- United Kingdom

- /

- Industrial REITs

- /

- LSE:BBOX

Tritax Big Box REIT (LON:BBOX) Has Compensated Shareholders With A Respectable 60% Return On Their Investment

Stock pickers are generally looking for stocks that will outperform the broader market. And in our experience, buying the right stocks can give your wealth a significant boost. For example, long term Tritax Big Box REIT plc (LON:BBOX) shareholders have enjoyed a 28% share price rise over the last half decade, well in excess of the market decline of around 11% (not including dividends).

Check out our latest analysis for Tritax Big Box REIT

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Tritax Big Box REIT actually saw its EPS drop 8.3% per year.

This means it's unlikely the market is judging the company based on earnings growth. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

In fact, the dividend has increased over time, which is a positive. Maybe dividend investors have helped support the share price. We'd posit that the revenue growth over the last five years, of 28% per year, would encourage people to invest.

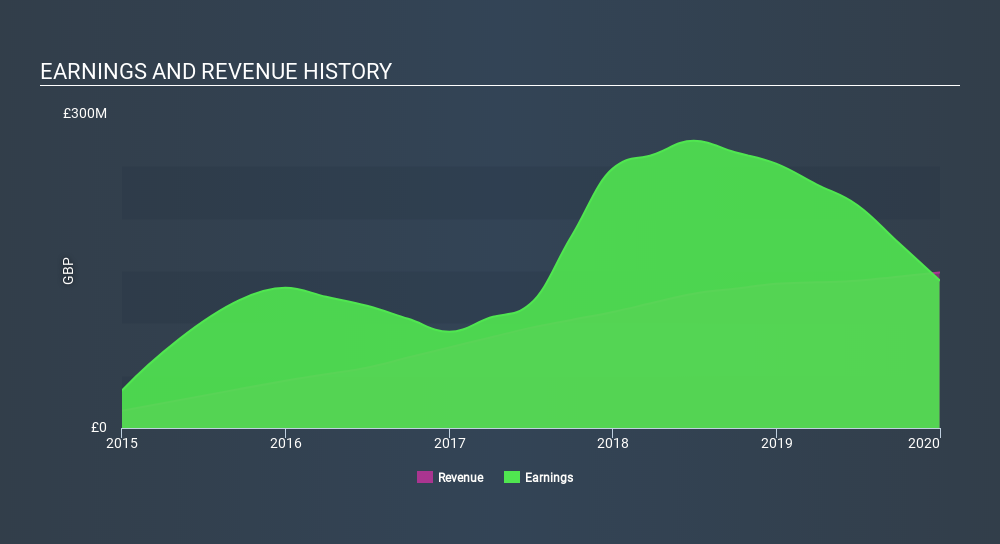

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Tritax Big Box REIT will earn in the future (free profit forecasts).

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Tritax Big Box REIT the TSR over the last 5 years was 60%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Although it hurts that Tritax Big Box REIT returned a loss of 0.9% in the last twelve months, the broader market was actually worse, returning a loss of 9.3%. Longer term investors wouldn't be so upset, since they would have made 9.9%, each year, over five years. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. It's always interesting to track share price performance over the longer term. But to understand Tritax Big Box REIT better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for Tritax Big Box REIT (of which 1 is concerning!) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About LSE:BBOX

Tritax Big Box REIT

Tritax Big Box REIT plc (ticker: BBOX) owns, manages and develops supply chain infrastructure that is critical to the UK economy.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives