- United Kingdom

- /

- Health Care REITs

- /

- LSE:AGR

Discover 3 Undervalued Small Caps In The United Kingdom With Insider Buying

Reviewed by Simply Wall St

The United Kingdom's stock market has been under pressure recently, with the FTSE 100 and FTSE 250 indices both closing lower amid weak trade data from China, highlighting ongoing global economic uncertainties. Despite these challenges, discerning investors often look for opportunities in undervalued small-cap stocks that show potential for growth, especially those with insider buying as a positive indicator of confidence.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 23.7x | 5.4x | 16.08% | ★★★★★☆ |

| C&C Group | NA | 0.4x | 48.07% | ★★★★★☆ |

| Breedon Group | 14.8x | 0.9x | 49.55% | ★★★★★☆ |

| Essentra | 812.3x | 1.6x | 47.50% | ★★★★★☆ |

| GB Group | NA | 3.0x | 34.79% | ★★★★★☆ |

| NWF Group | 9.0x | 0.1x | 33.69% | ★★★★☆☆ |

| H&T Group | 7.8x | 0.7x | 8.03% | ★★★★☆☆ |

| CVS Group | 22.3x | 1.2x | 41.17% | ★★★★☆☆ |

| Norcros | 7.8x | 0.5x | -0.48% | ★★★☆☆☆ |

| Watkin Jones | NA | 0.2x | -5.89% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

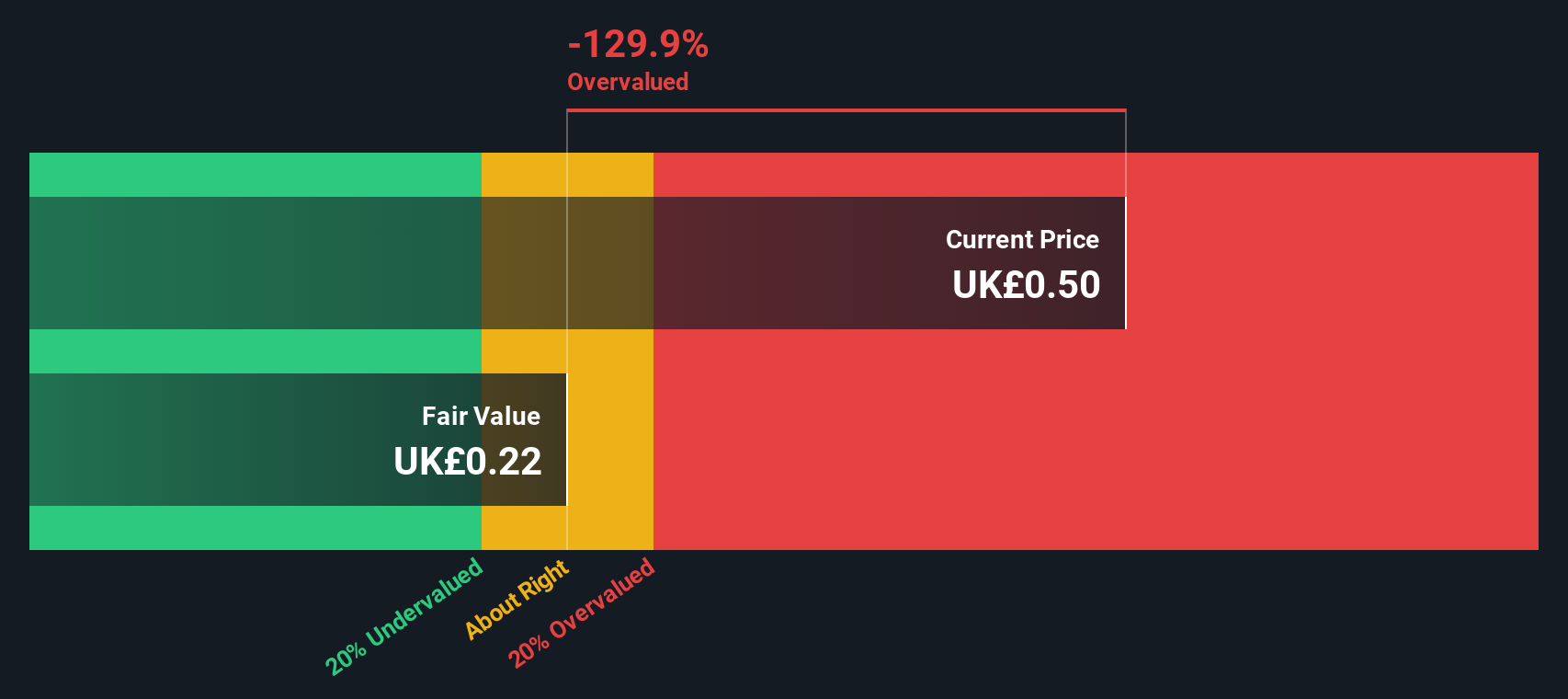

Assura (LSE:AGR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Assura is a UK-based real estate investment trust specializing in the development and management of primary care properties, with a market cap of approximately £2.37 billion.

Operations: Assura's primary revenue stream is from its core segment, generating £157.8 million. The company's gross profit margin has shown a trend around 90.81% to 96.32%. Recent financials indicate net income margins have fluctuated significantly, with the latest being -18.25%. Operating expenses and non-operating expenses also play a crucial role in impacting overall profitability.

PE: -46.1x

Assura, a UK-based healthcare property developer, has demonstrated insider confidence with recent share purchases. They have forecasted earnings growth of 41.82% per year and announced a quarterly dividend of £0.0084 per share to be paid on 9 October 2024. Despite relying entirely on external borrowing for funding, Assura's acquisition of a private hospital portfolio indicates strategic expansion in the healthcare sector. The company’s debt is not well covered by operating cash flow, highlighting potential financial risks.

- Dive into the specifics of Assura here with our thorough valuation report.

Review our historical performance report to gain insights into Assura's's past performance.

Domino's Pizza Group (LSE:DOM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Domino's Pizza Group operates as a leading pizza delivery and carryout company, managing franchisee sales, corporate stores, advertising and ecommerce income, rental income from properties, and various franchise fees with a market cap of approximately £1.50 billion.

Operations: Domino's Pizza Group generates revenue primarily from sales to franchisees, corporate store income, national advertising and ecommerce income, rental income on properties, and various franchise fees. The company's gross profit margin has shown an upward trend over the periods provided, reaching 47.48% as of June 2024.

PE: 15.5x

Domino's Pizza Group, a UK-based company, has shown insider confidence with significant share repurchases in 2024. They bought back 1.77 million shares for £6.2 million between January and May and completed the repurchase of 25.3 million shares for £90.1 million under a previous buyback program. Despite a drop in net income to £42.3 million from £80.2 million year-over-year, the company remains optimistic about growth in order count and sales for fiscal year 2024 while maintaining strategic initiatives amidst market uncertainties.

- Get an in-depth perspective on Domino's Pizza Group's performance by reading our valuation report here.

Understand Domino's Pizza Group's track record by examining our Past report.

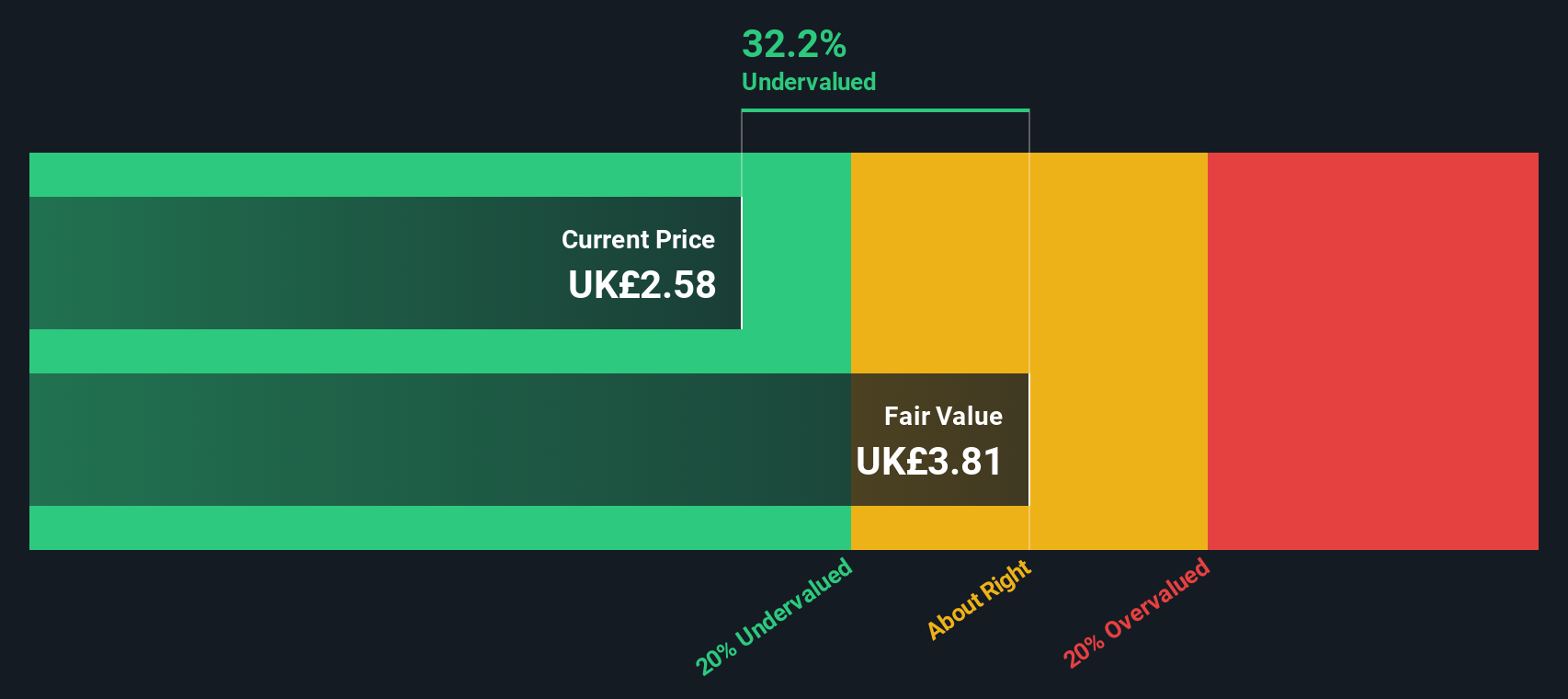

Norcros (LSE:NXR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Norcros is a company that specializes in building products, with operations generating £392.10 million in revenue.

Operations: Norcros generates revenue primarily from its Building Products segment, which reported £392.1 million. The company has experienced varying net income margins, with the most recent being 6.83% as of March 31, 2024. Operating expenses have shown fluctuations but were £349.40 million in the latest period ending September 3, 2024.

PE: 7.8x

Norcros, a UK-based company, has seen insider confidence with recent share purchases by executives in the last quarter. Despite reporting a 5.9% drop in revenue for the 13-week period ending June 2024 due to strategic exits, their net income rose to £26.8 million from £16.8 million year-over-year. The company declared a final dividend of 6.8 pence per share for FY2024, maintaining its total annual dividend at 10.2 pence per share, reflecting stable shareholder returns amidst market challenges.

- Navigate through the intricacies of Norcros with our comprehensive valuation report here.

Gain insights into Norcros' past trends and performance with our Past report.

Turning Ideas Into Actions

- Embark on your investment journey to our 27 Undervalued UK Small Caps With Insider Buying selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AGR

Assura

Assura plc is a national healthcare premises specialist and UK REIT based in Altrincham, UK - caring for more than 600 primary healthcare buildings, from which over six million patients are served.

Established dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives