Helen Gordon has been the CEO of Grainger plc (LON:GRI) since 2016, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether Grainger pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for Grainger

Comparing Grainger plc's CEO Compensation With the industry

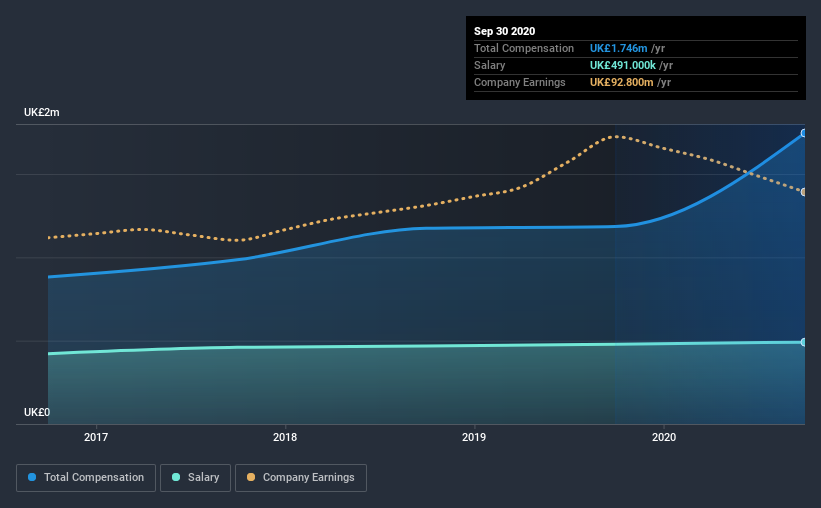

According to our data, Grainger plc has a market capitalization of UK£1.9b, and paid its CEO total annual compensation worth UK£1.7m over the year to September 2020. We note that's an increase of 47% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at UK£491k.

For comparison, other companies in the same industry with market capitalizations ranging between UK£1.5b and UK£4.7b had a median total CEO compensation of UK£836k. Hence, we can conclude that Helen Gordon is remunerated higher than the industry median. What's more, Helen Gordon holds UK£914k worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£491k | UK£479k | 28% |

| Other | UK£1.3m | UK£706k | 72% |

| Total Compensation | UK£1.7m | UK£1.2m | 100% |

On an industry level, around 54% of total compensation represents salary and 46% is other remuneration. It's interesting to note that Grainger allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Grainger plc's Growth Numbers

Over the last three years, Grainger plc has shrunk its earnings per share by 6.8% per year. In the last year, its revenue is down 3.9%.

The decline in EPS is a bit concerning. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Grainger plc Been A Good Investment?

Grainger plc has generated a total shareholder return of 20% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

As we touched on above, Grainger plc is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Unfortunately, EPS has not grown in three years, failing to impress us. And while shareholder returns have been respectable, they have hardly been superb. So you may want to delve deeper, because we don't think the amount Helen makes is justifiable.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 5 warning signs for Grainger (1 doesn't sit too well with us!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Grainger, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:GRI

Grainger

Designs, builds, develops, owns and operates rental homes in the United Kingdom.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives