a market capitalization of approximately £1.26 billion.

Operations: The company's revenue primarily comes from its flagship destinations in the UK, France, and Ireland, with significant costs associated with COGS and operating expenses. Gross profit margin has shown a declining trend from 87.53% in December 2013 to 79.90% by June 2024.

PE: -34.1x

Hammerson, a small company in the UK, recently issued a £400 million bond with a 5.875% coupon, extending its debt maturity from 2.9 to 5.2 years and reducing interest costs by £3.6 million annually. The bond was highly subscribed, indicating strong market confidence in their strategy to refinance existing debts and support growth plans. Insider confidence is evident through share purchases made over the past year, reflecting potential value as earnings are projected to grow significantly at 59% annually.

- Get an in-depth perspective on Hammerson's performance by reading our valuation report here.

Examine Hammerson's past performance report to understand how it has performed in the past.

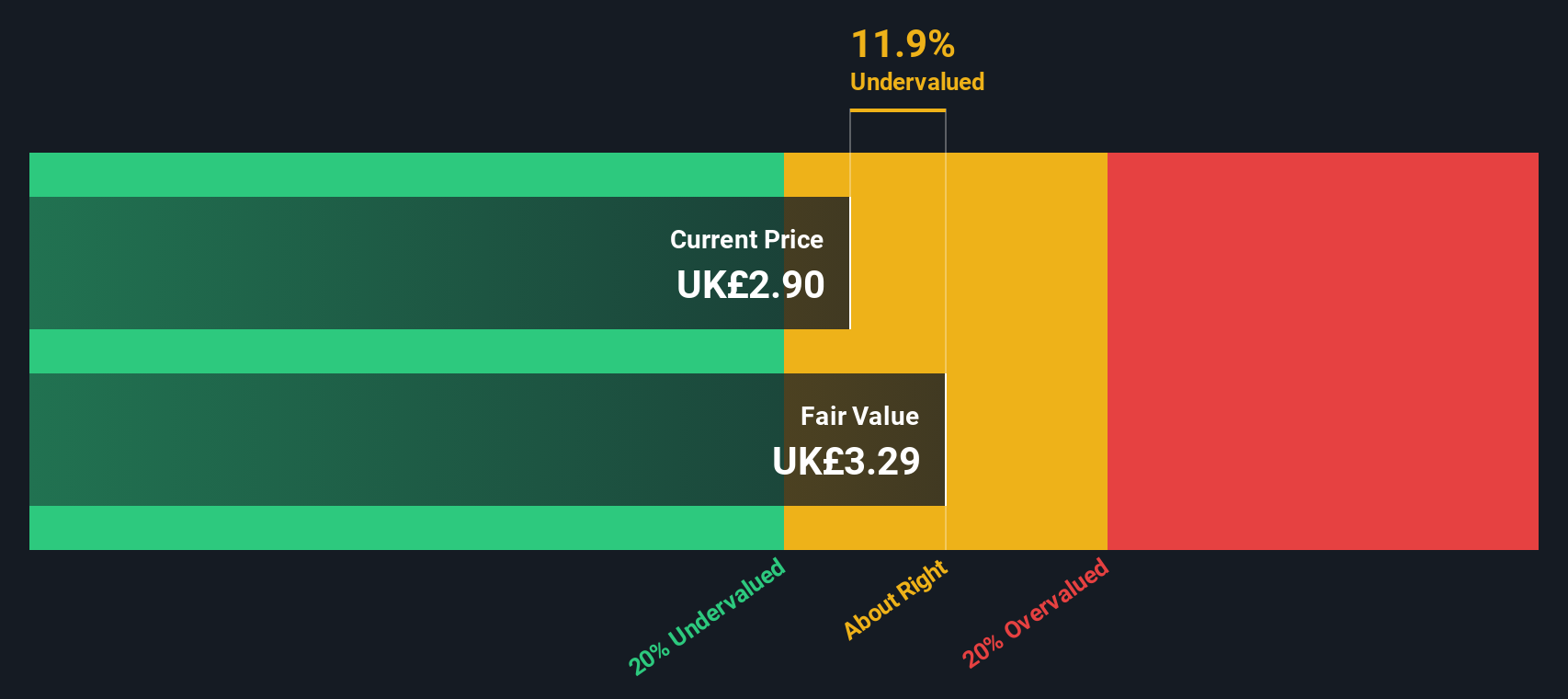

J D Wetherspoon (LSE:JDW)

Simply Wall St Value Rating: ★★★★★☆

Overview: J D Wetherspoon is a UK-based pub and restaurant chain known for its affordable food and drink offerings, with a market capitalization of approximately £1.03 billion.

Operations: Revenue is primarily generated from pubs, with the cost of goods sold (COGS) being a significant expense. The gross profit margin has shown fluctuations, reaching 0.11698% in recent periods. Operating expenses and non-operating expenses also impact net income margins, which have varied over time but were at 0.02397% recently.

PE: 15.5x

J D Wetherspoon, a prominent name in the UK pub industry, showcases potential as an undervalued investment. Despite external borrowing risks, they maintain a strong financial position with earnings covering interest payments. Recent figures reveal like-for-like sales rose 5.9% over 14 weeks ending November 3, 2024, although total sales grew only by 4.6% due to pub disposals. With earnings projected to grow annually by over 13%, and insider confidence demonstrated through significant share repurchases amounting to £39.5 million this year, the company presents intriguing prospects for growth amidst its challenges.

THG (LSE:THG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: THG operates in the beauty, nutrition, and technology sectors through its divisions THG Beauty, THG Ingenuity, and THG Nutrition, with a market capitalization of approximately £1.2 billion.

Operations: THG generates its revenue primarily from Beauty (£1.20 billion), Ingenuity (£659.71 million), and Nutrition (£621.11 million) segments, with the gross profit margin showing a trend of gradual increase from 34.30% in 2013 to around 41.83% by the end of 2023. The company incurs significant costs in sales and marketing, which reached £258.88 million by mid-2024, alongside general and administrative expenses totaling £675.52 million during the same period.

PE: -2.8x

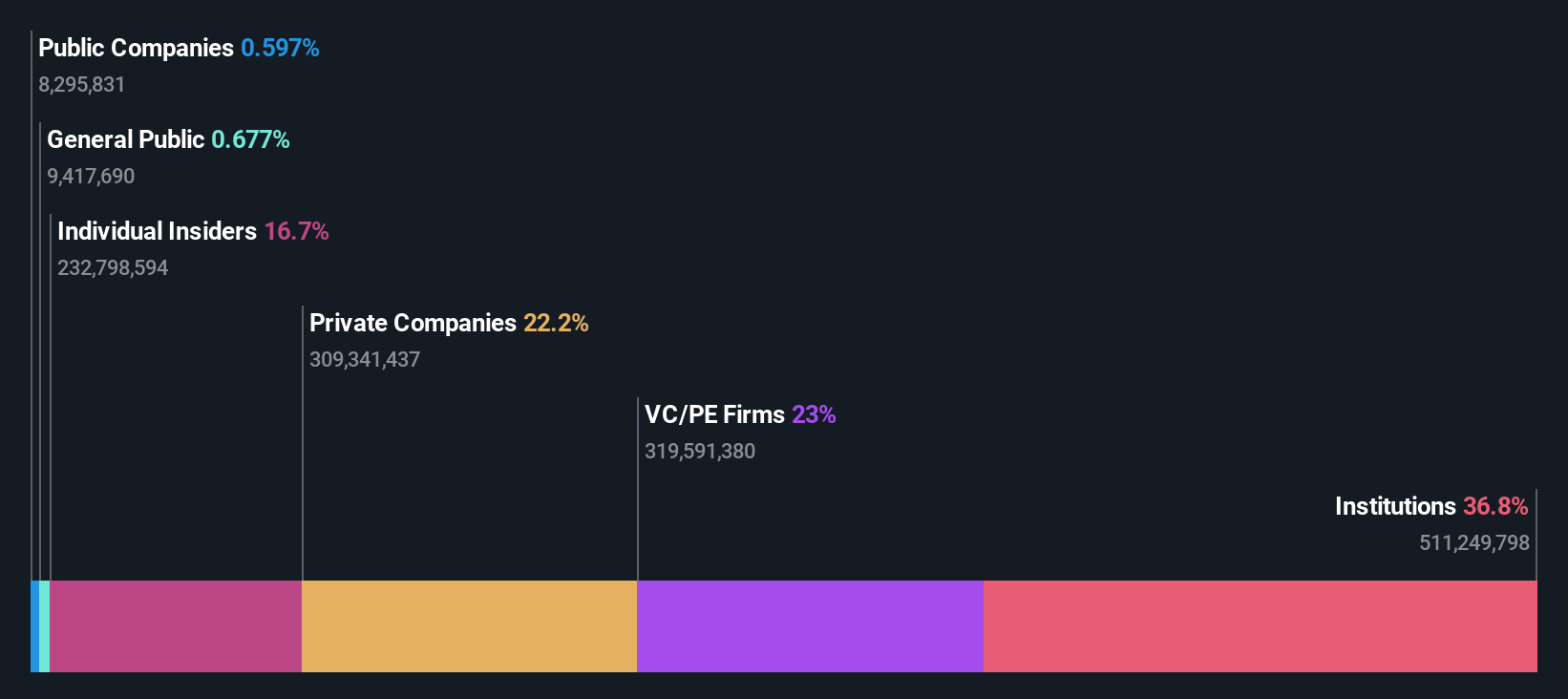

THG, a UK-based company, has seen significant insider confidence with share purchases over the past months. Despite its unprofitable status and reliance on higher-risk funding sources, THG's revenue is projected to grow 4.16% annually. Recent equity offerings raised £100.8 million at £0.49 per share, highlighting efforts to bolster financial stability amid volatility and shareholder dilution concerns. The potential demerger of THG Ingenuity could refine focus on profitable segments like Beauty and Nutrition, enhancing future prospects for value creation.

- Delve into the full analysis valuation report here for a deeper understanding of THG.

Assess THG's past performance with our detailed historical performance reports.

Key Takeaways

- Dive into all 23 of the Undervalued UK Small Caps With Insider Buying we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:JDW

J D Wetherspoon

Owns and operates pubs and hotels in the United Kingdom and the Republic of Ireland.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives