- United Kingdom

- /

- Software

- /

- LSE:PINE

European Undervalued Small Caps With Insider Buying To Watch

Reviewed by Simply Wall St

Amidst heightened global trade tensions and the recent imposition of higher-than-expected U.S. tariffs, European markets have experienced significant volatility, with major indices like the STOXX Europe 600 Index seeing their largest drop in five years. As investors navigate these turbulent times, identifying small-cap stocks that exhibit strong fundamentals and potential resilience can be crucial for those looking to capitalize on undervalued opportunities in the current economic landscape.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Warpaint London | 16.3x | 2.8x | 38.49% | ★★★★★★ |

| Tristel | 21.0x | 3.0x | 44.66% | ★★★★★★ |

| Vanquis Banking Group | NA | 0.5x | 45.84% | ★★★★★★ |

| Bytes Technology Group | 21.5x | 5.5x | 13.19% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 27.86% | ★★★★★☆ |

| Robert Walters | NA | 0.2x | 49.47% | ★★★★★☆ |

| Nyab | 20.2x | 1.0x | 43.08% | ★★★★☆☆ |

| Savills | 22.9x | 0.5x | 44.12% | ★★★★☆☆ |

| FRP Advisory Group | 11.5x | 2.1x | 17.45% | ★★★☆☆☆ |

| Arendals Fossekompani | 20.8x | 1.6x | 48.58% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

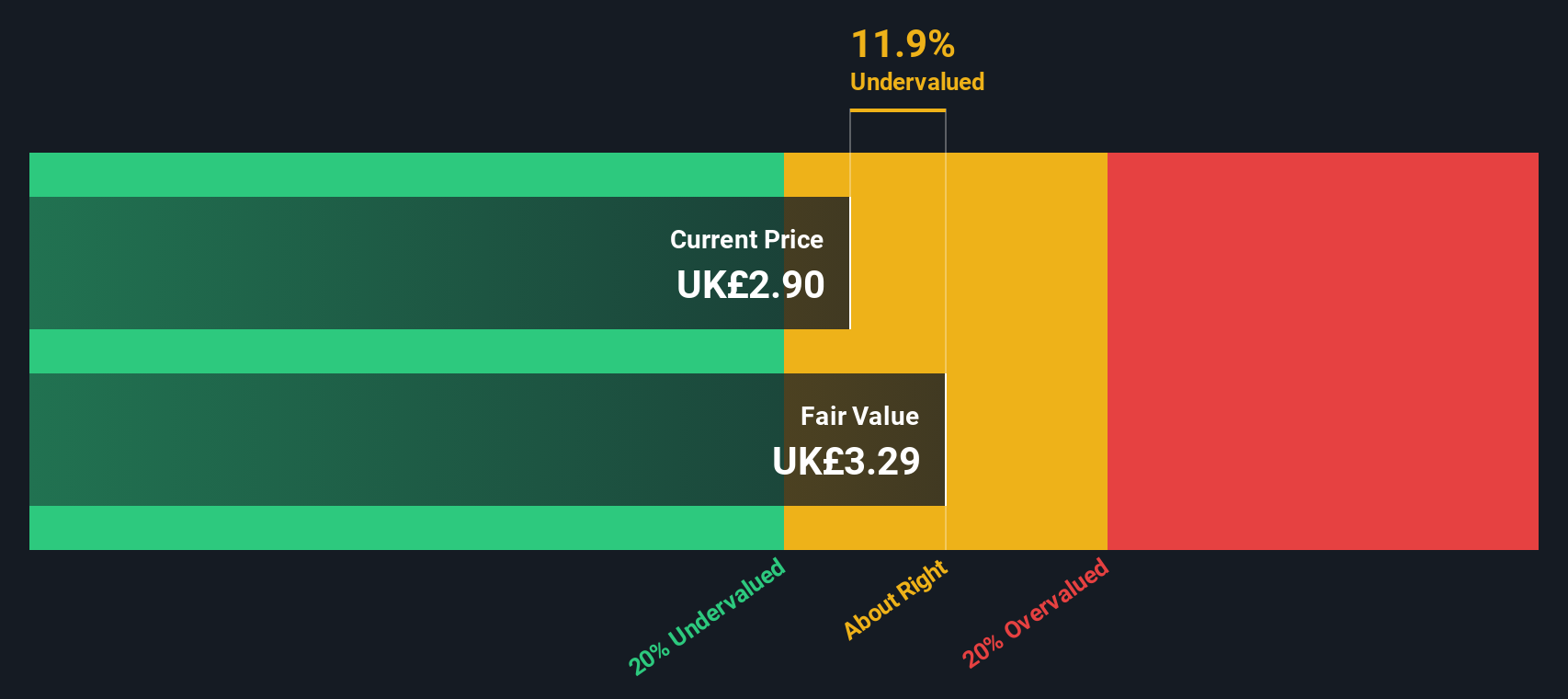

LBG Media (AIM:LBG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: LBG Media operates in the online media publishing industry, with a focus on creating and distributing digital content, and has a market cap of approximately £0.47 billion.

Operations: The company generates revenue from the online media publishing industry, with a focus on managing costs such as cost of goods sold and operating expenses. Over time, the gross profit margin has shown variability, reaching 33.24% in recent periods.

PE: 21.0x

LBG Media, a small company in Europe, has shown potential for growth with earnings projected to rise by 15% annually. Despite relying solely on external borrowing for funding, recent insider confidence is evident as they have made share purchases. The company reported sales of £64.95 million and net income of £8.95 million for the nine months ending September 2024. Executive changes include Dave Dilson joining as director and Dave Wilson focusing on finance during CFO transitions, indicating strategic leadership adjustments to support growth ambitions.

- Unlock comprehensive insights into our analysis of LBG Media stock in this valuation report.

Gain insights into LBG Media's past trends and performance with our Past report.

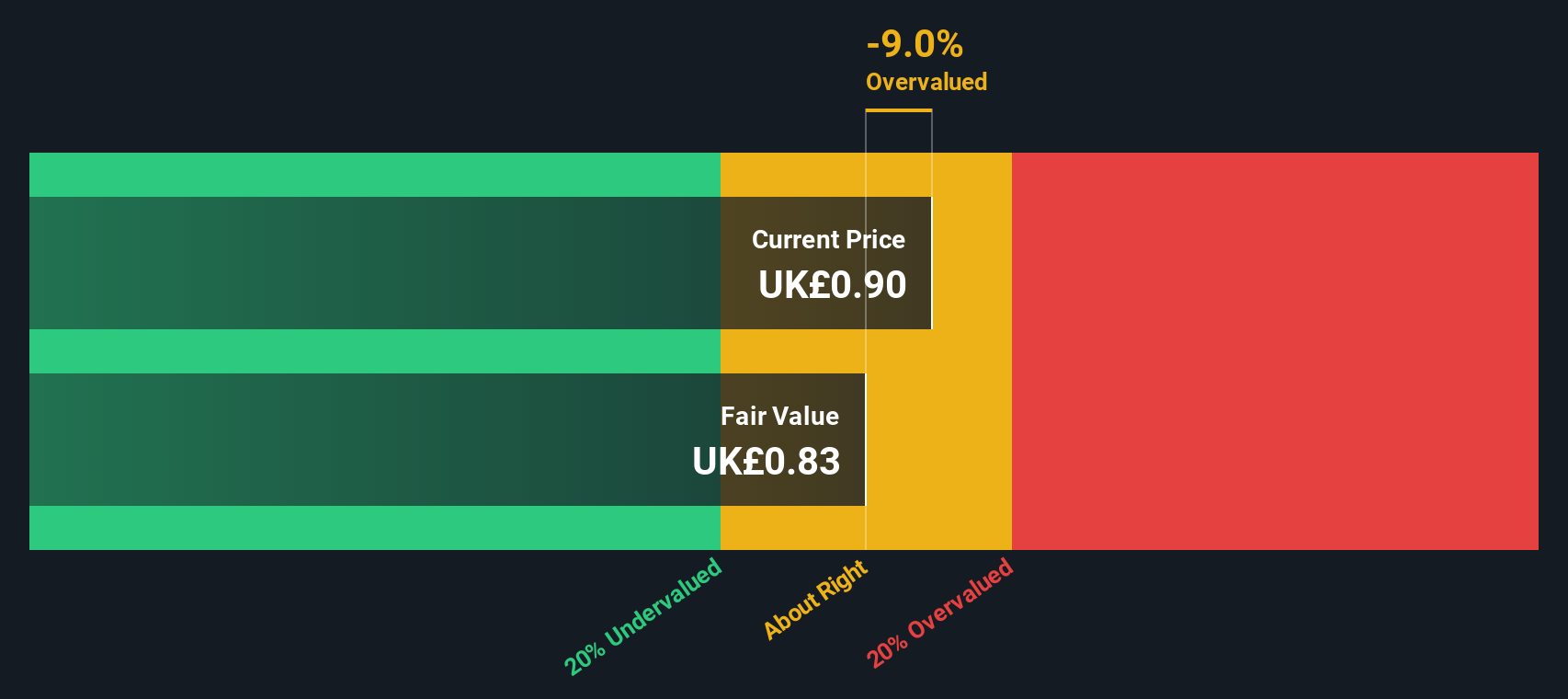

Hammerson (LSE:HMSO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hammerson is a property development and investment company focusing on flagship retail destinations in the UK, France, and Ireland with a market cap of £1.2 billion.

Operations: Hammerson's primary revenue streams are derived from its flagship destinations in the UK, France, and Ireland, with significant contributions observed in these segments. The company has faced fluctuating net income margins over recent years, with notable declines into negative territory from 2018 onwards. Operating expenses have been a consistent factor in the financial structure, impacting overall profitability.

PE: -25.4x

Hammerson, a European small cap, has caught attention with insider confidence shown by Habib Annous purchasing 75,806 shares valued at £204,739. Despite reporting a net loss of £526.3 million for 2024 and sales declining to £81.8 million from the previous year's £92.8 million, the company is poised for potential growth with earnings forecasted to rise by 45% annually. The Board's recommendation of an 8.07 pence dividend per share indicates optimism amidst challenging financials reliant on external borrowing.

- Click here to discover the nuances of Hammerson with our detailed analytical valuation report.

Explore historical data to track Hammerson's performance over time in our Past section.

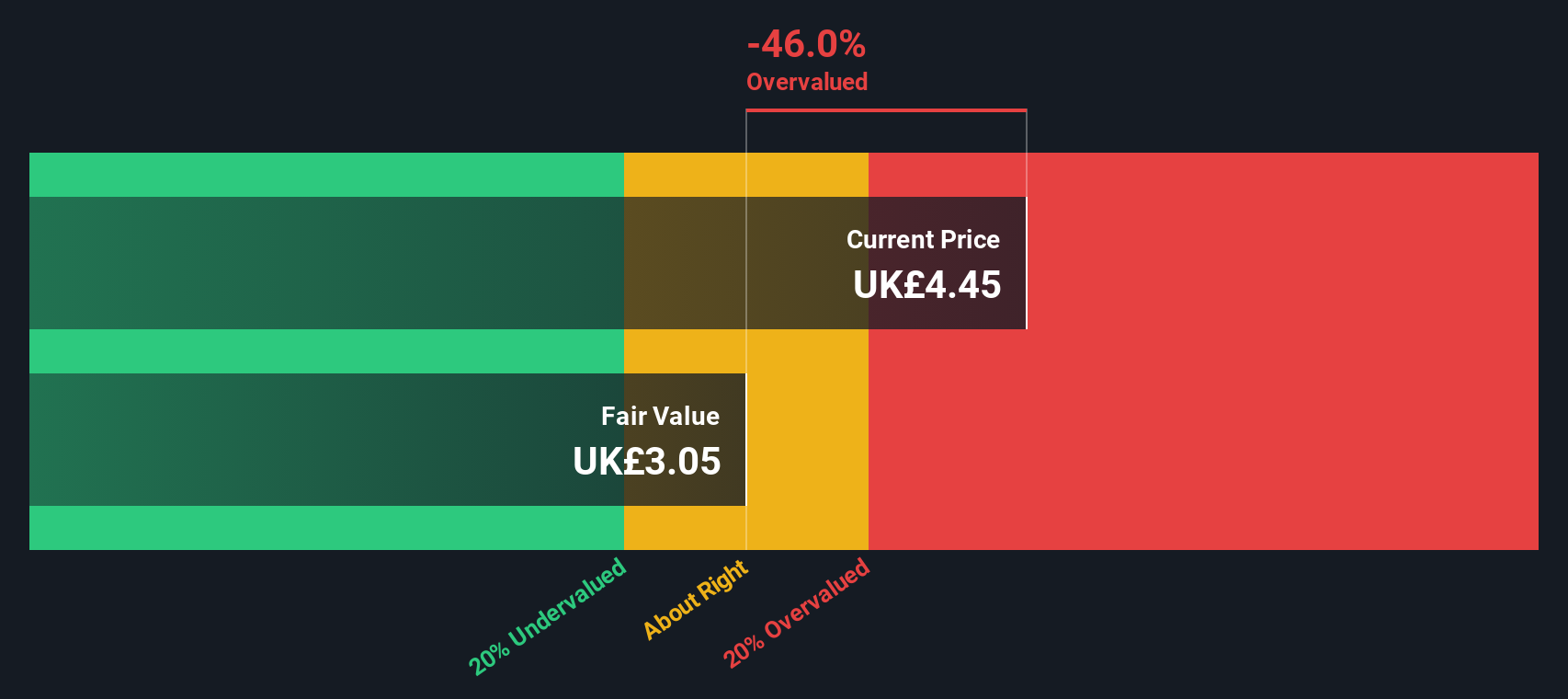

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Pinewood Technologies Group operates in the retail sector, focusing on gasoline and auto dealers, with a market cap of £2.45 billion.

Operations: Pinewood Technologies Group's revenue is primarily derived from its retail segment, specifically gasoline and auto dealers, with a reported revenue of £34.04 million for recent periods. The company has experienced fluctuations in its net income margin, reaching as high as 33.88% recently after periods of negative margins between 2018 and 2020. Operating expenses have varied over time but were notably reduced to £22.69 million in the latest period compared to previous years when they exceeded £400 million on multiple occasions.

PE: 48.3x

Pinewood Technologies Group, a small European company, recently showcased insider confidence with significant share purchases in early 2025. Despite past shareholder dilution, their earnings are projected to grow by 42.77% annually. A new five-year contract with Global Auto Holdings is expected to enhance revenue through the Pinewood Automotive Intelligence platform rollout across multiple regions. However, funding remains high-risk due to reliance on external borrowing rather than customer deposits. Recent equity offerings raised £42 million to support growth initiatives.

Where To Now?

- Navigate through the entire inventory of 52 Undervalued European Small Caps With Insider Buying here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Pinewood Technologies Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PINE

Pinewood Technologies Group

Operates as a cloud-based dealer management software provider that offers software solutions to the automotive industry in the United Kingdom and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives