- United Kingdom

- /

- Biotech

- /

- LSE:GNS

Top 3 Undervalued Small Caps With Insider Buying In United Kingdom For September 2024

Reviewed by Simply Wall St

The United Kingdom market has been experiencing turbulence, with the FTSE 100 index closing lower after weak trade data from China indicated ongoing struggles in global economic recovery. Amidst this backdrop, identifying undervalued small-cap stocks with insider buying can offer potential opportunities for investors looking to navigate the current market conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 23.2x | 5.2x | 17.62% | ★★★★★☆ |

| Domino's Pizza Group | 14.6x | 1.7x | 37.30% | ★★★★★☆ |

| Essentra | 782.6x | 1.5x | 41.88% | ★★★★★☆ |

| GB Group | NA | 2.8x | 37.83% | ★★★★★☆ |

| Genus | 159.3x | 1.9x | 2.78% | ★★★★★☆ |

| NWF Group | 8.4x | 0.1x | 37.64% | ★★★★☆☆ |

| CVS Group | 22.8x | 1.3x | 40.25% | ★★★★☆☆ |

| Norcros | 7.9x | 0.5x | -0.95% | ★★★☆☆☆ |

| Harworth Group | 14.9x | 7.8x | -552.51% | ★★★☆☆☆ |

| Watkin Jones | NA | 0.2x | -1376.88% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Genus (LSE:GNS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Genus is a biotechnology company focused on animal genetics, with operations in bovine and porcine breeding, and a market cap of approximately £2.50 billion.

Operations: Genus generates revenue primarily from its Genus ABS and Genus PIC segments, with recent revenues reaching £668.80 million. The company has shown fluctuations in its gross profit margin, peaking at 68.02% as of March 31, 2024. Operating expenses have varied significantly, impacting net income margins which have ranged from -1.40% to a high of 14.05%.

PE: 159.3x

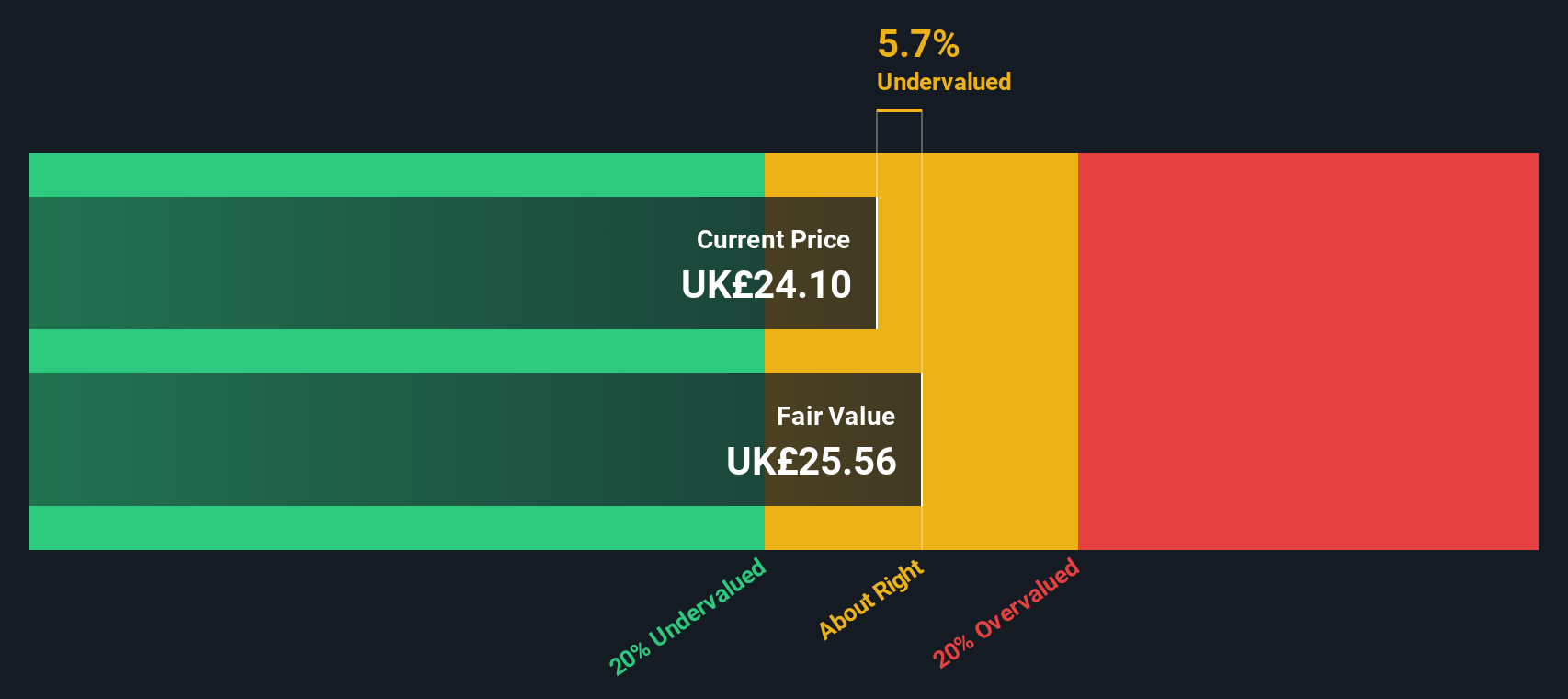

Genus, a UK-based small cap, reported full-year sales of £668.8 million and net income of £7.9 million for the year ending June 30, 2024. Despite a decline from last year's figures (£689.7 million in sales and £33.3 million in net income), the company remains attractive due to insider confidence with recent share purchases between July and September 2024. Earnings are forecasted to grow by 39.4% annually, though profit margins have decreased from 4.8% to 1.2%.

Hammerson (LSE:HMSO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hammerson is a property development and investment company focusing on flagship destinations in the UK, France, and Ireland with a market cap of £1.07 billion.

Operations: Hammerson's revenue streams include flagship destinations in the UK, France, and Ireland, alongside developments. The company has experienced significant fluctuations in net income margin over recent periods, with a notable decline to -0.18356% as of 2024-06-30. Gross profit margins have shown variability but were recorded at 79.90% for the same period.

PE: -34.9x

Hammerson, a notable player in the UK market, has recently secured a EUR 350 million non-recourse term loan alongside PIMCO Prime Real Estate to refinance Dundrum Town Centre. This move extends their average debt maturity from 2.2 to 2.9 years and maintains their LTV ratio unchanged as of June 30. Despite reporting a net loss of GBP 516.7 million for H1 2024, insider confidence is evident with significant share purchases over the past six months, indicating potential future growth amidst current undervaluation concerns.

- Take a closer look at Hammerson's potential here in our valuation report.

Review our historical performance report to gain insights into Hammerson's's past performance.

Sirius Real Estate (LSE:SRE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sirius Real Estate is a property investment company focused on owning and operating business parks, industrial complexes, and office buildings with a market cap of approximately €1.40 billion.

Operations: The company generates revenue primarily from property investments. For the period ending September 30, 2023, it reported a gross profit margin of 57.81% and net income margin of 14.76%.

PE: 16.5x

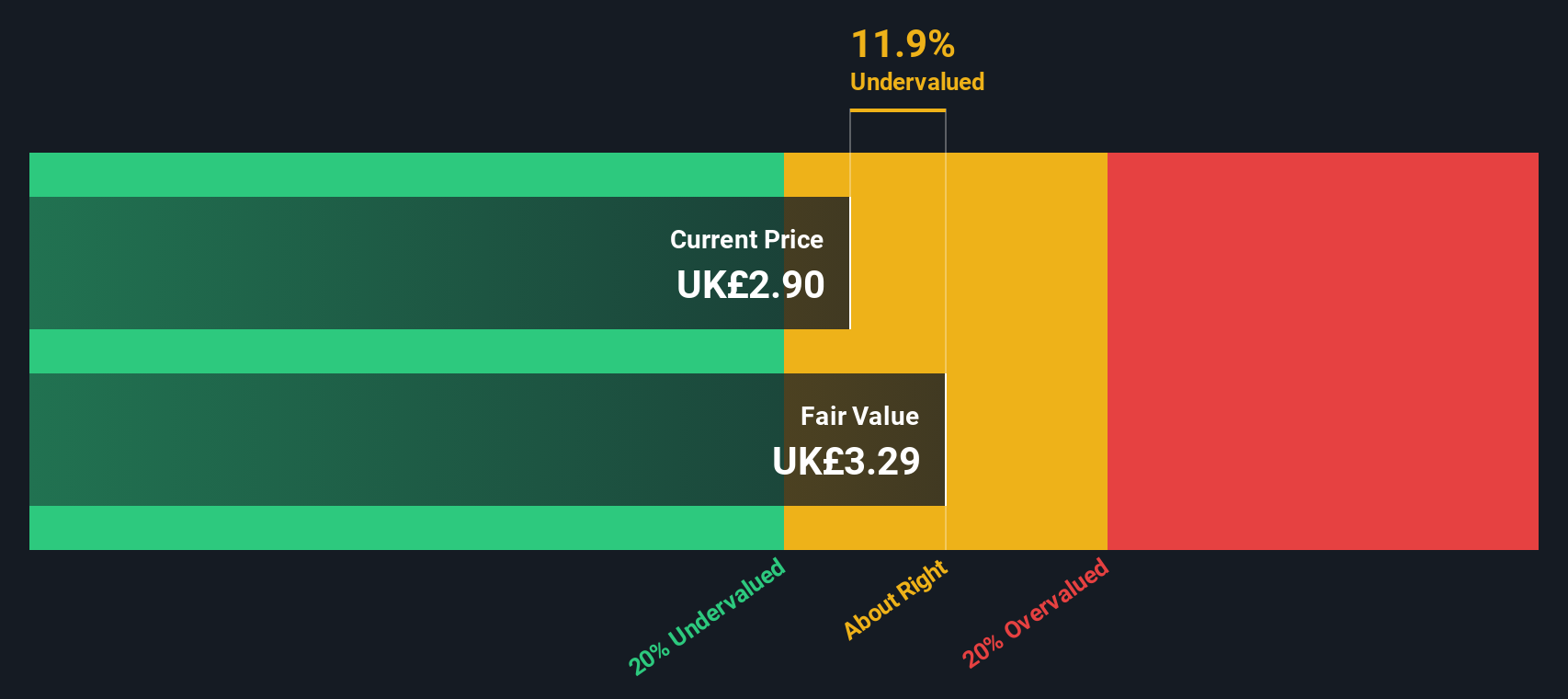

Sirius Real Estate recently completed a £152.5 million equity offering, supporting its acquisition strategy in Germany and the U.K. Their CEO highlighted a decade of consistent rental growth and dividend increases, showcasing operational strength. Earnings are forecasted to grow 16% annually, although debt is solely covered by external borrowing. Insider confidence is demonstrated by substantial share purchases in July 2024, reflecting optimism about future prospects despite higher risk funding sources.

- Delve into the full analysis valuation report here for a deeper understanding of Sirius Real Estate.

Explore historical data to track Sirius Real Estate's performance over time in our Past section.

Seize The Opportunity

- Delve into our full catalog of 23 Undervalued UK Small Caps With Insider Buying here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GNS

Genus

Operates as an animal genetics company in North America, Latin America, the United Kingdom, rest of Europe, the Middle East, Russia, Africa, and Asia.

Reasonable growth potential and slightly overvalued.